If Pemex needs support, Mexico will step in to help: Ramirez

Amy Stillman, Nacha Cattan and Sydney Maki, Bloomberg News

MEXICOCITY

EnergiesNet.com 04 22 2022

Petroleos Mexicanos bonds tumbled to fresh lows as the state-owned oil giant prepares to resume paying its own debt maturities, halting a government policy of covering its amortizations.

Pemex has the cash flow to make its debt payments, Mexico Finance Minister Rogelio Ramirez de la O said at an event in Washington on Thursday, confirming earlier reports.

“To the extent that they do have this cash flow and they can make the payments, they will be making their payments,” Ramirez said, adding that the government would be fully behind Pemex should the Covid-19 pandemic worsen again and the company needed its support.

Pemex, the world’s most indebted oil producer, owes about $2.5 billion in principal payments this year, and another $2.5 billion in interest, according to data compiled by Bloomberg. All together, the company is on the hook for $5 billion in payments to bondholders in the remainder of 2022. That includes a 1 billion euro ($1.08 billion) bond due on Thursday.

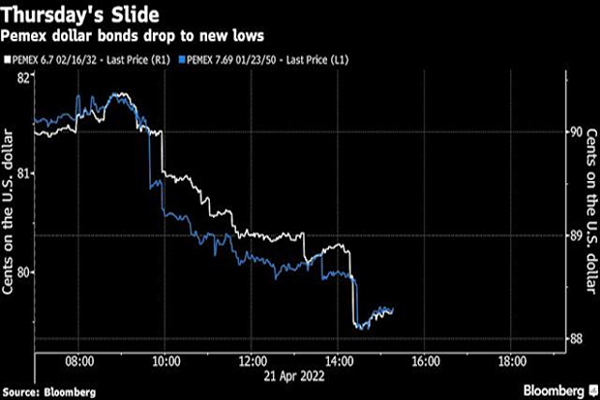

Investors digesting the shift in stance sent the company’s dollar debt due in 2032 to an all-time low of 88.4 cents. Notes maturing in 2050 also touched a record low of 79.9 cents.

Bloomberg News reported Thursday morning that Pemex will resume payments, according to a Finance Ministry official. The official, who declined to be identified about a private matter, said that coordination between the ministry and Pemex has vastly improved from that of previous years. Reuters had reported earlier that Pemex was being pressured to make its debt payments.

A Pemex representative and a spokesman for President Andres Manuel Lopez Obrador didn’t respond to a request for comment.

While Pemex is seeking to increase oil production and exports to take advantage of higher international prices, the company is under pressure to expand its refining output under a nationalist goal set by the president to make Mexico self-sufficient in fuel production. The president has pledged to support Pemex, and return the indebted state driller to its former glory by shedding Mexico’s dependence on foreign interests.

Pemex officials had previously said that they expected the government to make further amortization payments, potentially through the end of Lopez Obrador’s six-year term in 2024. Pemex received an amortization payment from the government in January, but further payments hadn’t been scheduled, Pemex’s acting Chief Financial Officer Antonio Lopez Velarde told investors on a conference call in February.

bloomberg.com 04 21 2022