Sheky Espejo, Platts S&P Global

MEXICO CITY

EnergioesNet.com 10 25 2024

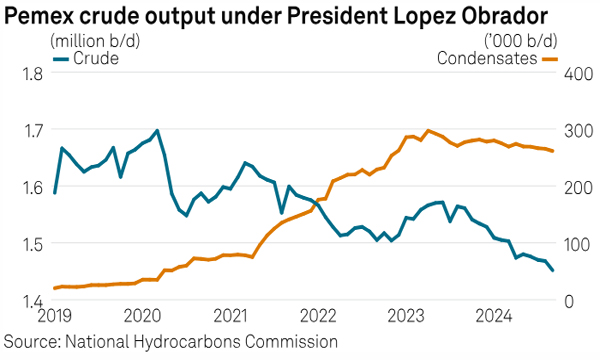

Crude production by Mexico’s state oil company Pemex fell to a new multidecade low in September, the last month under the administration of former President Andres Manuel López Obrador, who invested roughly $50 billion into the company to keep it afloat during his six-year term.

September gas production remained at its lowest for at least three decades at 4.34 Bcf/d as exploration falters, according to data released late Oct. 24 by the National Hydrocarbons Commission, or CNH.

Under López Obrador, Pemex was instructed to focus on onshore and shallow-water deposits, where Pemex has certainty of resources, to maintain steady outflows. The production goal, López Obrador said, would be sufficient to feed the national refining system, as Pemex would slowly eliminate its crude exports.

Pemex produced 1.452 million b/d of crude in September, compared with 1.468 million b/d in August, and 1.560 million b/d in September 2023, according to the CNH data. In December 2018, when López Obrador took office, crude production was 1.676 million b/d, the data shows.

Condensate production, which has for the past several years compensated for the decline in crude, was also down slightly to 261,000 b/d in September from 277,000 b/d in September 2023, bringing the total production of liquids to 1.713 million b/d, compared with 1.942 million in September 2023, the data shows. Gas production was 4.34 Bcf/d, compared with 4.78 Bcf/d in September 2023.

The crude production figure is the lowest since Pemex made the discovery of Cantarell, the largest field in its history in the late 1970s, CNH data shows. It also comes as some of the main fields of the company, like Zaap, Quesqui and Tupilco Profundo, underdelivered, which forced the company to drill more.

In September 2023, the company’s seven main producing fields generated 1.94 million barrels of liquids, compared to the current production of 1.82 million b/d, the data shows. These seven fields are close to their expected peak in production and are projected to enter a rapid decline, according to data compiled by S&P Global Commodity Insights. When this happens, Mexico’s total crude production is likely to fall accordingly, leading some experts to speculate that production could drop so low that the country may need to import crude to supply its refineries or rethink its fuel production goals.

In September 2023, Pemex was drilling a total of 244 fields, whereas it now needs to drill 246, according to the data.

This lower production, together with a slight increase in run rates at its refineries and the start of tests at a new refinery in the country, have already caused crude exports to falter.

US imports of Mexican crude oil reached a nine-week low, falling 36.4% week on week to 258,000 b/d in the week ended Oct. 18, according to data released Oct. 23 by the US Energy Information Administration.

spglobal. 10 24 2024