Peter MIllard, Bloomberg News

RIO

EnergiersNet.com 0 8 29 2024

President Luiz Inacio Lula da Silva’s push for more and cheaper natural gas is generating concern that Brazil is turning to interventionist policies in a move that could discourage investments by oil majors including Petroleo Brasileiro SA, Equinor ASA and Shell Plc.

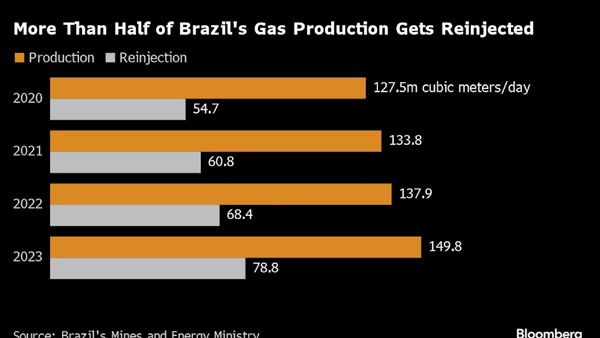

A decree published Tuesday allows Brazil’s oil regulator, known as the ANP, to set the amount of natural gas that oil producers reinject into reservoirs. More than 90% of Brazil’s oil and gas production is at offshore fields, where it can cost billions to transport gas to shore through pipelines. As a result, more than 50% of gas production gets reinjected in a process that also increases reservoir pressure to help produce more oil. The new decree could end up forcing that figure lower, to instead divert more gas to the fuel market.

Lula’s administration is prioritizing efforts to increase supplies of natural gas and bring down prices as a way to boost industrial activity. But having the regulator review how much natural gas oil producers reinject into offshore fields could make oil companies more cautious.

Equinor and Shell are both studying multi-billion-dollar offshore projects in Brazil, where the economics could be impacted if the companies are required to build gas pipelines and limit the amount of gas reinjection. Shell is analyzing the decree and declined to provide further comments in an emailed response. Equinor and Petrobras, Brazil’s biggest producer, didn’t immediately respond to requests for comment.

“There is a very fine line between regulation and intervention,” said Andre Fagundes, who covers Brazil for energy consultancy Welligence Inc. “A one-size-fits-all rule may discourage investments and directly impact the volume of liquids produced in the country.”

–With assistance from Daniel Carvalho and Mariana Durao.bloomberg.com 08 27 2024