By Kanishka Singh/Reuters

BENGALURU

EnergiesNet.com 01 14 2022

The U.S. Energy Department said on Thursday it had sold 18 million barrels of strategic crude oil reserves to six companies, including Exxon Mobil (XOM.N) and a unit of refiner Valero Energy Corp (VLO.N), after saying last year it would sell reserves to try to tamp down rising oil prices.

The Biden administration said last year that it would accelerate a previously approved sale of barrels – and loan out another 32 million barrels of crude – to try to lower oil prices that had reached multiyear highs. After a brief sell-off, the oil market’s rally has resumed its upward path.

The largest bidder was Valero Marketing and Supply, which bought more than 8 million barrels, the Energy Department said in a statement on Thursday.

The other buyers were refiners Phillips 66 (PSX.N), Motiva Enterprises and Marathon Petroleum (MPC.N), along with merchant firm Gunvor USA and Exxon Mobil, the department said.

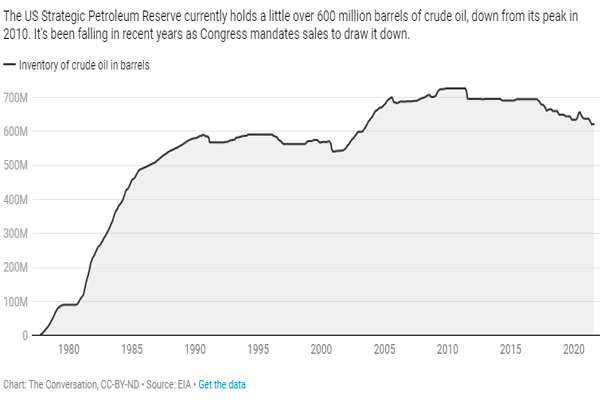

The U.S. strategic reserve was established in the 1970s after the 1973 Arab oil embargo. It currently holds nearly 600 million barrels of crude in caverns in Louisiana and Texas, enough for several months of supply.

In 2018, Congress mandated through the bipartisan Budget Act a total sale of 30 million barrels during fiscal years 2022 to 2025.

A total of 14 companies submitted 111 bids for evaluation.

The SPR plans to schedule deliveries between Feb. 1 and March 31, with early deliveries available in January if arrangements can be made, the department said.

The Energy Department has also already approved four exchanges of crude oil as part of the 32 million it has committed for loans. Companies that receive SPR crude oil through the exchange agree to return the amount of crude oil received, as well as an additional amount, depending on the length of time they hold the oil.

Reporting by Kanishka Singh in Bengaluru Editing by Chris Reese and Jonathan Oatis from Reuters

reuters.com 01 13 2022