Kiana Wilburg, Kaieteur News

GEIRGETOWN

EnergiesNet.com 05 11 2022

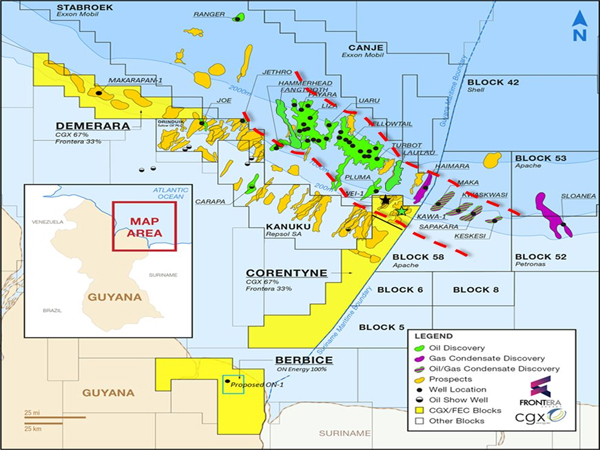

Canadian exploration partners, CGX Energy Inc. and Frontera Energy Corporation, were pleased to disclose on Monday that light oil is not only confined to the ExxonMobil-led Stabroek Block. According to the integrated results they received and examined for the Kawa-1 exploration well, light oil and gas condensate have been successfully unlocked in the Corentyne Block. Moves will be made later this year to see if a second well can find this resource in commercial quantities.

Gabriel de Alba, Chairman of Frontera’s Board of Directors and Co-Chairman of CGX’s Board of Directors told shareholders that the Kawa-1 well which was drilled to a total depth of 21,578 feet (6,577 metres) in the northern portion of the Corentyne Block actually found light oil in the Santonian and Coniacian and gas condensate in the Maastrichtian and Campanian plays.

The Chairman said the Kawa-1 discovery adds to the growing success story unfolding offshore Guyana while adding that the integrated Kawa-1 well results further support the partners’ belief in the potentially transformational opportunity they have in one of the most exciting basins in the world.

Following completion of drilling activities at the Kawa-1 exploration well, the partners said they engaged independent third-party laboratories and experts to complete detailed studies, refined mapping and analyses to provide opinions on reservoir quality and hydrocarbon type. They said this integrated analysis has provided further support for their initial interpretations that the Kawa-1 exploration well successfully discovered light oil in the Santonian and Coniacian and gas condensate in the Maastrichtian and Campanian as supported by cuttings, mud gas and annulus fluid analysis.

The partners said these findings are consistent with discovery wells reported by other operators surrounding the northern portion of the Corentyne Block and de-risks the forthcoming Wei-1 exploration well, expected to be spud in the third quarter of 2022.

WEI-1 EXPLORATION WELL

Frontera and CGX were keen to note that they continue to integrate detailed seismic and lithological analysis and pore pressure studies from the Kawa-1 well into preparations in advance of drilling its second exploration well, called Wei-1, in the third quarter of 2022, subject to rig release from a third-party operator.

The Wei-1 exploration well will be located approximately 14 kilometres northwest of the Kawa-1 exploration well in the Corentyne Block, approximately 200 kilometres offshore from Georgetown, Guyana. It will also be drilled in water depth of approximately 1,912 feet (583 metres) to a targeted total depth of 20,500 (6,248 metres) and will target Campanian and Santonian aged stacked channels in a western channel complex in the northern section of the Corentyne Block.

Importantly, the Canadian exploration firms said information gained at Kawa-1 has improved the chance of success at Wei-1 from 29 percent to 56 percent. Also, data from the Kawa-1 and Wei-1 exploration wells, will inform future activities and potential development decisions.

In the meantime, Kaieteur News understands that CGX is assessing several strategic opportunities to obtain additional financing to meet its share of the costs of the drilling programme.

PLUGGED AND ABANDONED

Kaieteur News previously reported that the Kawa-1 well was plugged and abandoned in the first quarter of 2022 as it was “never intended to be an active well.”

The Canadian partners had explained, however, that this is not to be interpreted to mean that it has walked away from Kawa-1. In fact, it was explained that CGX intends to do further appraisal works in the future for Kawa. Expounding on this issue, Jennifer Budlong, Exploration Manager at CGX said Kawa-1 was always planned as a ‘finder well’ vs ‘keeper well’. Budlong said finder wells are the norm for offshore exploration wells that have no previous nearby subsurface penetrations or offset wells. She said, “The goal of a finder well is to test the hydrocarbon generation, reservoir presence and trap models, and establish preliminary prospectivity regarding subsurface conditions (pressures, temperatures, fluids, reservoir quality).”

Additionally, the Exploration Manager said Kawa-1 was a finder well that has successfully been declared a discovery. She said the outcome supports further appraisal of the Kawa-1 discovery as well as further exploration of the Corentyne Block. She explained too that appraisal wells are drilled after a discovery, to confirm the size of a hydrocarbon deposit. She said these wells may be used normally to run drill stem tests, gather core or fluid samples or other evaluations.

THE CORENTYNE BLOCK HISTORY

The original Corentyne Petroleum Agreement (PA) covered approximately 11,683 km2 under two separate Petroleum Prospecting Licences (PPL). One covered the onshore portion while the other covered the onshore aspect of the block.

The original Corentyne PA was awarded to CGX in 1998, following which the company began an active exploration programme consisting of a 1,800 kilometre seismic acquisition and preparations to drill the Eagle well. The Eagle drilling location in 2000 was 15 kilometres within the Guyana-Suriname border.

However, a border dispute between Guyana and Suriname led to the company being forced off the Eagle location before drilling could begin. As a result of that incident, all active offshore exploration in Guyana was suspended by CGX and the other operators in the area, including Exxon and Maxus (Repsol, YPF).

On September 17, 2007, the International Tribunal on the Law of the Sea (“ITLOS”) awarded a maritime boundary between Guyana and Suriname. In the decision, ITLOS determined that it had the jurisdiction to decide on the merits of the dispute and that the line adopted by ITLOS to delimit the parties’ continental shelf and exclusive economic zone follows an unadjusted equidistance line. The arbitration was compulsory and binding. CGX had financed a significant portion of Guyana’s legal expenses at a cost of US$9.8 million. The decision was beneficial for CGX, as it concluded that 93 percent of CGX’s Corentyne PPL and 100 percent of the Georgetown PPL would be in the Guyana territory.

Because CGX was prevented from gaining unhindered access to a portion of the original Corentyne PPL area during the seven year resolution, the term of the contract was extended to June 2013.

In 2008, CGX was the first company to commit to acquire 3D seismic in Guyana when the Company acquired a 505 square kilometre 3D seismic programme to enhance its interpretation of its newly defined Eagle Deep prospect, a large stratigraphic trap in the Cretaceous. The cost of the seismic programme was approximately US$8 million. Processing and interpretation of the 3D seismic was completed in 2009.

Based on the interpretation of the 3D seismic volume and concurrent activities on both sides of the Atlantic margin, CGX interpreted numerous prospects on the Corentyne PPL and spudded the Eagle-1 well on February 13, 2012. It was subsequently declared a dry-hole.

On November 27, 2012, CGX received a new Corentyne PA, offshore Guyana, renewable after four years for up to six additional years. That new Corentyne PA applied to the offshore portion of the Corentyne PPL, covering 6,212 km2.

On December 15, 2017, the company was issued an addendum to the November 27, 2012 PA. Under the terms of the addendum to the new Corentyne PA beginning November 27, 2017, during phase two of the first renewal period the company has an obligation to drill one well.

That well was drilled last year August with Kawa-1. Additionally, the addendum to the new Corentyne PA resulted in a reduction of acreage to 4,709 km2.

kaieteurnewsonlines.com 05 10 2022