By Michelle Nijhuis

Monte Markley, a geologist who lives on a farm near Wichita, Kansas, describes his job as “putting things underground and keeping them there.” As an environmental consultant, he specializes in disposing of industrial waste in subterranean rock formations. “All through my career, I’ve helped industries deal with the things that come out of the back side of a plant that nobody wants to talk about,” he told me. In early 2020, he got a call from Shaun Kinetic, a co-founder of a Bay Area company called Charm Industrial. Kinetic, who has experience building robots, satellites, and rockets, wanted to know how to dispose of a particularly troubling kind of waste: the excess carbon that contributes to global warming.

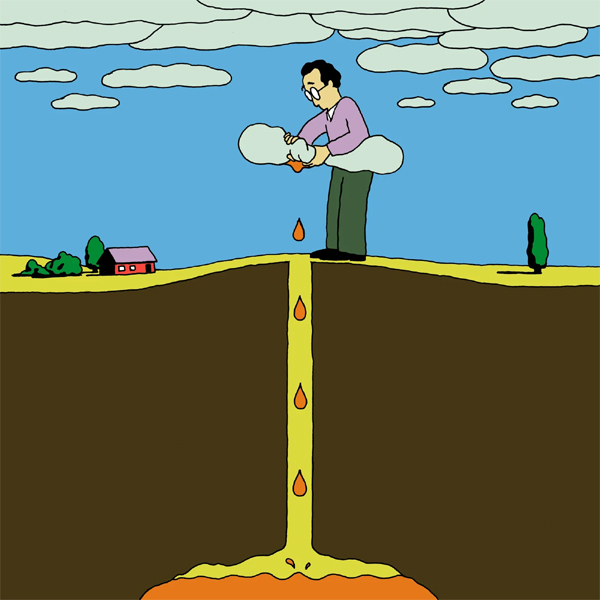

Markley had worked with companies that were trying to capture and store their own carbon emissions before they entered the atmosphere. But Charm was working with carbon that was already in circulation. The company was adapting a machine called a pyrolyzer, which heats plant material such as cornstalks in an oxygen-free environment, so that the plants turned into bio-oil, a carbon-rich liquid with the color and consistency of dark maple syrup. Kinetic wanted to know whether it was feasible to dispose of bio-oil underground. Markley said that it was—in fact, bio-oil would likely remain trapped there for centuries, if not longer. The process would resemble the drilling and burning of conventional oil, but in reverse.

In late 2021, Kinetic called again. Charm’s team hoped that, eventually, mobile pyrolyzers would allow the company to produce bio-oil on farms. To that end, Kinetic asked, could Charm Industrial test the latest version of its pyrolyzer on Markley’s land? Markley talked it over with his wife, Anna. Together, they had restored the acres they now farm, and both had a long-standing interest in conservation; the search for climate solutions appealed to them. Markley remembers thinking, “Wouldn’t it be cool to be able to tell our kids what we were a part of?” The couple signed an agreement to lease land to the company.

In January, 2022, a procession of semitrailers delivered three large shipping containers to the Markleys’ farm. Kinetic and his wife, Kelly, another Charm co-founder and the company’s chief technical officer, arrived in their Kia three days later, having been delayed by a blizzard. Charm’s engineers unpacked the pyrolyzer a few hundred yards from the Markleys’ house; they had nicknamed the device the Apatosaurus, after the long-necked, herbivorous dinosaur. Markley was delighted by its gangly complexity. “It looked like something that would show up on Elon Musk’s Twitter,” he told me.

Then came the realities of a Midwestern winter. Snow piled up on the container that housed the pyrolyzer. Freezing temperatures stalled the machine’s LCD screens. The pyrolyzer was designed to process ten metric tons of biomass per day, but cornstalks from nearby farms contained rocks and other debris that had to be filtered out. The machine often hummed until two in the morning. “My wife would be, like, ‘What have you done?!’ ” Markley recalled. The couple sometimes invited the tinkerers in for coffee or dinner. After six months, the number of tons of bio-oil that the Charm team had produced was in the single digits. The pyrolyzer worked, but nowhere near as well as it needed to.

The best way to stave off catastrophic climate change is to stop burning fossil fuels. Lately, though, the world’s leading climate scientists have warned that a gradual phase-out of oil, gas, and coal won’t be enough. If humanity is to keep the planet from warming more than 1.5 degrees Celsius, we will likely need to remove at least a gigaton of carbon, and possibly more than ten gigatons, from the atmosphere every year—and to stash it somewhere for centuries to come. (One gigaton is more than twice the combined weight of every person on the planet.) Critics of carbon removal have long feared that it will offer polluters an easy way out, by giving them an excuse to continue their emissions. The real problem may be that there is nothing easy about it.

Last summer, as Charm was preparing for its next field test, I travelled to the plains of northeastern Colorado to visit the company’s “miniforge,” which is neither miniature nor a functioning forge. Charm rents a thirty-thousand-foot warehouse that looks, from the inside, like a very roomy tech company; about ten employees were sitting in front of computer screens, within easy reach of a pickleball court. The other side of the warehouse smelled, incongruously, like a pine forest. The walls were stacked with two-hundred-and-fifty-gallon bags, each one filled with wood chips from trees that had been cut to curb wildfires. In the parking lot out back stood a pyrolyzer known as the NutriBullet, a roughly ten-foot-tall machine that was sheltered from the sun by a white tent. A narrow conveyor belt, rising steeply to a series of boxy chambers, gave the setup a Rube Goldberg aspect.

The NutriBullet requires a small amount of propane to start up, but the biomass it processes provides enough energy to keep it going. Grumbling quietly, it consumed a handful of matchbook-size chips at a time, as a trio of workers in overalls and safety glasses monitored its vitals. I followed Grace Connors, an M.I.T.-trained engineer with red hair and bright-green eyes, to a large plastic tank. “Do you smell it?” she asked.

I did. The tank was two-thirds full of bio-oil, and it smelled faintly sweet, even appetizing. The most famous product of bio-oil is “liquid smoke,” the flavoring despised by barbecue purists. Some Charm employees grow so tired of the smell that they ultimately lose their taste for grilling.

Charm was drawn to its northeastern Colorado location because the area is rich with not only corn but also energy infrastructure, which attracts a skilled workforce. A straight gravel road leading to the miniforge is lined with agricultural fields and bobbing pumpjacks; current miniforge employees have experience in solar and wind-turbine installation, agricultural finance, and tractor design.

Charm traces its origins to a customer-data company, Segment, which four college students founded in 2011. In 2014, Segment tried to reduce its carbon emissions by purchasing renewable-energy credits, limiting the red meat in company lunches, and buying carbon offsets. Segment paid about twenty thousand dollars to protect rain forests in Indonesia and Brazil, Peter Reinhardt, a co-founder who served as the company’s C.E.O., said. But he became skeptical about the effectiveness of these efforts. “All you got was a paper certificate that said, ‘You did it!,’ ” Reinhardt told me. “Was it successfully protected? Which forest was it? Can you show me on Google Maps? It was totally opaque.” The next year, wildfires devastated Indonesia. Reinhardt remembers thinking, “Well, this seems pretty fucked.”

Reinhardt started spending Saturdays in startup mode, trying to vet alternatives to offsets with several colleagues. They wanted to invest in technologies that reduced the carbon in the atmosphere, but all of the options were flawed. Nature-based solutions, such as forest restoration and soil conservation, seemed to be the simplest and the cheapest. But Reinhardt worried that their benefits were difficult to measure and often overstated, and that they were vulnerable to climate-fuelled disasters. Direct air capture, which typically uses fans to draw air through a carbon-trapping chemical filter, is more quantifiable and durable, but it consumes fantastic amounts of energy. (Unlike carbon capture and storage, which traps new emissions from a single source such as a coal plant, direct air capture targets carbon dioxide that is already in the air.) Other carbon-removal methods—enhanced rock weathering, kelp farming—seemed speculative, and came with their own uncertainties and downsides.

At first, Reinhardt and his colleagues wanted to convert carbon into usable products. They planned to use pyrolysis to produce biochar—a solid form of carbon that resembles charcoal and can enrich soil—as well as syngas, which can fuel industrial processes such as steelmaking. In February, 2018, Reinhardt created Charm Industrial along with three co-founders, including Shaun and Kelly Kinetic. They secured seed funding from private investors, including Reinhardt himself. (The Kinetics helped lead the company for five years and left in 2023.)

Charm’s timing was both fortuitous and foreboding. In October of that year, the Intergovernmental Panel on Climate Change said that limiting global warming to 1.5 degrees Celsius would require the removal of up to a thousand gigatons of carbon by 2100. Charm had joined a nascent industry—but no company had the capacity to remove carbon at anything close to a commercial scale.

In the U.S., the corn industry alone produces some four hundred million metric tons—two-fifths of a gigaton—of stalks and leaves each year, around fifty per cent of which is carbon. According to Charm’s estimates, half of those stalks and leaves could be removed sustainably. American forests also produce significant amounts of biomass; last year, the U.S. Forest Service and its partners cut trees and brush on more than 2.3 million acres of land to reduce the risk of fires. When these materials burn or are left to decompose, much of their carbon is released into the atmosphere. The trouble is that they’re also too light and bulky—essentially, too fluffy—to transport cheaply. And, the more biomass you want, the more you wind up paying for every ton, because large suppliers are fewer and farther between. “You might be able to get a ton of biomass delivered somewhere for sixty dollars,” Reinhardt told me. “But, if you want a million tons, each one might cost one hundred and fifty dollars.” In 2020, Reinhardt started to worry that these factors would drive up the price of syngas, making it too expensive for the steel industry.

Shaun Kinetic, Charm’s chief scientist at the time, proposed an alternative: perhaps, instead of shipping biomass a long way to a centralized pyrolyzer, Charm could move smaller machines to farms and forests. If the company could adjust their pyrolyzers to make primarily bio-oil, instead of biochar and syngas, the company would have a high-density, easily transportable form of carbon (which would later be convertible into syngas).

As soon as Charm engineers had produced a few vials, however, Kinetic grew anxious about how they would get rid of excess bio-oil. He had worked in laboratories in Colorado and Antarctica, and had learned that abandoned chemicals can become hazards. That was when he started to call companies that specialize in the disposal of liquid waste, like the one that employs Monte Markley. He was astonished to learn that the U.S. is home to hundreds of thousands of disposal wells, which are routinely injected with waste—cheese whey, brine from meatpacking facilities, and, more commonly, byproducts of oil-and-gas drilling—that can’t feasibly be burned, recycled, or dumped in a landfill. (The oil-and-gas industry has successfully lobbied for exemptions from environmental regulations for its disposal wells, and, in recent years, its high-pressure injection of polluted water has led to groundwater contamination and earthquakes.)

Kinetic initially thought of disposal wells as little more than a place to store messy materials. But in the aftermath of his conversations with Markley, while under a covid-19 lockdown in San Francisco, he realized that the wells might themselves serve as a carbon sink. Before oil, gas, and coal were extracted and burned, producing vast quantities of greenhouse gases, their gigatons of carbon had been trapped underground; by burying bio-oil in a disposal well, Charm might start to undo some of the harms of fossil fuels.

Charm applied for a patent for bio-oil injection as a means of carbon removal. A few weeks later, the company found its first customer. Stripe, the payment-processing company, wanted to spur innovation in carbon storage by spending at least a million dollars a year on “negative emissions technology.” The company promised to pay six hundred dollars a ton for hundreds of tons of carbon storage—a commitment worth about a quarter-million dollars. Soon, Microsoft, Square, Shopify, and other tech companies made similar promises to Charm and its industry peers. “Shit,” Reinhardt remembers thinking. “Now we have to go do this work.” In January, 2022, fourteen months after Segment was purchased for $3.2 billion, Reinhardt left the company and became Charm Industrial’s full-time C.E.O.

Although bio-oil looks similar to crude oil, it’s chemically much messier, composed of a hodgepodge of molecules rather than uniform chains of hydrocarbons. It contains organic acids that can corrode steel and aluminum, and has a tendency to solidify. In part for these reasons, it’s not a very functional fuel. Charm hired contractors, including Markley’s company, to evaluate the impact of injecting bio-oil into different geological layers, under various temperatures and pressures. (Charm said that because bio-oil hardens, and because of its density and the depth at which it is buried, it is unlikely to leak into water sources.)

The results were mixed. During one test, in early 2023, Charm engineers pumped a truckload of bio-oil into a holding tank. Then they discovered that the holding tank contained some residual water, which caused the bio-oil to separate into phases, like salad dressing. Cold outdoor temperatures congealed the oily bottom layer; when workers released the tank’s contents into a quarter-mile pipeline that led to a deep injection well, it quickly filled with gunk. “It was an ‘Oh, shit’ moment,” Reinhardt told me. Charm’s equipment operators learned to insulate their holding tanks and check for moisture. Only after several successful tests were the co-founders confident that they could permanently store bio-oil underground. Now they had to produce enough to help the climate.

In the startup world, co-founders often reframe failures as “learnings,” and Charm’s first field test, on Markley’s farm in Kansas, yielded plenty. For Reinhardt, the big one was that “the machine probably never should have been in Kansas.” If Charm wanted to sell gigatons of carbon removal, it would have to increase its pyrolysis capacity by orders of magnitude. To do that, it would have to build, test, and improve its machines much more quickly than far-flung field trials would permit.

Carbon removal has another, more fundamental problem. Carbon dioxide can still be dumped into the atmosphere more or less for free; from a financial perspective, why would anyone pay to take it out? Unless more companies make climate responsibility part of their brands, or governments force them to comply with environmental regulations, carbon removal will be a bad deal.

There are very few historical precedents for the growth that the climate crisis demands of the carbon-removal industry. In the mid-twentieth century, the synthetic-fertilizer industry grew at a blistering pace, Gregory Nemet, a professor at the University of Wisconsin-Madison who studies energy policy, told me. More recently, the solar-energy business has grown faster than almost any other, thanks in part to the rapidly falling costs of making solar panels. But both industries were able to offer their customers a tangible product with immediate benefits. Carbon removal simply offers us a better collective chance at survival. It’s arguably more valuable, but harder to value.

The best analogue for the carbon-removal industry may be waste management, according to Noah Deich, who serves in the Biden Administration as a senior adviser for the Office of Fossil Energy and Carbon Management, in the Department of Energy. As with garbage collection, Deich told me, “carbon removal delivers a service that I think we want as a society.” And, although trash has certainly made some entrepreneurs rich, its safe and permanent disposal ultimately depends on public funding. As part of the Infrastructure Investment and Jobs Act, the Biden Administration recently announced a $1.2-billion investment in carbon removal, which funds two large direct-air-capture facilities. In late May, the Department of Energy announced credit-purchase agreements with Charm and twenty-three other carbon-removal companies. “We now have a business model emerging for carbon removal that could be scaled,” Deich told me.

Polluters are already touting carbon removal as a justification to keep polluting, however. Occidental Petroleum, one of the largest oil-and-gas producers in the United States, is a partner in the federally funded carbon-removal facility in Texas. Its C.E.O., Vicki Hollub, has predicted that carbon removal “is going to be the technology that helps to preserve our industry over time.”

Olúfẹ́mi O. Táíwò, a philosophy professor at Georgetown and a climate activist, says that, as the government funds carbon removal, it has the responsibility to eliminate these moral hazards. With several colleagues, he has argued that the public should control carbon-removal technologies, and that removal facilities should be governed by local communities. “Public entities should be in the driver’s seat,” Táíwò told me. As a model for such efforts, he cited community-run coöperatives that helped to electrify rural America during the New Deal, which were funded by federal loans.

By August, 2023, Charm engineers felt that they had made enough improvements to the pyrolyzer to justify another field test. At the company’s Colorado facility, a team of equipment operators attached the NutriBullet, perched on a forty-foot trailer, to a truck bound for Northern California.

Carbon removal is vulnerable to the same kind of sleight-of-hand accounting that plagues carbon-offset projects: if a company emits more carbon than it removes, any benefits to the climate evaporate. Several independent registries have sprung up to vet and verify the tons that carbon-removal companies claim to have removed. Charm recently signed on with the registry Isometric, which tallies not only direct emissions but also “embodied emissions,” such as pollution from making equipment and trucking it across the country.

The team unpacked the NutriBullet near Redding, California, at a former sawmill. For the next six weeks, staffers worked around the clock, changing shifts at 5:30 a.m. and p.m. A contractor unloaded wood chips onto a concrete pad until they formed a small mountain. During night shifts, workers loaded the chips into woven plastic bags, hung the bags on a forklift, and emptied them over a screen, to filter out oversized pieces and debris; each morning, the workers turned on the pyrolyzer and began turning the sorted chips into bio-oil—“which, on a good day, is super boring,” Emilie Wood, who led the field-test team, told me.

This time, Charm’s work had government funding. The California Public Utilities Commission raises money for clean-energy research by charging utility fees; some are paid by customers of Pacific Gas and Electric, which provides gas and electricity to Northern California. (P.G. & E. declared bankruptcy in 2019, after its transmission lines caused catastrophic wildfires, and emerged from bankruptcy the following year.) Indirectly, Charm’s effort to put carbon back in the ground was underwritten by an industry still busy taking it out.

Despite interruptions from driving rain, extreme heat, high winds, wildfire smoke, and a minor earthquake, the team processed about ten tons of biomass into five tons of bio-oil. (Charm said that the oil would be used for research, but that, since this was a trial run, it would not generate any carbon-removal credits.) Then they trucked the NutriBullet back to Colorado.

Hundreds of companies are now experimenting with carbon-removal technologies, ranging from direct air capture to peatland restoration. The amount of carbon that technology permanently removes from the atmosphere, however, remains vanishingly small next to the tens of gigatons that humans emit each year. 1PointFive, the subsidiary of Occidental Petroleum which is working on carbon removal in Texas, has sold hundreds of thousands of tons of carbon-removal credits to corporate buyers, but hasn’t yet begun removing carbon; its plants are still under construction. Charm, which often describes itself as an industry leader, has announced the permanent removal of about seven thousand metric tons—about seven-millionths of a gigaton. ♦

____________________________________________________________________

Michelle Nijhuis is a science writer in Washington State and the author of “Beloved Beasts: Fighting for Life in an Age of Extinction.” EnergiesNet.com does not necessarily share these views.

Editor’s Note: This article was originally published by The New Yorker , June7, 2024. All comments posted and published on EnergiesNet or Petroleumworld, do not reflect either for or against the opinion expressed in the comment as an endorsement of EnergiesNet or Petroleumworld.

What Is the Opposite of Oil Drilling? | The New Yorker

Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of environmental and humanitarian significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml.

EnergiesNet.com 06 23 2024