Market Report

Building Income:

Week #12 of 2024, Week ‘s report on ideas for positive cash flow

Update on relevant financial information.

March 18-22, 2024

1 Macroeconomic Environment:

Week ending:

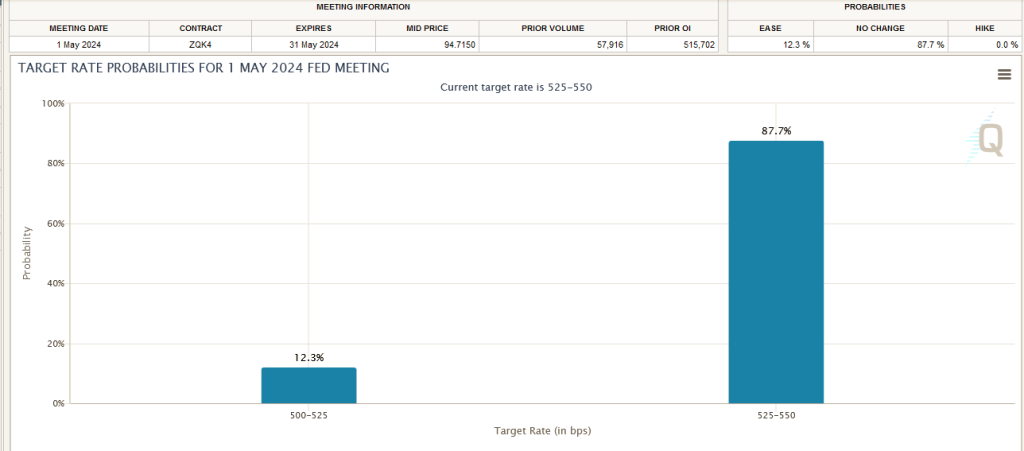

Interest rates were maintained, and the forecast for three rate cuts in 2024 remains unchanged.

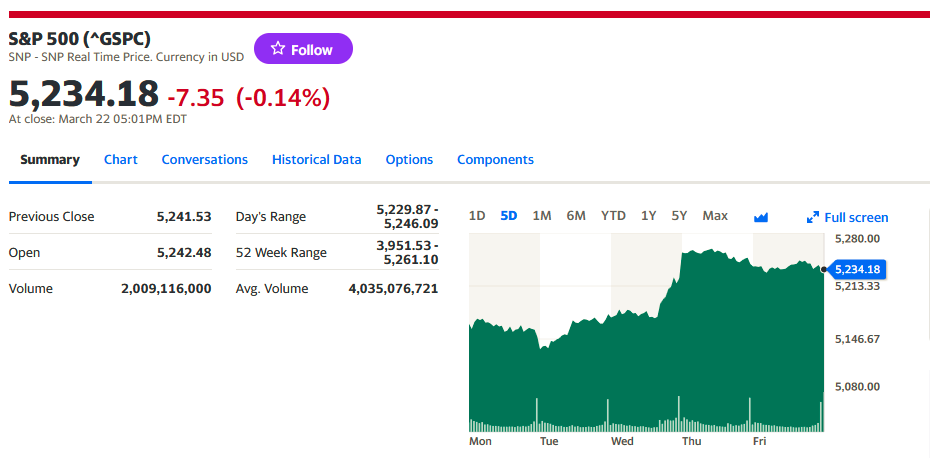

Stocks hit a new record high price following the Federal Reserve’s new forecasts for rate cuts, falling inflation and economic growth. The S&P 500 above 5,200 for the first time, ending at 5,234.

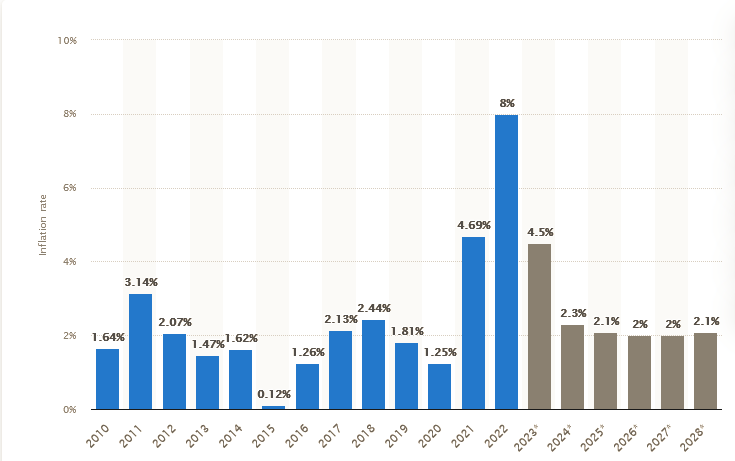

Falling inflation without recession.

Expected annual inflation rate in the U.S. from 2010 to 2028

https://www.statista.com/statistics/244983/projected-inflation-rate-in-the-united-states/

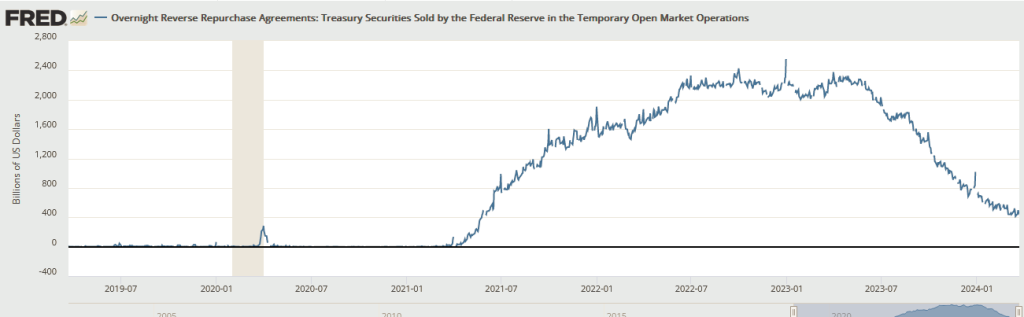

Market liquidity improves again due to less Fed tightening

https://fred.stlouisfed.org/series/RRPONTSYD

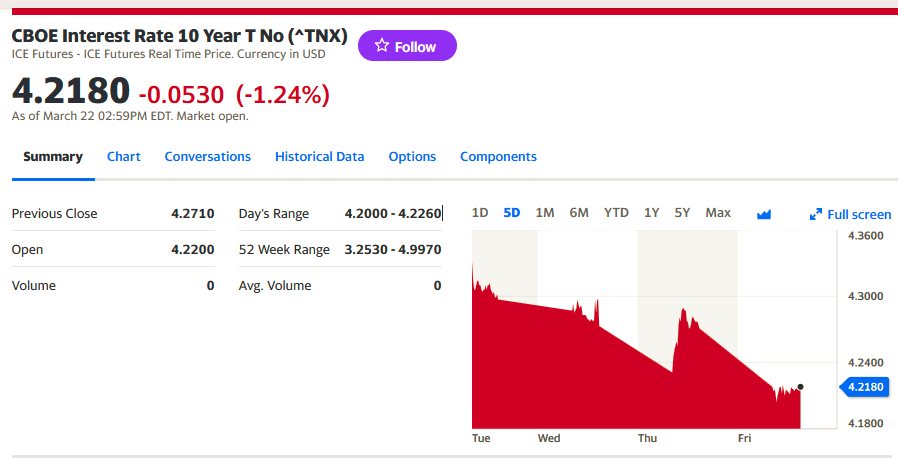

The 10-year bond lowers yield and rises in price, in a bullish sign.

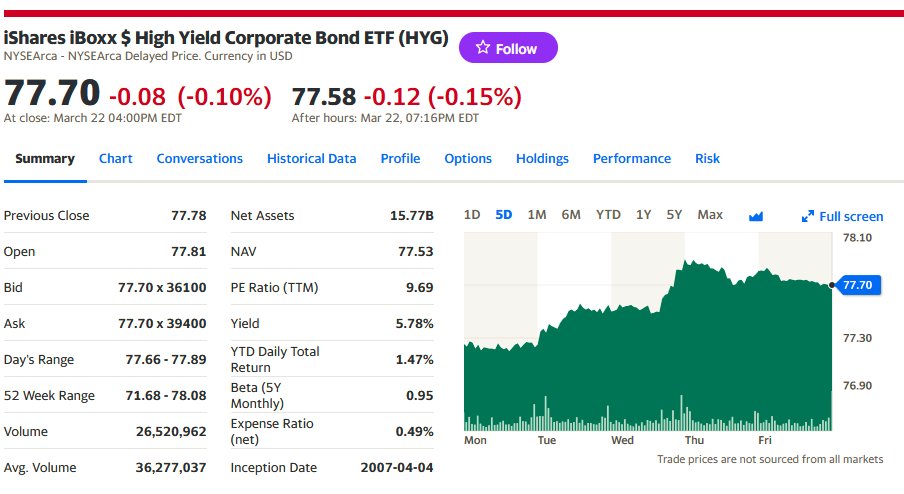

Corporate bonds in sideways mode.

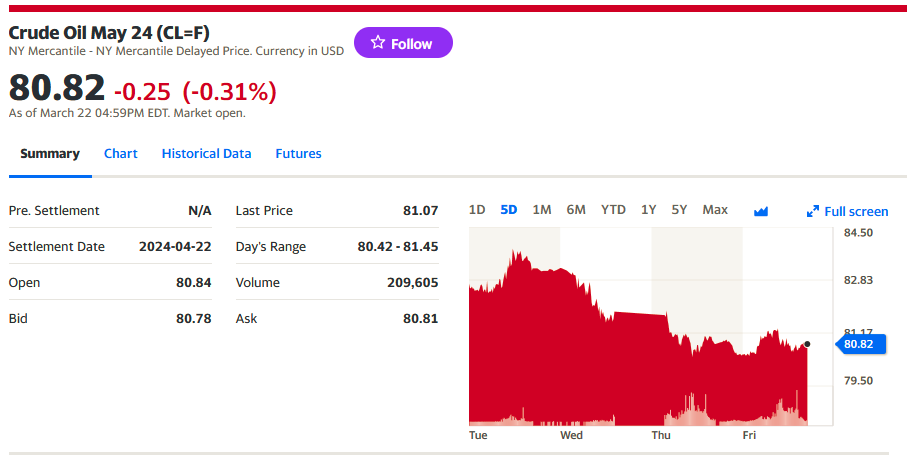

Oil prices were stable, with peaks and troughs of 3% during the week.

Oil rises slightly on the week as UN Gaza ceasefire resolution fails.

Market Driver

Oil has been steady at around $80 and is “operating like a yoyo — bouncing up and down but not really going anywhere,” said Manish Raj, managing director at Velandera Energy Partners. “That is because the markets are flush with ample inventory worldwide and the [Federal Reserve is] ghosting out on interest-rate timing.”

“Although oil’s direction isn’t straightforward, we are buying the dips as we feel downside is limited” as long as Organization of the Petroleum Exporting Countries “continues its resolve” to stick to its voluntary production cuts, Raj told MarketWatch.

On Friday, a U.S.-led United Nations resolution for an immediate cease-fire in the Israel-Hamas war failed to pass after Russia and China vetoed it.

The draft resolution had triggered a “bull market squeeze” on Thursday, pressuring prices, Stephen Innes, managing partner at SPI Asset Management, said in a note.

The passage of the resolution would have helped to temporarily ease some concerns about tensions in the oil-rich Middle East, but prices ended a bit lower Friday despite the resolution’s failure to pass.

Meanwhile, the U.S. has urged Ukraine to stop its attacks on Russian energy facilities, the Financial Times reported, warning that the drone strikes that are estimated to have knocked around 7% of the country’s refining capacity offline threaten to drive up global oil prices and provoke retaliation.

“Ukraine officials have stated the intent is to damage a key industry that provides revenue for Russia’s war and to disrupt domestic fuel supplies,” analysts at ICICI Bank said in a note Friday.

Houthi militants in Yemen continue to target shipping vessels in the Red Sea, despite airstrikes from the U.S. that have resulted in an “increase in concerns over more disruptions to supplies from the region,” ICICI Bank analysts said.

“However, so far the hit to actual supply from developments in the Middle-East has not taken place — that is in turn limiting the degree of upside in Brent crude-oil prices,” they said.

Meanwhile, oil prices posted back-to-back declines in the wake of Wednesday’s Federal Reserve policy announcement, despite “macroeconomic optimism fueled by the [Fed’s] indication of three potential rate cuts” in 2024 that typically is seen as bullish for oil sales and the economy, Innes said. “This suggests [that] a more favorable geopolitical landscape regarding the cease-fire resolution outweighs the positive outlook on oil markets driven by the Fed and the oil industry think tank demand upgrades.”

Oil price moves

Oil futures finished lower on Friday but tallied a slight gain for the week as a United Nations Gaza ceasefire resolution failed to pass and attacks between Russia and Ukraine intensified.

- West Texas Intermediate crude CL00, -0.32% for May delivery CL.1, -0.32% CLK24, -0.32% fell 44 cents, or 0.5%, to settle at $80.63 a barrel on the New York Mercantile Exchange. Prices edged up by nearly 0.1% for the week, according to Dow Jones Market Data.

- May Brent crude BRNK24, +0.15%, the global benchmark, shed 35 cents, or 0.4%, to settle at $85.43 a barrel on ICE Futures Europe, ending 0.1% higher on the week. June Brent BRN00, +0.13% BRNM24, +0.13%, the most actively traded contract, lost 41 cents, or 0.5%, at $84.83 a barrel.

- April gasoline RBJ24, +0.28% tacked on 0.5% to $2.74 a gallon, edging up by 0.7% for the week.

- April heating oil HOJ24, -0.36% declined by 0.6% to $2.65 a gallon, for a weekly loss of 2.7%.

- Natural gas for April delivery NGJ24, -1.72% settled at $1.66 per million British thermal units, down 1.4% on Friday, and 0.2% higher for the week.

Translation by Elio Ohep, Editor EnergiesNet

Source:MarketWatch

Next Week

Next week, 5 Fed members will speak between Monday and Friday at different events, that moves prices. In addition comes the February personal consumption expenditures data on March 29, although the NYSE and Nasdaq will be closed that day for Good Friday.

For the next Fed meeting on May 1 they lowered the odds of safety to 87 according to the chart.

2 Micro

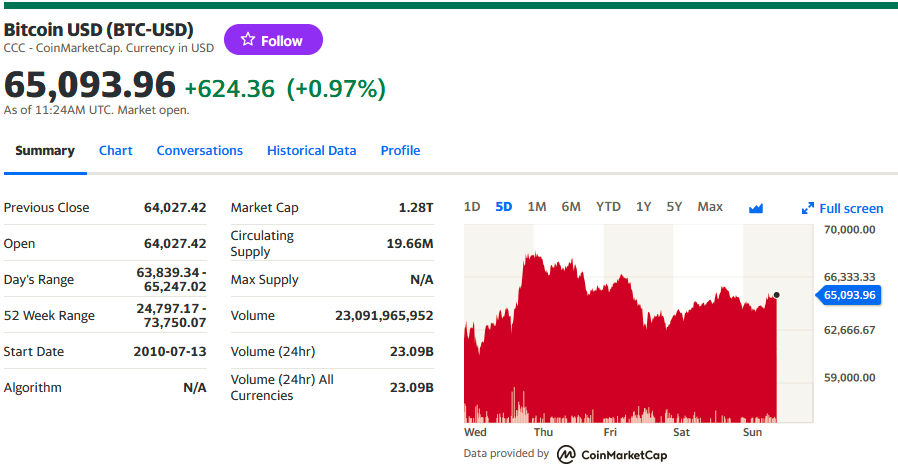

Bitcoin volatile , waiting for new opportunities to move, analysts see it weaker.

3 Building a long-term portfolio

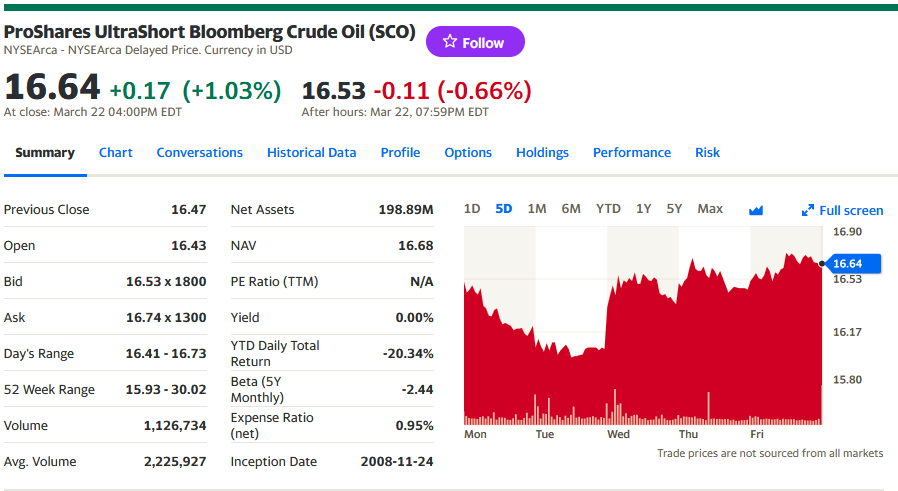

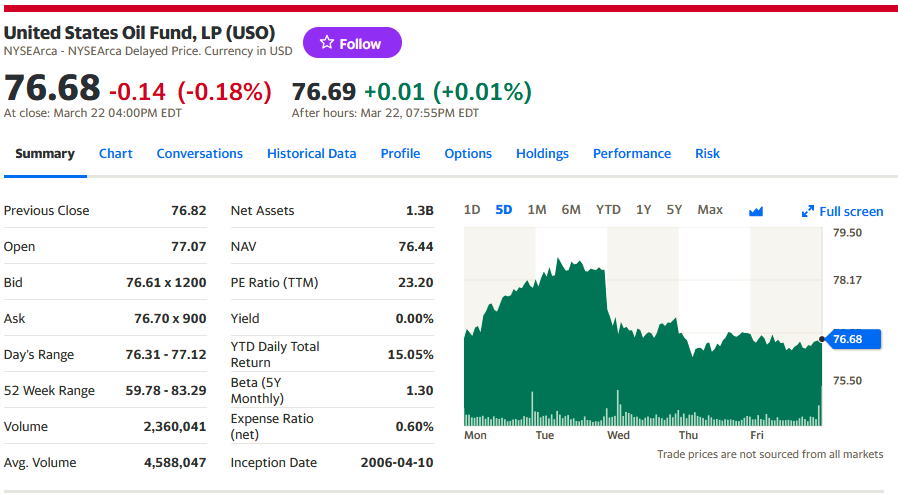

This week the energy ETF markets moved like this:

The ProShares UltraShort Bloomberg Bloomberg Crude Oil, SCO which works with short crude oil futures contracts, is up 1%.

Meanwhile, the United States Oil Fund USO, which contains, in addition to crude oil futures, futures in natural gas, diesel and gasoline, with less volatility, is down -0.6%.

The arbitrage between the prices of both funds was +0.4% per week.

4 Execution of an algorithm or method to generate cash flow on a long term portfolio or with money in the account.

Our procedure involves reviewing volumes, volatility, technical analysis on short and long term support and resistance charts.

This is our favorite strategy.

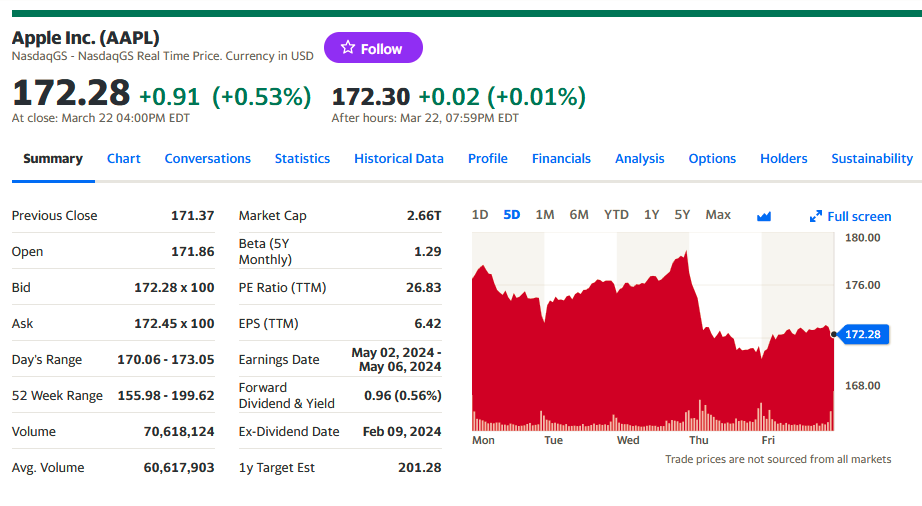

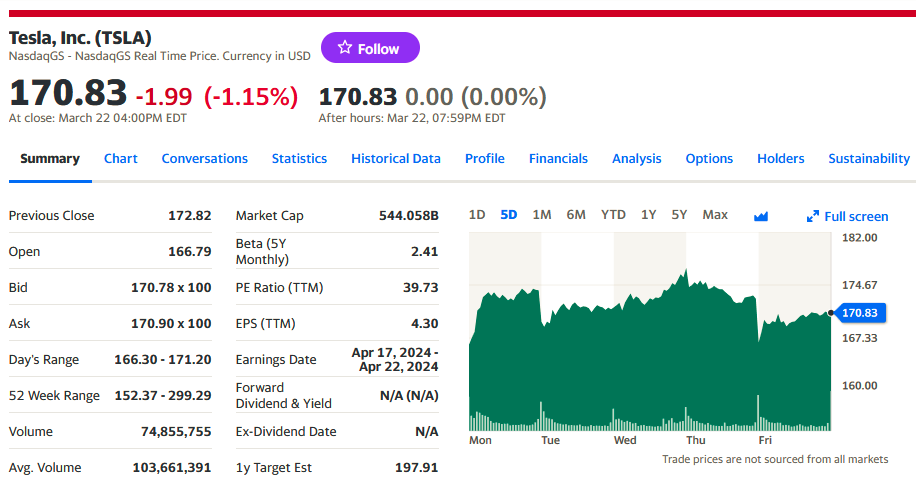

Inside the Magnificent 7 AAPL under pressure due to lawsuits from the justice department for alleged monopoly. TESLA remains under pressure and under liquidity this week although the price is beating.

5 Analysis of previous week’s forecast results

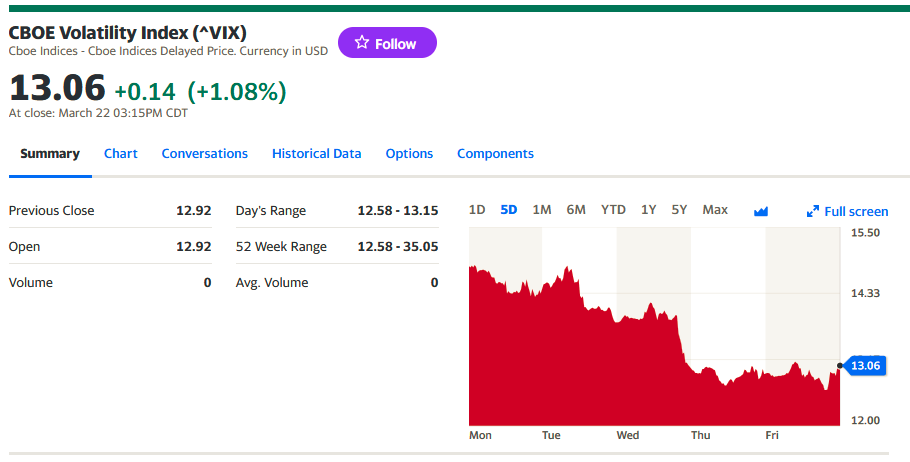

Volatility as measured by the CBOE Volatility Index declined 10%.

6 Forecast for the week ahead:

With the VIX at 13 or below , we see a clear sign of adjustments in stock prices driven by profit taking and portfolio rotations. The trend will remain bullish.

We will compare and hypothesize with the returns of oil, Gold, SPY, crude oil and the 10 year bond.

We will use our method for stocks and options in SP500 ranges between 5,100 support and 5250 resistance. It will probably touch the 5050 numbers because of volatility. We will wait.

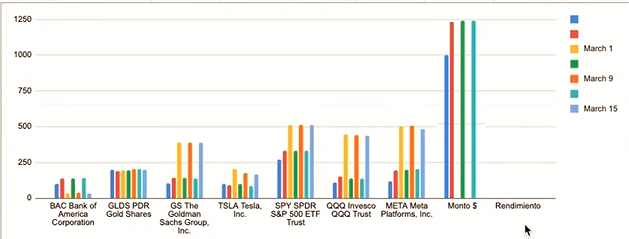

Weekly performance of the US $ 1,000 investment challenge, in 22 weeks:

Venezuelan market

Price of the dollar vs Bs

BCV : Bs 36.35

Unofficial : Bs 38.9

NOTE: We do not recommend investments, we only give our opinions.

For special courses or investment management, please contact us at : Instagram @coachraultorrealba or email : editor@petroleumworld.com

_________________________________________________________

Raúl Torrealba Ramos, B.A. in Administration and Accounting, Universidad Católica Andrés Bello, Caracas; Lawyer, Universidad Metropolitana, Caracas, is an experienced financial analyst since 1990. The views expressed are not necessarily those of EnergiesNet.

Editor’s note: This article is published as an opinion and is not recommended for investment. All comments submitted and posted on EnergiesNet do not reflect either for or against the opinion expressed and is not an endorsement by EnergiesNet or Petroleumworld.

Energiesnet.com 23 03 2024