U.S. Court Rejects Lawsuit Against PDVSA for Alleged Debts of More Than $1.5 Billion

EnergiesNet

HOUSTON

EnergiesNewt.com 22 05 2025

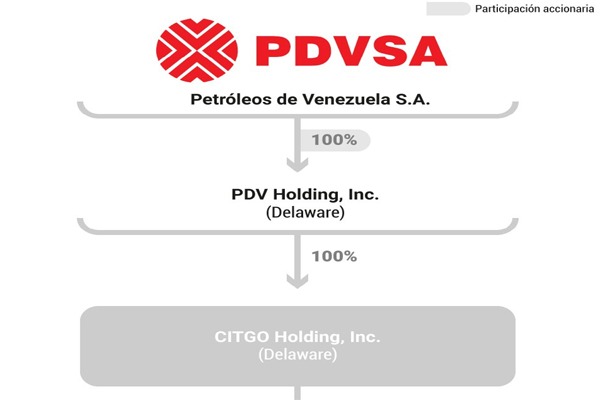

The recent decision by Judge Jed S. Rakoff in the Southern District of New York represents a crucial milestone for PDVSA and its subsidiary PDVH in the U.S. The lawsuit, filed by Girard Street Holdings and G&A Strategic Investment, sought to prove that PDVH was PDVSA’s “alter ego,” which would mean that the subsidiary should take responsibility for debts incurred by PDVSA between 2016 and 2017, valued at more than $1.5 billion. However, the judge rejected this claim, preventing creditors from extending their claims to PDVH, which protects the company’s assets in the U.S.

This decision has a significant impact on PDVH’s asset protection in the United States, as it prevents PDVSA’s creditors from accessing the assets of its U.S.-based subsidiary. It also sets a relevant legal precedent in disputes involving sovereign debt and state-owned enterprises, strengthening PDVSA’s position in future financial and legal negotiations. In financial terms, the ruling could improve PDVH’s stability by eliminating a potential threat of additional liens or litigation, which may influence the perception of risk among investors and creditors.

PDVSA’s Ad Hoc Board of Directors has celebrated the ruling and reaffirmed the commitment to defend the company’s assets abroad. Judge Rakoff is expected to release a more detailed opinion on the reasons behind his decision in the near future, which will offer greater clarity on the long-term impact of this ruling. Against a backdrop of economic and legal tensions for PDVSA, the resolution of this case marks a turning point in its asset protection and financial responsibility strategy.

PDVSA AD HOC ADDRESSES THE PUBLIC

May 21, 2025

The Ad Hoc Administrative Board of PDVSA wishes to inform that on May 20, 2025, U.S. District Judge Jed S. Rakoff of the Southern District of New York dismissed the claims of Girard Street Holdings and G&A Strategic Investment in a lawsuit against PDVSA and PDVH, PDVSA’s U.S. subsidiary. In their complaint, the plaintiffs alleged that PDVH is the alter ego of PDVSA.

The plaintiffs sought to hold PDVH liable for notes issued by PDVSA between 2016 and 2017, supposedly valued in excess of 1.5 billion dollars, on the grounds that PDVH operated as PDVSA’s alter ego. With the decision issued yesterday, the judge has rejected the notion that PDVSA’s liability can be extended to PDVH.

Judge Rakoff has stated that he will issue an opinion explaining his reasons for ruling in favor of PDVSA and PDVH soon.

The Ad Hoc Board of PDVSA reiterates its commitment to defending our assets abroad, and, as soon as possible, we will provide further insight into this important decision.

Ad Hoc Administrative Board of PDVSA

May 21, 2025

The decision

Judge Jed S. Rakoff’s decision to reject the lawsuit against PDVSA and its subsidiary PDVH marks a crucial legal precedent in protecting assets of state-owned companies abroad. By denying the application of the figure of the “alter ego”, the ruling prevents creditors from extending their claims to PDVH, ensuring the stability of its operations in the US. This result strengthens PDVSA’s position in future financial and legal negotiations, in addition to mitigating the risk of additional embargoes and litigation. PDVSA’s Ad Hoc Board of Directors has welcomed the decision and reaffirmed its commitment to defend its international assets. The judge is expected to release a detailed opinion in the coming days, which will provide greater clarity on the long-term impact of this determination.

Source: PDVSA Ad Hoc, IA

Written by Elio Ohep, EnergiesNet

EnergiesNet.com 22 05 2025