U.S. emerged as first destination of Venezuela’s crude exports . Outages reduced stocks of exportable diluted crude oil

Marianna Parraga and Mircely Guanipa, Reuters

HOUSTON/MARACAY

EnergiesNet.com 08 07 2024

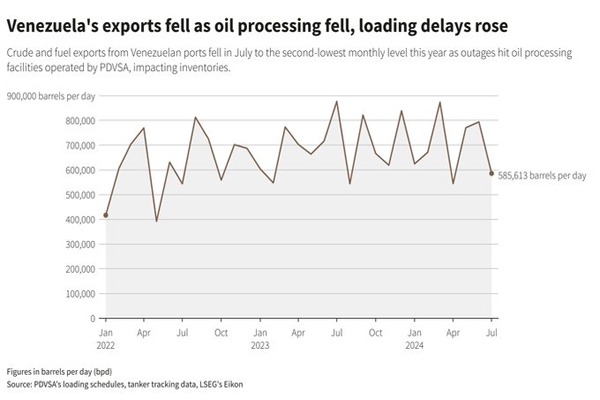

Venezuela’s oil exports fell in July as crude processing units were hit by outages, reducing stocks available from the country’s main producing region and increasing delays to load cargoes, according to documents and vessel monitoring data.

The OPEC country’s exports had recovered in previous months helped by U.S. licenses and authorizations to partners of state oil company PDVSA PDVSA.UL, but domestic operational issues knocked down the volume of crude and fuel shipped to the second lowest monthly level this year.

A total of 38 cargoes departed from Venezuela’s waters last month carrying an average of 585,600 barrels per day (bpd) of crude and fuel, and 266,000 metric tons of oil byproducts and petrochemicals, the documents and data from LSEG showed.

Oil exports were 26% lower than the previous month, and 33% below the same month of 2023. Shipments of byproducts and petrochemicals including petroleum coke and methanol declined 26% from June.

The data showed the U.S received some 281,260 bpd, the main destination of Venezuela’s oil exports for the first time since Washington began imposing energy sanctions on the country in 2019. It was followed by China with 231,400 bpd.

U.S. producer Chevron CVX.N reached its second highest monthly export level this year, shipping some 238,0000 bpd to U.S. ports. Spain’s Repsol REP.MC, which in July began selling Venezuelan crude to U.S. customers, shipped 102,000 bpd to the U.S. and Europe.

Upgraders and blending stations that process the extra heavy oil produced at Venezuela’s vast Orinoco Belt did not work near full capacity in July, an internal PDVSA document showed.

Projects Petrolera Sinovensa and Petrocedeno had brief operational interruptions due to equipment malfunctioning, while an outage left a third project’s upgrader, Petromonagas, out of service since early July.

Low inventories of fuel oil and some crude grades from the Orinoco Belt, including diluted crude oil (DCO), and the need of loading cargoes through ship-to-ship transfers increased shipping delays PDVSA has been facing since early this year.

A disputed election in Venezuela in which both incumbent President Nicolas Maduro and the opposition coalition’s candidate, Edmundo Gonzalez, claimed victory has slowed down economic activity in recent days while triggering widespread protests and arrests.

But PDVSA’s main operations, including crude production and refining, have been working without major interruptions.

Venezuela’s exports fell as oil processing fell, loading delays rose https://tmsnrt.rs/46DmIVM

Reporting by Marianna Parraga in Houston and Mircely Guanipa in Maracay, Venezuela; Editing by David Gregorio

reuters.com 08 05 2024