Oil may be a recession indicator — but Trump’s sudden tariff-hike pause makes it harder to read

Myra P. Saefong, MarketWatch

SAN FRANCISCO

EnergiesNet.com 04 10 2025

Losses in oil had been fast and furious since President Donald Trump announced his wide-ranging plans for tariffs last week — that is, until he suddenly decided to pause tariff hikes on most countries while slapping China with an even higher tariff rate for its imports into the United States.

Trump was getting what he’s always wanted — lower oil prices that can cut fuel costs for Americans, but he also managed to shift worries from rising inflation to a potential recession.

“Trump likely wanted oil below $60 to tout a win on inflation and claim he lowered costs for the average American,” said Rebecca Babin, senior energy trader and managing director at CIBC Private Wealth in New York. He was getting the “price he wanted, but for the wrong reasons.”

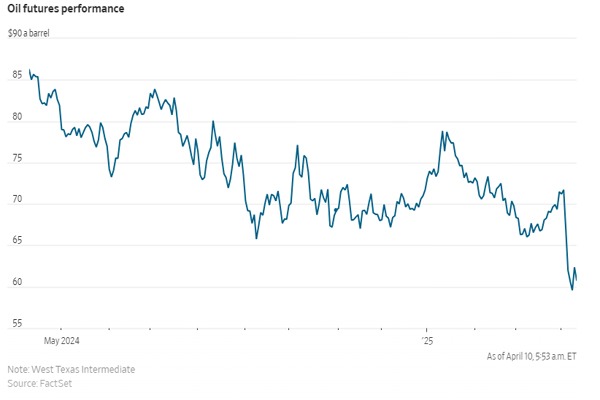

On Wednesday, U.S. benchmark West Texas Intermediate crude for May deliverydropped to as low as $56.06 a barrel on the New York Mercantile Exchange, tapping their lowest level since February 2021.

Then prices rebounded to settle $2.77, or nearly 4.7%, higher at $62.35, with gains sparked by Trump’s decision to pause ”reciprocal” tariff hikes and offer a lower tariff rate of 10% for most countries for 90 days, with the exception of China, which saw its tariff rate raised to 125%.

The spread between Wednesday’s high and low for WTI was $6.87 a barrel, the largest intraday spread since March 15, 2023, according to a Dow Jones Market Data analysis of CCQG data.

But prices have still lost 13% since the close on April 2 — the day Trump announced his wide-sweeping tariffs plans.

Oil prices weren’t falling because of strong supply or productivity gains, Babin told MarketWatch. They were falling due to “growing fears of a global slowdown and fallout from [Trump’s] own tariff policies.”

“It’s hard to declare victory when falling oil is a symptom of economic stress, not strength,” she said.

For now, Trump’s announcement of a pause in some tariff hikes may “remove the Armageddon scenario,” said Babin. But there’s a lot of uncertainty on how this plays out — so it’s “way too early to signal all clear” in terms of prospects for further declines in oil prices.

At the same time, “never underestimate the velocity of a relief rally,” she said. Commodity-trading advisers have built substantial short positions, and there was a lot of bearish sentiment baked into crude prices, so it’s possible to see prices move up to $65 a barrel.

Recession indicator?

That makes for a confusing read on prospects for a recession.

Oil is sometimes seen as a “real-time indicator of a recession” given that prices for the commodity reflect best estimates of supply and demand, said Rob Thummel, senior portfolio manager at Tortoise Capital.

If oil prices are falling and are low, then that could mean oil demand is weakening and the oil market is oversupplied, he said. And given the strong correlation between oil demand and economic growth, “some concur that weak oil demand is a sign of a current and/or impending recession.”

However, the economic data to declare a recession is always “delayed,” Thummel said. Despite the 90-day pause in tariff hikes, higher tariffs are in place for China, the world’s second-largest oil consumer, and the major oil producers known as OPEC+ are still adding supply to the market, so he expects WTI oil prices to trade in the $55 to $65 range.

Henry Hoffman, co-portfolio manager on the Catalyst Energy Infrastructure Fund, told MarketWatch ahead of Trump’s latest tariff move that unless fears around trade disruptions, slowing global demand and policy missteps by the Trump administration start showing up in hard data, such as job losses, contracting PMIs, widening credit spreads or market contagion, “a recession isn’t inevitable.”

But “if these trade disputes continue much longer, it’s likely global economics will suffer significant economic damage,” said Hoffman.

So far, some indicators related to oil, such as time spreads and physical flows, are “holding up better than spot prices,” said CIBC’s Babin. That suggests the physical market isn’t collapsing, she said, but crude can also send “false recession signals during volatility.”

Still, some would say that a recession is not an inevitable response to oil prices falling.

”It’s the other way around,” said Stewart Glickman, deputy research director and energy equity analyst at CFRA Research.

‘Tariff-related decisions seemingly are made multiple times a day. Let’s wait and

see if we can make it through the rest of the week without new tariff proclamations.’— Stewart Glickman, CFRA Research

Tariffs are driving the fears over a recession, he said. “We fear a recession, and the drop in WTI is a reflection of that.”

Glickman was hesitant to call a bottom for oil prices following the turnaround Wednesday. “Tariff-related decisions seemingly are made multiple times a day,” he said. “Let’s wait and see if we can make it through the rest of the week without new tariff proclamations.”

Oil-price drop winners and losers

Still, a roughly 13% decline in U.S. benchmark since Trump’s original tariff announcement last week is hard to ignore and crude production could take a hit.

The recent plunge in oil prices prompts the question of what happens if WTI oil prices go as low as $50 a barrel, and the answer may be that onshore crude-oil production in the lower 48 U.S. states declines by more than 1 million barrels per day over 12 months, according to S&P Global Commodity Insights.

Trump has a well-known slogan of “drill, baby, drill” to increase production and lower energy prices. But oil prices around $60 a barrel wouldn’t spur much “drill, baby, drill” in the U.S., said Simon Wong, analyst at Gabelli Funds.

U.S. shale exploration and production operators and U.S.-focused oilfield service providers are negatively impacted by lower oil prices, he told MarketWatch. “U.S. production will still likely grow at or around $60, stay flat around $58 [to] $60, but start declining under $55,” said Wong.

Still, there are some who benefit from lower U.S. oil prices, the most visible of whom may be drivers filling up at the fuel pumps.

Gasoline prices at the pump have started to flip lower in a majority of U.S. states in the past week, said Patrick De Haan, head of petroleum analysis at GasBuddy.

He was expecting to see gas prices accelerate their decline in the days ahead, but the temporary pause in some tariff hikes Wednesday for most countries has led to a rally in oil. That’s a scenario he said could potentially dash chances of sub-$3-a-gallon national average gas prices by late April.

Not like COVID times

Whatever happens, consider this: Four years ago this week, over a billion people around the world were under lockdowns because of COVID-19 — and at the time, WTI oil prices were trading under $60 a barrel, said Pavel Molchanov, investment strategy analyst at Raymond James.

Even so, he believes that the oil market is not experiencing a COVID-type cratering in demand.

“As a headwind for oil demand, tariffs are much less extreme than COVID,” said Molchanov. “But we also need to keep in mind the bearish supply-side factors: a near-record amount of oilfield projects coming online in 2025,” and OPEC+ starting to unwind its production cuts.

Read: Oil prices are cratering on Trump’s tariffs. So why does OPEC+ think the world needs more crude?

marketWatch.com 04 09 2025