Mayra P. Saefond and William Watts, MarketWatch

SAN FRANCISCO/NEW YORK

EnergiesNet.com 07 02 2024

Oil futures settled with a loss on Tuesday, with prices giving up early gains as concerns that powerful Hurricane Beryl could cause disruptions to offshore crude production in the Gulf of Mexico eased, for now.

Expectations for heavy travel around the Fourth of July holiday in the U.S. on Thursday, however, helped to limit losses for oil.

Price moves

- West Texas Intermediate crude CL00, -0.25% for August delivery CL.1, -0.25% CLQ24, -0.25% fell 57 cents, or 0.7%, to settle at $82.81 a barrel on the New York Mercantile Exchange, after settling Monday at its highest since April 26.

- September Brent crude BRN00, 0.42% BRNU24, 0.42%, the global benchmark, lost 36 cents, or 0.4%, at $86.24 a barrel on ICE Futures Europe.

- August gasoline RBQ24, -0.09% shed 0.2% to $2.57 a gallon.

- August heating oil HOQ24, +0.80% climbed 0.6% to $2.63 a gallon.

- Natural gas for August delivery NGQ24, -0.48% settled at $2.44 per million British thermal units, down 1.7%.

Market drivers

Traders have eased back on the hurricane price premium in oil, Phil Flynn, senior market analyst at the Price Futures Group, told MarketWatch.

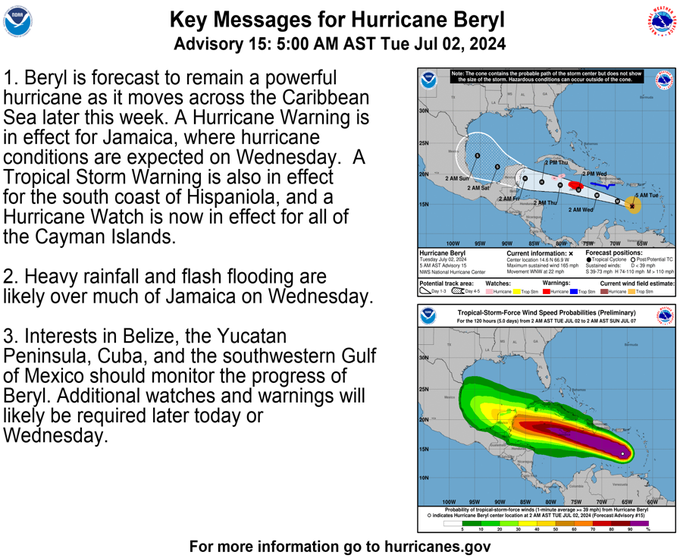

Most of the storm predictions show Hurricane Beryl going south of some of the major oil platforms and rigs, Flynn noted. Still, “as the storm gets closer a few days out, we’ll have to judge to see how much production gets shut in, if any,” he said.

Beryl made landfall on the island of Carriacou in Grenada and became the earliest Category 5 storm ever in the Atlantic.

Beryl isn’t expected to impact operations in the Gulf of Mexico immediately but could cause disruptions later in the week, said Ipek Ozkardeskaya, senior analyst at Swissquote Bank, in a note.

Early Tuesday, Flynn said in a report that storm risk was “taking a back seat to geopolitical risk factors and signals of the potential for record-breaking holiday demand.”

“Not only do we have U.S. military bases on high alert for a credible threat of terror attack, now we have the Iranian-backed Houthi rebels daring the U.S. to defend international waters,” he wrote.

“Even without the storm, the markets are starting to price in a global oil supply deficit as the spreads are suggesting that the markets are already starting to tighten significantly,” Flynn added.

Oil prices had finished higher on Monday, with WTI at its highest since April 26 and Brent at its highest settlement since April 30, lifted in part by expectations for robust travel for the July Fourth holiday on Thursday.

marketwatc.com 07 02 2024