Deadline for recommendation on winning bid expired on Aug. 22. The court-ordered sale hearing is scheduled for Oct. 30

Nicolle Yapur, Gillian Tan, and Derek Decloet, Bloomberg News

CARACAS/NEW YORK

EnergiesNet.com 08 26 2028

Elliott Investment Management is the leading bidder in a US court-ordered auction of the parent company of Venezuelan-owned refiner Citgo Petroleum Corp., according to people with knowledge of the process.

Elliott was competing against bidders including independent refiner Vitol Group and Canadian miner Gold Reserve Inc., which was working on a joint bid with billionaire Carl Icahn’s CVR Energy, said the people, who asked not to be identified because they’re not authorized to speak publicly. Elliott has now been granted exclusivity to negotiate a deal, some of the people said.

The auction process has been long and winding, and Elliott’s emergence as the top contender doesn’t necessarily mean it will end up with the asset.

Citgo operates refineries in Louisiana, Illinois and Texas and owns stakes in terminals, pipelines and lubricant plants. The sale of its parent company has been controversial, as Venezuelan President Nicolás Maduro blames the opposition, which controls the country’s foreign assets, for losing the company to creditors.

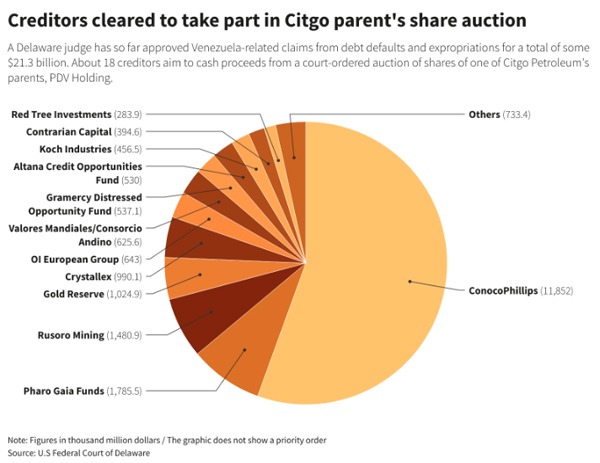

The sale marks the culmination of a years-long legal battle started by another Canadian miner, Crystallex, who went after Citgo’s parent in court to collect an unpaid arbitration award from the expropriation of its Venezuela assets by late president Hugo Chávez. Since then, a long list of creditors holding a total of $20 billion of claims have joined the process.

The court-appointed special master overseeing the sale, Robert B. Pincus, asked the judge in a filing late Friday to give him more time to finalize his recommendation of the winning bidder for Citgo’s parent, PDV Holding, to Sept. 16 from Aug. 22. Pincus said he and his advisers have been in “robust negotiations” with an unidentified bidder and need the time to finalize “due diligence and definitive documentation in support of a sale transaction.” If granted, Pincus’ request would move the sale hearing to Nov. 7.

To move forward with the sale, the buyer must get an authorization from the US Treasury’s Office of Foreign Assets Control, as current US sanctions protect Citgo from embargo.

–With assistance from Bob Van Voris.

bloomberg.com 08 24 2024