Kaieteur News

GEORGETOWN

EnergiesNet.com 11 28 2022

The Government of Guyana through the Ministry of Natural Resources on Thursday announced that British Petroleum (BP) International Limited has been contracted to market the country’s oil. However, the costs that will be attached to these services were not provided.

In this regard, the Alliance For Change (AFC) is demanding that the entire agreement with the company be made public.

During a Press Conference on Friday, Shadow Natural Resources Minister, David Patterson said the AFC noted the Government’s announcement which stated the name of the company that won the bid and that the company was not seeking a commission on each barrel of oil it sells for the country.

BP and one other company had similar bids, while the other firms that expressed interest submitted the specific compensation they were seeking.

According to Patterson, “The details of these submissions and the background have to be made public.”

“The normal procedure for such marketing services, the company would normally either charge a commission on every barrel that is sold. So you would have seen bids there where persons were saying four US cents, one US cent per barrel and obviously when they sell it they collect that commission and then remit the rest to the government or as in BP’s bid they would submit it but it would be charging a fixed base fee…those are the two known methods,” he said.

The former Minister of Public Infrastructure was keen to note that this could mean the shipment price could reach US$100,000 per transaction. An adamant Patterson said that no company works for free and the Government must make public its agreement with BP International.

He reminded that when Guyana signed onto the Extractive Industries Transparency Initiative (EITI), it agreed to adhere to the Santiago Principles which outline that marketing contracts must be made public.

“So other than a press release saying that how you have appointed BP International for one year, the government is required, if they are gonna comply with the EITI standards, to say how it benefits, who will benefit (and) how BP International are gonna recoup their money,” he pointed out.

At the same time Patterson pointed to the fact that Guyana must be careful as to which countries it sells its oil to, given that some have been blacklisted for various reasons. This is yet another reason for the agreement to be made public, he argued as such terms will be stated in the contract.

On Thursday, Government in a statement said BP International Limited won the contract to market Guyana’s share of profit oil from the Liza Destiny and Liza Unity Floating, Production, Storage and Offloading (FPSO) vessels. That contract will last for one year.

It comes weeks after Guyana signed a partnership pact with a UK Trade Mission and was granted visa free travel to the United Kingdom.

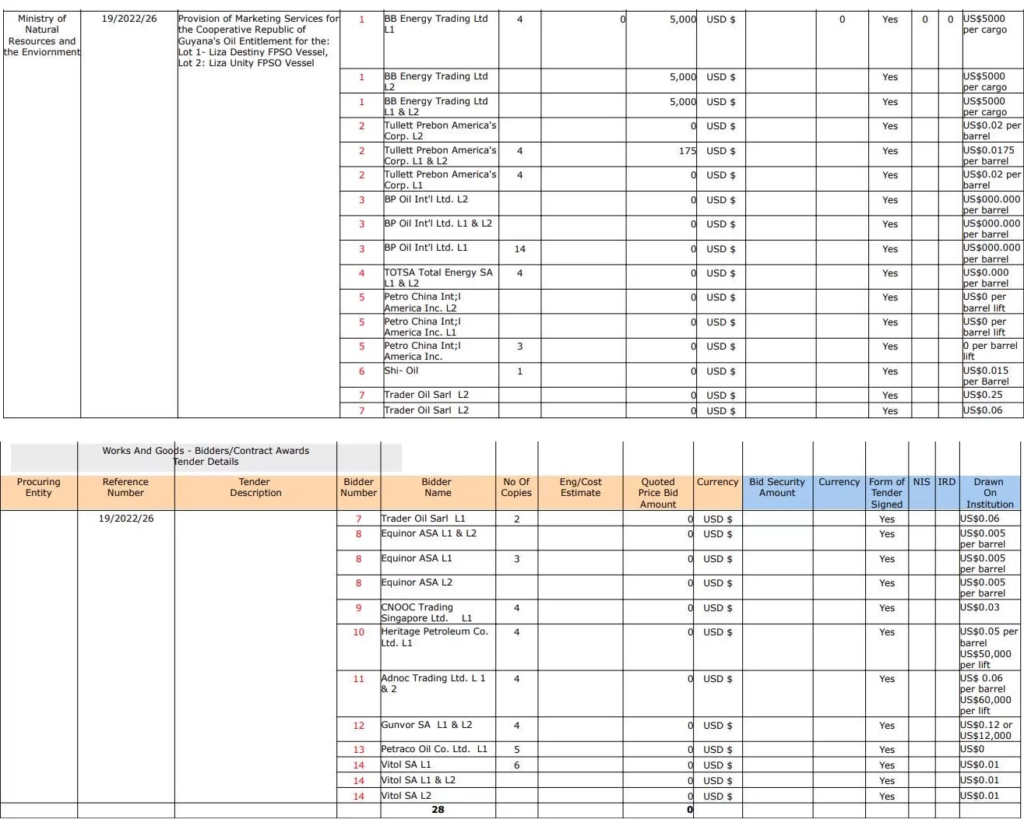

The firm beat 13 other firms to win the contract. Those firms and their respective bids are listed in the chart attached to this news item.

According to tender documents, BP International will be responsible for providing all functions of marketing, assessing regional and global demand centres, selecting customers and making appropriate transportation arrangements, providing support and guidance to the client in all operating and back-office responsibilities of managing these crude sales. It will also be expected to facilitate timely and cost efficient crude oil operations; and support the client in the continued introduction of the grade to multiple geographies and refinery systems.

Kaieteur News previously reported that Aramco Trading Limited (ATL), the London-based trading subsidiary for the State controlled Saudi Aramco, had inked a one year contract with the Ministry to market Guyana’s crude entitlement from the Liza Phase One Project. That contract came to an end last month.

ATL was among 15 bidders in the Brent-linked tender for Guyana’s light sweet Liza grade, and “was identified as the lowest compliant evaluated bidder at the price of $0.025/bl,” the Ministry had said.

The other bidders were, Bibi Energy Trading, Shell Western Supply and Trading, Chevron, Petraco Oil, China National Offshore Oil Corporation, Natural Gas Company of Trinidad and Tobago, and Heritage Petroleum, Hess, Vitol, Mercuria Trading, Total Energies, Litasco and Trafigura. Proposed commissions ranged from US$0.02/bl to US$0.26/bl.

As for the Liza Unity crude, Government has been doing its own marketing. At least two cargoes were already sold but little is known about the buyers and how they were selected.

Importantly, sales agreements for the country’s share of profit oil have not been made public. The International Secretariat for the Extractive Industries Transparency Initiative (EITI) has since called for Guyana to do better on this front.

It has also pointed out that the country is yet to declare consistently, information pertaining to the volumes of oil collected in accordance with the profit-sharing split in the Stabroek Block Production Sharing Agreement (PSA), alongside the identity of the buyer for each oil cargo.

kaieteurnewsonlines.com 11 27 2022