Scott Squires, Bloomberg News

MEXICO CITY

EnergiesNet.com 10 30 2024

Petroleos Mexicanos’ loss doubled in the third quarter amid slumping sales, currency fluctuations and other factors, a negative sign for Mexican President Claudia Sheinbaum’s hand-picked executive leadership team.

Pemex’s loss widened to 161.3 billion pesos ($8.1 billion) from 79.1 billion a year earlier, the company reported Tuesday. The explorer’s crude and condensate output fell by almost 5% compared with a year earlier and has been dropping since the start of 2024. Net debt stood at $97.3 billion, the company said.

The results are the first under the leadership of Chief Executive Officer Victor Rodriguez, a former academic appointed by Sheinbaum to rescue the world’s most-indebted major oil producer. Aside from nearly $100 billion in debt, the company’s woes include abysmal safety and environmental records, a bloated workforce, inefficient offshore platforms and refineries that bleed cash.

Earlier this month, Mexico’s Senate approved a bill that reclassifies state-controlled energy giants as “public companies,” giving the government more control and no longer requiring them to turn profits. That may be key in helping Sheinbaum deliver on promises to fix Pemex’s finances and help shore up one of the crown jewels of the Mexican economy.

“Pemex’s reclassification as a public company won’t limit partnerships with the private sector,” Rodriguez said during a conference with analysts on Tuesday. “Private investment will be particularly welcomed, especially in co-generation and clean energy projects.”

Pemex is currently working with Mexico’s Finance and Energy ministries on a solution to its debt burden, Chief Financial Officer Juan Carlos Carpio said during the call. Details of a liability-management plan will be released after Sheinbaum’s administration publishes its 2025 budget, and the company expects the government next year to extend financial support similar to 2024’s amount, according to Carpio. The driller isn’t currently considering any new debt issuance, he noted.

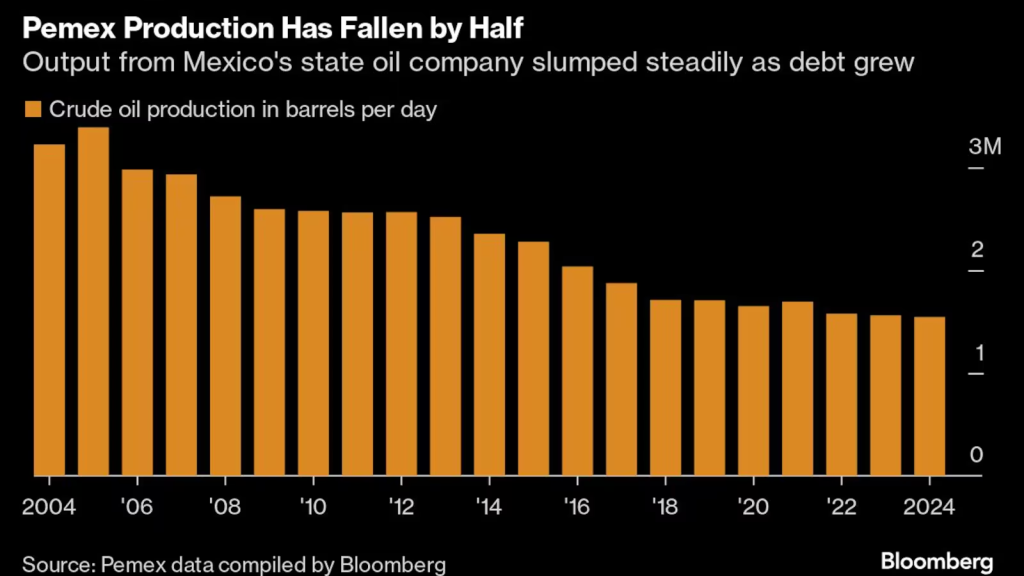

Pemex’s woes extend well beyond its balance sheet. Production has slid to about half the peak of two decades ago, and the company’s aging refineries — most of which were built in the 1920s and 1930s — are money losers. Despite Former President Andres Manuel Lopez Obrador’s repeated promises that Mexico would produce all the fuel it consumes by the end of his term, it still imports more than half its gasoline supply.

Dos Bocas, the company’s flagship refinery in Tabasco state, only processed crude at 25% of capacity in August, processed zero barrels in the first half of October because of technical issues, and went offline entirely last week.

Lopez Obrador dumped up to $80 billion into the company via capital injections and tax breaks over his six-year term. But little, if anything, improved, underscoring just how much of a drag Pemex’s inefficiency has become on the nation’s bottom line.

There’s also been a raft of oil spills, methane leaks, and safety problems in recent years, including an incident earlier this month at a Texas refinery in which two people died. The company had nine worker fatalities in 2022, according to the most recent data available to Bloomberg.

That has sparked many investors to call for change, leading the company to publish its first ever environmental, social and governance plan earlier this year.

Sheinbaum has promised to keep daily oil production around 1.8 million barrels in coming years, using renewable energy sources to meet Mexico’s growing electricity demand. She is aiming to make Mexican refineries more efficient, reduce fuel imports and grow Pemex’s mandate to include new ventures like lithium extraction and electric-vehicle infrastructure.

bloomberg.com 10 29 2024