George Lei, Bloomberg News

NEW YORK

energiesNet.com 04 01 2022

Latin America is emerging as an oasis of stability amid the global bond rout spurred by the Ukraine war, benefiting from a 6,600-mile distance from the conflict.

The region’s dollar-denominated sovereign and corporate bonds returned 0.4% since Russia invaded Ukraine in late February, compared to a 9.8% loss in Eastern European, Middle Eastern and African notes and an almost 3% slide in Asian debt, according to Bloomberg indexes. It was also a brutal period for U.S. Treasuries, which went through their worst quarter of modern times.

Investors have flocked to Latin America over the past month, steering away from securities directly affected by the war. Unlike most European-developing nations, the region’s major economies don’t have strong trade links to Russia and still benefit from the massive rally in commodity prices as big raw material producers.

The recent outperformance marked a U-turn from the first two months of the year, when Latin American bonds were hit by a selloff in developing-world assets caused by fears of the Federal Reserve tightening. While the region’s notes have since rebounded, a big portion of the global debt market continued to suffer as traders braced for a more aggressive series of U.S. interest-rate hikes.

Energy and Inflation

The surge in commodity prices triggered by supply-shock concerns since the war started made investors particularly interested in bonds from the region’s resource behemoths. The debt market is the only way to invest in state-run companies including Petroleos Mexicanos and Corporacion Nacional del Cobre de Chile, which don’t have publicly-listed stocks.

“Quasi-sovereign oil companies from Colombia to Brazil to Mexico are investment picks we like at this current juncture,” said Kathryn Rooney Vera, head of global macro research at Bulltick LLC, who recommends a buy-and-hold approach to energy credits since “there is more room for upsides.”

While higher commodity prices benefit raw material producers, it also contributes to already elevated inflation in the region. For that reason, investors are also favoring inflation-linked bonds, seeking protection against rising consumer prices.

“We hold onto our real-rate overweights in Mexico and Brazil,” Citigroup analysts led by Andrea Kiguel wrote in a March 29 report. The bank is long on Mexico’s inflation-linked bonds, known as Udibonos, due November 2023 and Brazil’s NTN-B notes maturing on August 2024. Goldman Sachs also recommends wagers on Udibonos, favoring those due 2031.

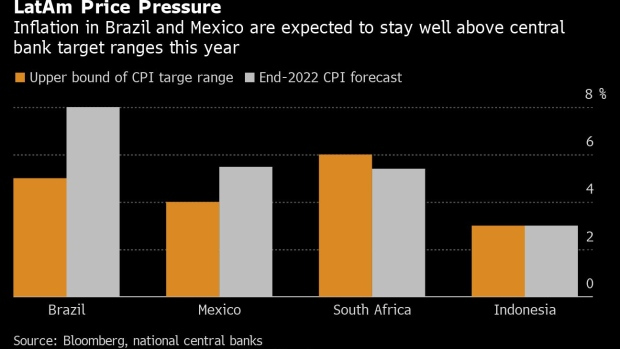

Brazil and Mexico’s inflation rates are expected to finish 2022 above the upper bound of their central bank target ranges, according to a Bloomberg survey. In comparison, inflation expectations in other key emerging markets such as South Africa and Indonesia are well contained.bloomberg.com 04 01 2022