By Javier Blas

The law of conservation of energy is ingrained in every high school science student: energy can’t be created or destroyed, only transformed or transferred. The global natural gas market represents the political version of that primary tenet of thermodynamics.

Europe’s demand for liquefied natural gas (LNG) to replace Russian imports has now been transferred to the US. Until now, shipping American LNG into Europe has been a policy that’s won accolades for President Joe Biden. Politically, it helped contain Vladimir Putin, and economically, it boosted the US energy industry. It has also helped to rebalance the trade deficit.

Now comes the greater test. As the American gas market begins to connect with the European one, the price problems in Europe are crossing the Atlantic.

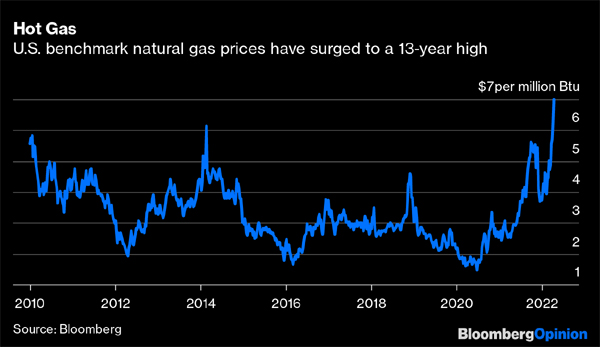

Last week, the price of benchmark US gas surged to a 13-year high, exceeding $US7 ($9.20) per million British thermal unit, more than double the 2010-2020 average Americans paid of about $US3.30 per million Btu. Though still a fraction of the more than $US30 per million Btu that European consumers are paying, American prices are already feeling the tug of demand in the continent.

Natural gas markets have historically tended to be regional. Until recently, the US market was almost an island, connected only to Mexico and Canada via limited pipelines. But in the past six years, the US gas industry has slowly linked up to the rest of world as liquefaction facilities opened up in Texas, Louisiana, Maryland and Georgia.

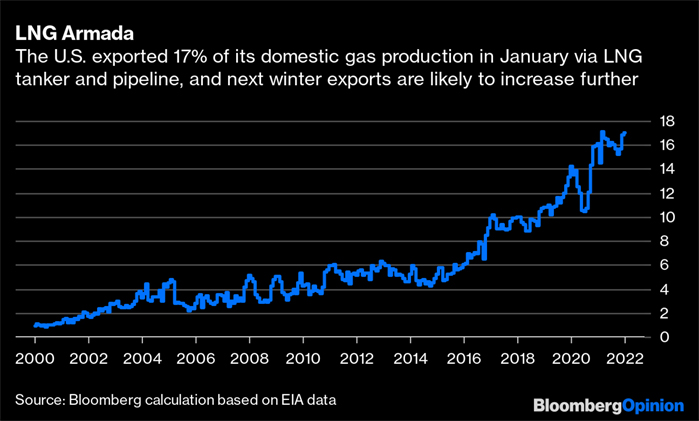

Thanks to all those LNG terminals, the US exported 17 per cent of its domestic gas production in January, the last monthly data available.

By next winter, the US Energy Information Administration, a government body, forecasts that one in five molecules of gas produced in America will be sold overseas. Two decades ago, the US barely exported any gas at all.

US gas production has not kept pace with the surge in exports and stronger-than-expected domestic demand. As a result, American gas storage facilities have emerged from winter far emptier than expected. As of last week, inventories stood at roughly 17 per cent below the five-year average for this time of the year.

To be sure, cold weather has kept demand elevated, and freezing temperatures in the key production region of west Texas have hampered output.

Related:US was world’s top LNG exporter in December, spurred by Europe crisis

But there’s a structural element too: US shale companies aren’t responding to high prices as they did in the past, as they prioritise profits over volume. The number of rigs drilling for gas in America stood at about 150 last week, far below the nearly 1000 of 13 years ago, the last time that gas prices were above $US7 per million Btu.

Part of the reluctance to drill more is due to fears about a price collapse if the weather cuts gas demand and the economy slows down in late 2022 or early 2023.

Another problem is sky-high inflation for steel, a key input into drilling for gas, and other supply bottlenecks.

Nor do industry executives mind making life harder for Biden ahead of mid-term elections in November. Although the Democratic president has now embraced the oil and gas sector, he had campaigned on an ambitious environmental agenda, famously promising that he was “going to end fossil fuels”.

Wall Street has also become reluctant to finance the industry over climate-change concerns.

There’s another fear: that Europe won’t consume as much American gas as it plans today if the war in Ukraine ends soon. In private, many US shale executives believe Germany will ultimately stick with Russia.

Without more drilling, the US will struggle to rebuild inventories this summer, particularly if hot weather increases demand for air conditioning. In turn, power plants will consume more gas to produce electricity. In the options market, gas traders are already betting for higher prices later this year, and into next winter.

Related: Welcome to ‘most bullish moment in LNG’s history’

For example, the amount of outstanding contracts for call options that will pay if prices reach $US10 and $US15 per million Btu by March 2023 has surged recently.

Although the bets aren’t a forecast, it’s an indication of the balance of risks. If those risks materialise, the price surge may trigger a political storm next winter. In February, a group of senators, including Elizabeth Warren, wrote a letter to the Biden administration urging a “swift action to limit US natural gas exports,” warning that without it families will see “even larger increases in their heating bills”.

Since then, Russia’s invasion of Ukraine has redrawn the world’s energy map and Biden has promised to do the opposite of what the senators requested: he travelled to Brussels and pledged more American LNG supplies to help Europe unplug itself from Russian gas.

Biden should not waver on his support for more US LNG exports, even if that means higher prices – and another inflation headache. But he does need help from the shale industry, which has the advantage of geology: the prolific Marcellus and Permian gas basins.

For much of the industry’s complaints about Biden’s often-incoherent energy policy, the truth is the White House has already secured a new market for US gas exports in Europe. All that’s needed is the extra gas. Both the Biden administration and the US shale industry need to sit down and make it happen.

___________________________________________________

Javier Blas is a Bloomberg Opinion columnist covering energy and commodities. He previously was commodities editor at the Financial Times and is the coauthor of “The World for Sale: Money, Power, and the Traders Who Barter the Earth’s Resources.” @JavierBlas. Energiesnet.com does not necessarily share these views.

Editor’s Note: This article was originally published by Bloomberg Opinion, on April 19, 2022. All comments posted and published on EnergiesNet.com, do not reflect either for or against the opinion expressed in the comment as an endorsement of EnergiesNet.com or Petroleumworld.

Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of environmental and humanitarian significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml.

energiesnet.com 04 19 20022