Richard Weiss, Bloomberg News

BERLIN

EnergyNews.com 03 23 2022

Qatar said it agreed to work on supplying Germany with liquefied natural gas as Europe’s biggest economy seeks to reduce its dependence on Russian energy.

After years of uncertainty that stymied Qatari LNG sales, German Economy Minister Robert Habeck said during talks in Doha on Sunday his government plans to fast-track the construction of two LNG import terminals, QatarEnergy said in a statement that lacked specifics.

Both countries agreed “that their respective commercial entities would re-engage and progress discussions on long term LNG supplies from Qatar to Germany,” according to the statement.

Learn how regulatory, ESG, and policy awareness are integral to the business considerations of any A&D transaction in the upstream exploration, production or midstream markets.Click here

“Now it’s up to companies to sign the contracts,” Habeck said on Twitter.

Regional Trip

Habeck’s trip – which will also see him visit the United Arab Emirates, one of the world’s biggest oil exporters – is part of efforts by major economies to secure energy after Russia’s invasion of Ukraine threw global supplies into disarray. U.K. Prime Minister Boris Johnson held talks in Saudi Arabia and UAE last week to ask them to pump more oil.

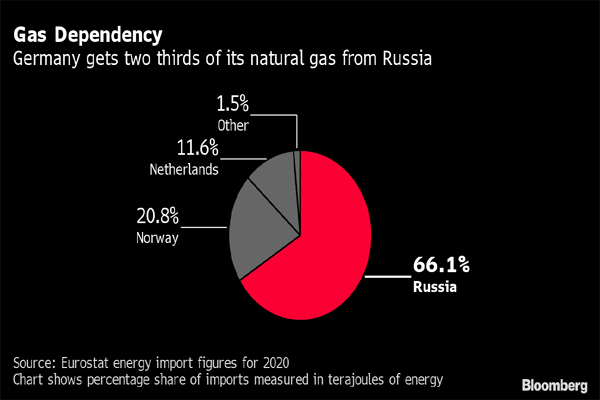

Germany gets more than half of its natural gas, half of its coal and roughly a third of its oil from Russia. In another effort to diversify, Germany and Norway are considering building a hydrogen pipeline to reduce Europe’s dependence on Russian energy.

Germany’s challenge is finding short-term alternatives to Russian gas this year, a bottleneck Habeck acknowledged before his trip. The country doesn’t have any LNG import terminals of its own after years of debating whether they’re necessary.

While Qatar was the world’s biggest LNG producer last year, its officials had previously said it couldn’t help much because most of its gas is sold under long-term supply contracts to Asia. Only 10 per cent to 15 per cent of Qatari LNG can be diverted at short notice. The rest would need the permission of contracted buyers to be sent to Europe.

Qatar is spending almost $30 billion to increase its output capacity by 50 per cent, but the project isn’t expected to yield its first gas until the end of 2025.

The U.S. was Europe’s biggest source of LNG in 2021, accounting for 26 per cent of imports by European Union countries and the U.K., followed by Qatar with 24 per cent and Russia with 20 per cent, according to the U.S. Energy Information Administration.

“Qatar is in the process of increasing its gas extraction and we need more gas in the short term to replace Russian supplies,” Habeck said in his Twitter video. “That is what I discussed with the Emir and the energy minister.”

bloomberg.com 03 21 2022