By Chris Bryant | Bloomberg

Good luck finding an industry hit as hard by inflation and supply-chain upheaval as wind-turbine makers.

Manufacturers like Vestas Wind Systems A/S have been blown off course by a perfect storm of transport snarl-ups and surging freight and raw material costs. Instead of raking in profits on soaring demand for clean energy, the Danish firm is struggling just to break even. Last week, loss-making European rival Siemens Gamesa Renewable Energy S.A ousted its chief executive officer — its second change at the top in less than two years. General Electric Co.’s renewables arm is also losing money.

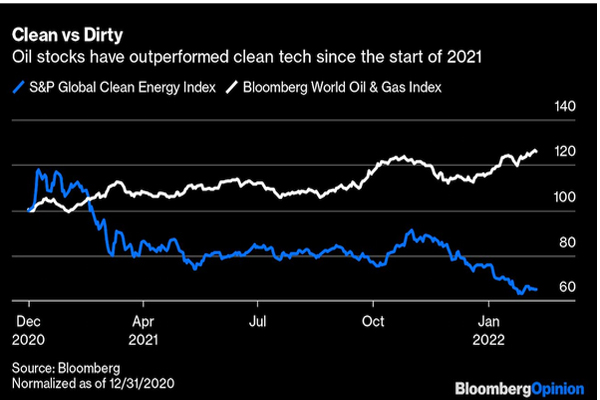

This is a worrying turn for an industry with a vital role in helping the world decarbonize. For investors, it shows how betting on seemingly clear-cut “megatrends,” such as the rise of renewables, can backfire in the short-term. With oil prices rising above $90, oil stocks have massively outperformed clean tech in the past year. It’s a reminder, too, that even highly consolidated industries like wind-power machinery can struggle to pass on rising input costs to customers.

A year ago, the turbine makers were flying high. A gush of money flowed into clean-tech stocks, and investors didn’t have all that many wind-equipment firms to pick from. Outside of China, the three top players I’ve mentioned control around three-quarters of the onshore market. No wonder valuations ballooned.

But as the profit warnings piled up, the money flows faded and European wind stocks plummeted. Vestas’ has almost halved since last year’s peak, while Siemens Gamesa’s has fallen even more. Hedge funds have shorted the shares of smaller German turbine maker Nordex SE, betting that prices will fall further. (GE’s renewables unit isn’t separately listed.)

When you consider the size and complexity of a wind turbine, it’s no wonder they’re struggling: The rotors of high-spec onshore models span more than 160 meters (525 feet) and a nacelle (the central structure) can weigh several hundred tons. The latest offshore turbine designs are even larger.

Almost 85% of a wind turbine’s mass is comprised of steel, according to BloombergNEF. It’s not hard to imagine what’s happened to that bill of raw materials. Even after a recent pullback, steel prices are almost double pre-pandemic levels. Copper and resin prices have also surged.

Logistics is an even bigger headache. Due to the size of these machines and local rules, the process of assembling wind turbines is spread all over the world. That’s a challenge when supply chains are running smoothly. But delivery times for some components has increased from five to nearly 50 weeks, Siemens Gamesa said earlier this month. Delays add further cost and can trigger customer penalty clauses, making the transportation and installation of turbines, blades and towers very costly endeavors.

This wouldn’t be such a problem if manufacturers could quickly pass on cost increases to customers. Unfortunately, their order backlogs stem from a time when raw materials and logistics costs were much lower, and it appears they weren’t able to fully protect themselves against price increases via hedging. Analysts expect Siemens Gamesa to burn more than 750 million euros ($860 million) of cash in the fiscal year that ends in September, in part because it’s holding more inventory as a safety cushion against delays.

Though manufacturers are hiking prices — an abrupt change for a world accustomed to steadily falling equipment costs — customer discussions are difficult because it can threaten a project’s profitability. If completion is delayed but the developer has already sold the power, it could be forced to buy electricity at hugely inflated spot market prices. European wind farm operators were also hit last year by unusually low wind speeds. No wonder some of them are holding back from placing new orders.

While some of this is just bad luck, wind-turbine profit margins were already under pressure before the pandemic. Permit issues and NIMBYism have slowed project development in parts of Europe, while the shift from fixed-priced subsidies to more competitive wind auctions put downward pressure on pricing.

Manufacturers compensated by investing in larger, more powerful turbines, but they’ve suffered quality issues: Vestas’s warranty costs have increased due to blade repairs, while Siemens Gamesa had to make design changes to its new large onshore turbine.

In hindsight some of these companies shouldered too much risk. Now they’re belatedly strengthening cost-escalation clauses in supplier agreements and partnering with logistics firms to ensure priority shipments.

This new emphasis on protecting profitability should relieve investors. And there are additional grounds for guarded optimism. The rise in electricity prices far exceeds that of wind machinery costs and is expected to spur more demand for clean power generation, for example. The industry may also get a boost if the U.S. renews wind-power subsidies that expired last year. High-margin, multi-year maintenance contracts and offshore projects are other bright spots.

Still, the coming year or so looks like a slog. Long-suffering shareholders of Siemens Gamesa should hope controlling shareholder Siemens Energy AG bites the bullet and offers to buy them out at a premium. For everyone else, this brutal storm can’t pass soon enough.

Chris Bryant is a Bloomberg Opinion columnist covering industrial companies. He previously worked for the Financial Times. Energiesnet.com does not necessarily share these views.

Editor’s Note: This article was originally published by Bloomberg Opinion, on February 10, 2022. All comments posted and published on EnergiesNet.com, do not reflect either for or against the opinion expressed in the comment as an endorsement of EnergiesNet.com or Petroleumworld.

Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of environmental and humanitarian significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml.

energiesnet.com 02 10 2022