CEO tasked with reviving output, slashing $100 billion debt. Troubled state oil company is world’s most indebted producer.

Scott Squires, Bloomberg News

MEXICO CITY

EnergiesNet.com 0828 2024

Mexico’s President-elect Claudia Sheinbaum appointed energy economist Victor Rodriguez Padilla to lead state-owned oil driller and refiner Petroleos Mexicanos as her administration looks to revive the company’s flagging production and trim its nearly $100 billion debt burden.

Sheinbaum tapped Rodriguez, a professor at the National Autonomous University of Mexico, for the job to boost Pemex’s profitability and rescue the company from ballooning debt and recurring accidents as she seeks to jump start Mexico’s green energy transition.

“He has 42 years of experience in the energy sector and of course he’s been a defender of the energy companies of the nation,” Sheinbaum said when she announced the appointment during a news conference Monday. “Victor knows Pemex.”

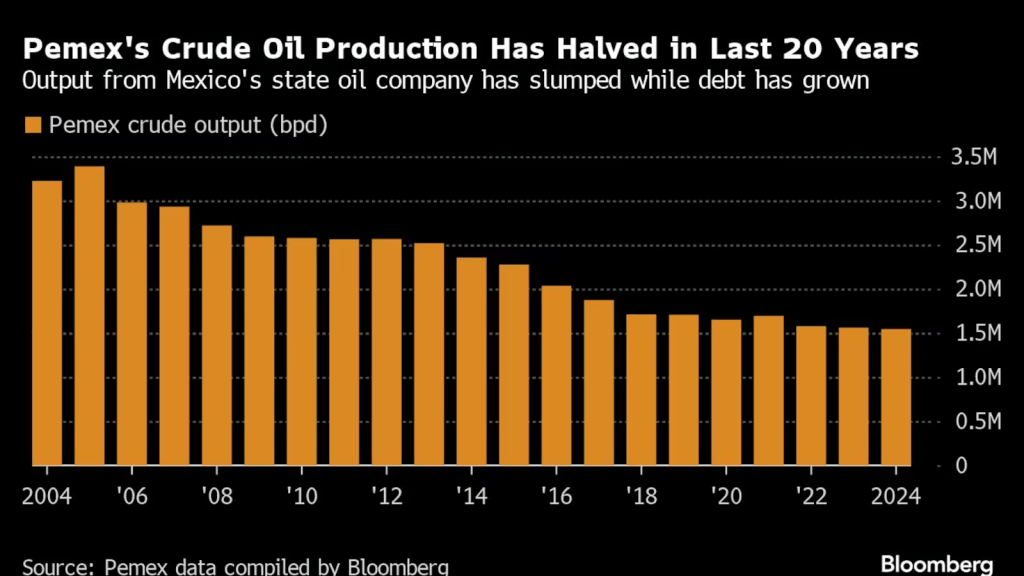

Rodriguez will face the gargantuan task of turning around production that has slumped to about half its peak 20 years ago. The company’s debt burden stands at about $99.4 billion, making it the world’s most indebted oil producer. It’s been saddled with deadly fires, oil spills and methane leaks in recent years as its infrastructure crumbles. It relies heavily on government handouts to stay afloat.

“Pemex is not a dead company — nor is it as bad as they think,” Rodriguez said during the news conference. “We need to maintain the energy base of the economy, which continues to be oil and gas, while we carry out the energy transition.”

Mexico will maintain crude production at around 1.8 million barrels per day, but all new energy demand will be met through renewable sources, Rodriguez said. It’s a goal that Sheinbaum, an environmental engineer, repeatedly touted during her campaign.

“Pemex is not going to limit itself to making oil and gas condensate as it has always done,” Rodriguez said. “We will have to make a big effort to develop renewable sources of energy of all kinds, and Pemex will have a fundamental role.”

He cited solar and off-shore wind power energy as potential options.

Rodriguez, who has co-authored several academic and opinion articles with Sheinbaum, holds a doctorate in energy economics from Pierre Mendès-France University. He has spent the majority of his career at National Autonomous University of Mexico, where he received degrees in physics and engineering.

Having an academic at the helm of Pemex could lead to greater collaboration between the company and Mexico’s energy and finance ministries, Bradesco analyst Rodolfo Ramos wrote in a note to clients. He also noted that Rodriguez’s willingness to partner with the private sector could help the company’s bottom line.

Returning Pemex to profitability will be a monumental task. Last quarter, the company posted its worst loss since the global pandemic emerged more than four years ago, mostly due to a slide in the value of the peso in recent months.

To stay afloat, the company has relied on government handouts. President Andres Manuel Lopez Obrador has showered it with capital injections and tax relief totaling as much as $80 billion, though the infusions have done little to improve oil output.

Pemex is also facing billions in late payments to service providers. Repeat accidents in recent years have led many investors concerned with environmental, social and governance metrics to flee.

Rodriguez will take the helm when Sheinbaum assumes office Oct. 1. Pemex’s outgoing CEO, Octavio Romero, will remain in the government, Sheinbaum said, without specifying his role.

Sheinbaum says she envisions Pemex playing a role in Mexico’s transition to cleaner sources of energy and has promised to expand it into green technologies, including hydrogen, lithium extraction and electric-vehicle infrastructure. The company published its first sustainability plan in March after some of its creditors threatened to divest from the company if it didn’t clean up its ESG record.

Another major question is how Pemex will work with the private sector to turn around production, such as the company’s recent deal to farm out some of its offshore production to private drillers. Sheinbaum has vowed to keep state-owned enterprises at the center of Mexico’s energy sector, echoing a position taken by AMLO.

Sheinbaum has also said she expects to refinance the company’s bonds before large maturities come due in 2025. The company has more than $7 billion in bonds maturing next year, according to the latest company data.

–With assistance from Alex Vasquez.

bloomberg.com 08 27 2024