the announcement of a plan to release reserves of crude.(Amr Nabil/AP)

By Stanley Reed, NYTimes

LONDON

EnergiesNet.com 03 03 2022

With the price of a barrel of oil soaring, the group of oil producers known as OPEC Plus declined to take steps to cool the market at its monthly meeting on Wednesday.

In a statement that had surreal qualities given the surging prices in recent weeks, the group, which includes Russia, said current fundamentals and the outlook for the future pointed “to a well-balanced market.”

It blamed “volatility” on “geopolitical developments” — in other words, Russia’s onslaught in Ukraine.

Some analysts were not impressed. “Such an argument will increasingly strain credulity,” Helima Croft, an analyst at RBC Capital Markets, an investment bank, wrote in a note to clients.

Left unmentioned in the statement was the fact that Russia’s deputy prime minister, Alexander Novak, is a co-chair of OPEC Plus.

The cartel said it would continue a strategy agreed to in July, rubber-stamping a modest 400,000-barrel-a-day production increase for April. Analysts widely consider an increase of this size insufficient to cool down prices. In addition, many OPEC Plus countries have been producing substantially less oil than the group’s targets.

After the meeting, which was held by teleconference, prices surged again. Brent crude nearly reached $114 a barrel, the highest since 2014. West Texas Intermediate hit $112.50 a barrel, a 10-year high.

What OPEC Plus members will actually deliver to the market in the coming weeks is anyone’s guess.

Russia produces about one in 10 of the world’s barrels. But analysts say Russian crude is struggling to find buyers despite discounts approaching 20 percent as buyers and shippers, worried about getting ensnared in Western sanctions against Moscow, look for oil elsewhere. About 70 percent of Russian traded crude is being affected, according to Energy Aspects, a research firm.

“Most European majors are not touching Russian oil, and only a few European refiners and trading firms are still in the market,” the firm said in a note to clients. Freight rates and insurance premiums for dealing with Russian oil also have soared.

Even before Russia’s invasion of Ukraine, OPEC Plus was producing substantially less than its targets. The International Energy Agency, which works to shape energy policy around the world, estimated that OPEC Plus fell short by 900,000 barrels a day in January — about 1 percent of overall production.

Saudi Arabia, the de facto leader of the Organization of the Petroleum Exporting Countries, is likely to have some concern about what is becoming a disorderly rise in oil prices. Apparently matters have not reached a point where the Saudis and allies like the United Arab Emirates might act unilaterally and put more than their agreed share of oil on the market.

In addition, analysts say, the Saudis may be content to let geopolitics take the heat for the oil price spike and keep the cash rolling.

With Mr. Novak serving as a co-chair of OPEC Plus, discussions of the details of output increases may be at best awkward. OPEC Plus did not hold a news conference after the Wednesday meeting, perhaps to avoid uncomfortable questions that would have been directed at Mr. Novak.

Saudi Arabia’s relationship with Russia has long been contentious, but the collapse of oil prices in 2014, partly due to rapid increases in output in the United States, a rival to both, pushed the two petroleum powers to cooperate to manage output.

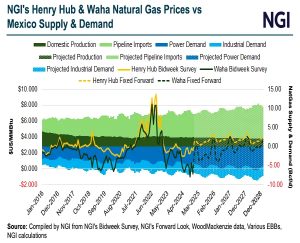

Understand Rising Gas Prices in the U.S.

A steady rise. American consumers have seen the cost of gasoline, along with many other goods and services, surge sharply in recent weeks. Last month, gas prices hit their highest level since 2014, and the national average for a gallon of gas is now $3.41, according to AAA.

The role of crude oil production. Gas prices have gone up in part because of fluctuations in supply and demand. Demand for oil fell early in the pandemic, so oil-producing nations cut production. But over the past year, demand for oil recovered far faster than production was restored, driving prices up.

Additional factors at play. The price of crude oil is only one element driving up gas prices. Compliance with renewable-fuel standards can contribute to the cost, the price of ethanol has increased, and labor shortages in the trucking industry have made it more expensive to deliver gas.

A global energy crunch. Other types of fuels, including natural gas and coal, are also growing more expensive. Natural gas prices have shot up more than 150 percent in recent months, threatening to raise prices of food, chemicals, plastic goods and heat this winter.

The U.S. response. To combat soaring prices and their effects on inflation, President Biden ordered the release of oil from the nation’s emergency stockpile. He also asked the Federal Trade Commission to investigate possible “illegal conduct” by oil and gas companies.

Moscow is not a member of OPEC, but it was drawn into an alliance with the Saudi-led cartel — OPEC Plus — in 2016. The two fell out briefly in 2020 at the beginning of the pandemic, setting off a price war, but quickly patched matters up. Riyadh and Moscow to a great extent call the shots in OPEC Plus, to the resentment of some other members.

Executives of several companies, including Pioneer Natural Resources, Devon Energy and Continental Resources, have said in recent days that they were committed to limiting production to avoid oversupplying the market and pushing down prices to unprofitable levels. Many companies adopted this strategy after oil prices plunged in the early days of the coronavirus pandemic.

Vicki Hollub, Occidental’s chief executive, told analysts on Friday that there was “no need and no intent to invest in production growth.”

And mechanisms for halting the rise in prices look to be in short supply. The announcement on Tuesday by the International Energy Agency of a 60-million-barrel emergency release of oil held in reserves caused a jump in prices, rather than the intended cooling of the market.

“We do not view this as sufficient relief,” analysts from Goldman Sachs wrote in a note to clients on Tuesday. They said reduced consumption of oil because of the high prices — or “demand destruction” — “is now likely the only sufficient rebalancing mechanism.”

In other words, further price increases are needed to bring the world’s thirst for oil back in line with the supply.

-Clifford Krauss contributed reporting.

Stanley Reed has been writing from London for The Times since 2012 on energy, the environment and the Middle East. Prior to that he was London bureau chief for BusinessWeek magazine. @stanleyreed12

A version of this article appears on The New York Times -NYTimes in print on March 3, 2022, Section B, Page 1 of the New York edition with the headline: As Oil Soars, OPEC Plus Is Declining To Offer Help.