Peter Millar, Bloomberg News

RIO

EnergiesNet.com 06 24 2024

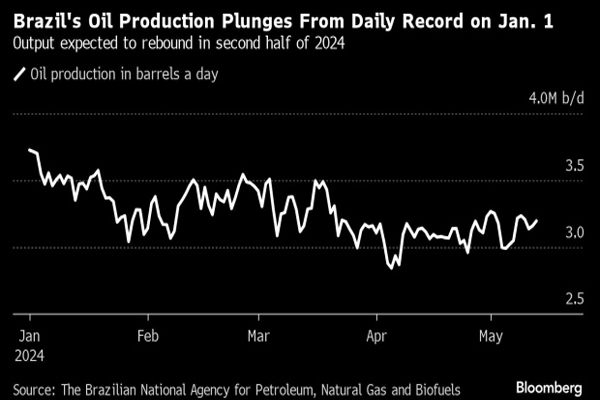

Brazil’s rebound from a stunning collapse in oil production promises to complicate OPEC efforts to micromanage global supplies and prices.

Daily crude output in the South American powerhouse kicked off the year at 3.73 million barrels, then plummeted nearly 25% as roustabouts crawled all over mammoth offshore platforms to perform repairs and replace worn-out gear.

Now more than one-third of the deficit has been restored, offering far-reaching implications for Latin America’s largest economy and worldwide energy markets. All that additional oil will hinder the Organization of Petroleum Exporting Countries’ efforts to boost prices by cutting production.

Brazil’s prodigious offshore oil troves, like US shale, are an ever-present bugaboo for OPEC and its hegemony over global crude balances. The recent surprise decision by the cartel and its allies to relax some controls on oil exports could come back to bite if the Brazilian rebound is too robust.

Petroleo Brasileiro SA is moving forward a start date for a 100,000 barrel-a-day production vessel to the fourth quarter of 2024, the state-controlled explorer said on June 19.

Brazil has pushed to strengthen ties with OPEC and its allies under President Luiz Inacio Lula da Silva, while refraining from any commitments to constrain output through its quota system. Last year Brazil announced it was joining a cooperation charter with the OPEC+ alliance that provides a platform for dialog among producing countries.

Brazilian fields may actually overshoot the pre-collapse figure by roughly 200,000 barrels a day this year as maintenance work finishes up and two new offshore development commence operations, according to Wood Mackenzie Ltd.

“More wells will be connected and start to produce,” Wood Mackenzie wrote in an email. “We believe it’s too early to say production will disappoint.”

Welligence Inc., meanwhile, is more cautious, forecasting daily output of 3.4 million to 3.5 million for the rest of this year. Brazilian production growth won’t resume 2023’s breakneck pace until the second half of 2025, with the arrival of four new offshore installations, said Andre Fagundes, who covers Brazil for the energy consultancy and previously worked for the ANP.

Petrobras and other oil drillers face multiple headwinds. The environmental agency known as Ibama is on strike and it looks like the standoff over wages will only get worse. This has delayed permits for new production equipment and related work. The strike already has curbed 80,000 barrels of daily output, according to the Brazilian Petroleum Institute.

And then there’s Tupi, Brazil’s crown jewel, where crude production peaked several years ago and continues to fade. Petrobras needs to negotiate with the ANP to extend the operating license before it can commit to investing billions in a secondary-recovery program to stem the decline.

During a conference call with analysts in May, Petrobras attributed the production hiccups to so-called planned maintenance, and said it expects to gradually return to previous. The company didn’t respond to a request for comment for this story.

–With assistance from Mariana Durao and Beatriz Amat

bloomberg.com 06 21 2024