LONDON

EnergiesNet.com 02 08 2022

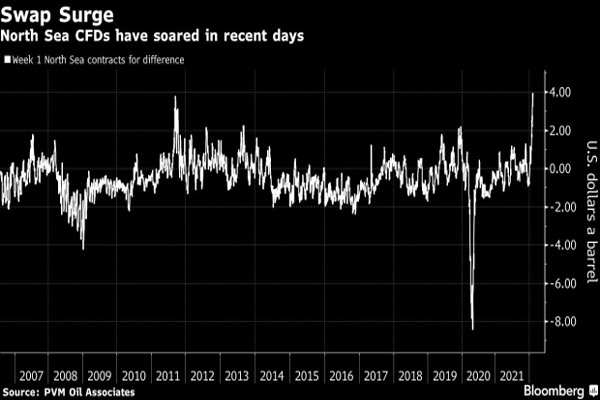

n the arcane world of North Sea oil trading, there’s a thriving swaps market that values the commodity for every week of the year. Right now it is on fire.

Derivatives that price crude for one week ahead — known as contracts for difference — are trading at the highest level since at least 2006, according to data from brokerage PVM Oil Associates.

That surge, coupled with a structure that indicates a scarcity of supply in the coming weeks, suggests an extreme level of strength in the North Sea market that prices much of the world’s oil.

The rally is mirrored in other corners of the oil market. Whether it’s crude oil, or refined products like diesel, futures curves are moving into the realm of super-backwardation — where prompt prices are higher than those in the future — indicating a scarcity of supply. The latest runaway strength comes amid a heady mix of robust demand, patchy supply additions from the Organization of Petroleum Exporting Countries and its allies, and heightened geopolitical risks.

“The more people we speak to, the common theme remains that they have never seen a tight market like this before,” said Keshav Lohiya, founder of consultant Oilytics Ltd

bloomberg 02 07 2022