As the shale industry matures, it has sharpened its ability to reduce costs and increase productivity. OPEC+ should be worried.

By David Fickling | Bloomberg

With oil galloping closer to $100 a barrel, who’s going to come to the rescue?

Output from the Organization of the Petroleum Exporting Countries remains stuck around five million barrels a day below peak levels, constrained by weak production from Angola, Iran, Nigeria and Venezuela. Russian crude is still flowing, but it’s hostage to geopolitical tensions over Ukraine.

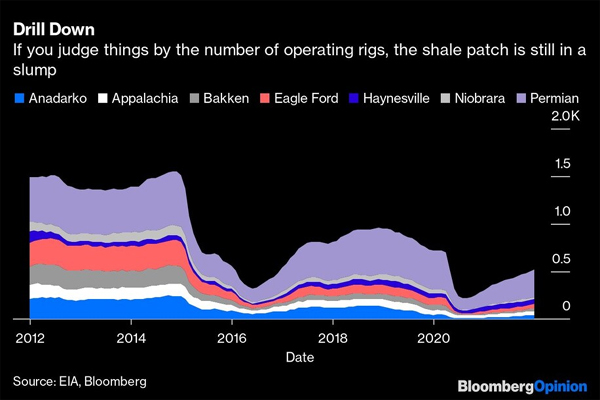

Meanwhile, U.S. shale producers are still perceived to be licking their wounds from 2020’s lurch into negative oil prices, focused on reassuring shareholders that there’ll be no repeat of the bonfire of capital they engaged in during the past decade. Take a look at the number of operating rigs out there, and you’d think the recovery had barely started:

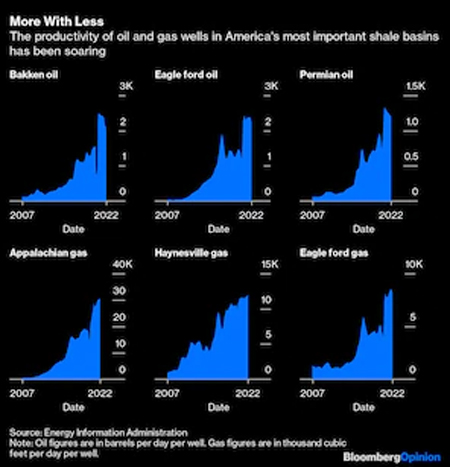

It’s not the number of wells drilled in America’s shale basins that could change the cost of filling up your car at the gas station, though, but the amount of crude they produce. And on that front, the shale patch is motoring ahead.

Oil production this month will rise to 8.54 million barrels a day, according to the Energy Information Administration — just 730,000 barrels below the record in November 2019. Gas production already broke through previous record levels last summer.

Exxon Mobil Corp. and Chevron Corp. last week announced plans to increase their production from Texas’s Permian basin alone by about 175,800 barrels. That suggests the baton of development activity is passing from the private companies that have been quietly lifting output over the past few years without having to worry about shareholder views, to public businesses with the scale and muscle to really ramp things up.

If ConocoPhillips Chief Executive Officer Ryan Lance is right that shale output will increase by 800,000 to 900,000 barrels over the course of 2022, as he said on a conference call last week, then we’ll be within a whisker of the previous record before the year is out — and then smashing through it in 2023, when Lance expects the same growth in output again. “If you’re not worried about it, you should be,” he said.

The byword for companies drilling the U.S. shale patch over the past two years has been capital discipline — restraining spending and using the rivers of cash flowing from $92 oil to reward investors for sticking with the sector. But discipline has always been eroded by temptation, and with shale break-even costs averaging $37 late last year, according to consultants Rystad Energy — compared to $47 in 2018, and $82 in 2014 — the margins on shifting some of that spending to pump more barrels at current prices are getting irresistible.

Improving profitability is connected to the decline in active wells in several ways. One factor is that the most marginal holes have been shut since 2020, leaving only the most profitable sites in operation. Still, shale wells are all but spent after two years, so that only accounts for part of the change.

A better explanation is simply that frackers are better at getting barrels out of the ground as the industry matures. One of the best ways to reduce costs in any industry is to use the same amount of investment to produce a larger volumes — and across the most important shale basins, production per well has been surging over the past two years.

The sudden nature of the productivity boom itself suggests that it’s not all about rapid efficiency gains. The so-called fracklog — a stockpile of wells that had been drilled but were never brought into production because prices were too low to make a profit — has shrunk by nearly half since peaking at 8,853 in June 2020.

Most of those holes are likely only being brought onstream because prices have risen to a level where they can spit out cash as well as hydrocarbons. Extracting their barrels now will also result in lower costs than waiting until next year, when the Biden administration’s rules on fugitive methane emissions are likely to require the installation of new equipment to prevent leaks and venting of gas.

Costs may be on the rise again this year as drilling heats up — but that’s just a sign of the activity that’s coming back online. In the Permian, which dominates output, shale exploration and development rig numbers are back to about 70% of their levels before 2020’s oil crash. In the Haynesville, a gas-rich basin close to export harbors on the U.S. Gulf coast, they’re within a whisker of their highest numbers since 2012.

The strongest argument for the ongoing relevance of the shale industry is that, unlike conventional oil which relies on vast fields that take decades to be used up, the rapid turnover of new wells leads to continuous improvements in technology and productivity that send costs lower with each boom-bust cycle.

That makes the current increase in output a standing threat to OPEC+, which needs to count on far higher breakeven prices if its core members are to run surpluses on their budgets. Far from losing the battle with OPEC+ in 2020, it’s looking like the shale patch has won.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

David Fickling is a Bloomberg Opinion columnist covering commodities, as well as industrial and consumer companies. He has been a reporter for Bloomberg News, Dow Jones, the Wall Street Journal, the Financial Times and the Guardian. Energiesnet.com does not necessarily share these views.

Editor’s Note: This article was originally published by Bloomberg Opinion, on February 08, 2022. All comments posted and published on EnergiesNet.com, do not reflect either for or against the opinion expressed in the comment as an endorsement of EnergiesNet.com or Petroleumworld.

Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of environmental and humanitarian significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml.

energiesnet.com 02 09 2022