By Javier Blas

The three most dangerous words in the oil market are “OPEC is dead.” The oil cartel’s obituary has been written many, many times — and always prematurely. The almost non-stop departure of member countries during the past decade – Indonesia in 2016, Qatar in 2019, Ecuador in 2020 — have provided ample opportunity to prepare eulogies, all of them a waste of words.1

So is the exit of Angola, announced on Thursday, anything but another blip for OPEC? At first glance, it’s irrelevant. But it has deeper implications for the bloc that go beyond what it means for global crude supplies.

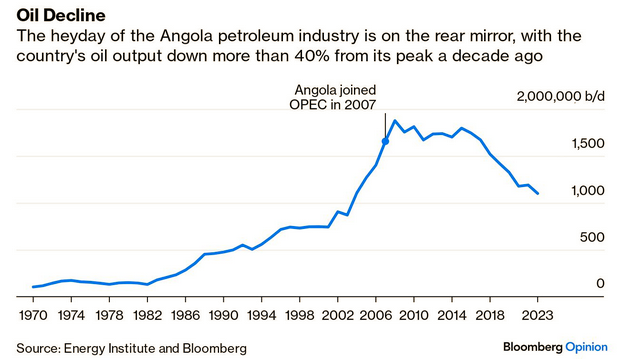

Inside OPEC, power is measured in millions of barrels a day. Angola doesn’t pump many, and there’s little chance it would produce more in the foreseeable future. According to the International Energy Agency, Angola pumped almost 1.1 million barrels a day in November, down 45% from a peak of more than 1.9 million barrels in 2010. Moreover, the nation is already at full capacity. Contrast that with Saudi Arabia, which produces about 9 million barrels, less than its 12.5 million potential.

The departure of an OPEC nation would worry those who remain inside the cartel — and anyone else bullish on oil prices — if that country could rapidly boost production by tapping its spare capacity, or develop new oilfields over time. But Angola cannot do either. There’s no more output available, and there aren’t foreign investors knocking at its door to fund exploration and development.

Whether inside or outside OPEC, the heyday of Angola’s petroleum industry is behind it. As such, its exit mirrors the limited impact of previous departures. Indonesia, Qatar and Ecuador haven’t altered the global supply and demand balance since they quit the organization.

But the walkout does signal some troubling developments for the oil club. The announcement, with the government in Luanda openly expressing its frustration with the cartel, sheds some light on an open secret: Lots of OPEC member countries are less than happy about the direction the group has taken over the last few years under the leadership of Saudi Arabia.

The view, expressed always in private, is that Riyadh is trying to keep oil prices too high, close to $100-a-barrel, which is propping up rivals, notably the US shale industry. If OPEC continues doing so, sooner or later it would have to cut production even more, ceding more market share. Other OPEC members would be happy with oil prices lower, in the $60-to-$70 range. That complaint comes along another one: Riyadh, under its Energy Minister Prince Abdulaziz bin Salman, isn’t listening to the concerns from others, trying to bully any dissident views into submission.

The key country to watch isn’t Angola, but the United Arab Emirates, which recently won a hard-fought campaign against Riyadh to secure a higher OPEC production level. I don’t think Abu Dhabi is done. During the campaign, Emirati diplomats went as far as questioning the value of OPEC membership. My belief is that those briefings were more a tool in the campaign to secure a quota increase than a real threat. But it shows that everything isn’t rosy inside the cartel. The UAE not only has ample spare capacity – it pumps 3.1 million and probably can do 4 million – but also foreign backing to invest in new oilfields that would boost production capacity to as much as 5 million barrels.

The departure of Angola makes it more likely that Riyadh will have to let the UAE to produce, over time, even more oil. The risks for OPEC start in Luanda — but ultimately end more dangerously in Abu Dhabi.

_______

- While Indonesia, Qatar and Ecuador left, Gabon re-entered OPEC in 2016, followed by Equatorial Guinea in 2017, and the Republic of Congo in 2018. With the departure of Angola, OPEC will see its membership reduced to twelve members.

_________________________________________________

Javier Blas is a Bloomberg Opinion columnist covering energy and commodities. He previously was commodities editor at the Financial Times and is the coauthor of “The World for Sale: Money, Power, and the Traders Who Barter the Earth’s Resources.” @JavierBlas. Energiesnet.com does not necessarily share these views.

Editor’s Note: This article was originally published by Bloomberg Opinion, on December 21, 2023. All comments posted and published on EnergiesNet.com, do not reflect either for or against the opinion expressed in the comment as an endorsement of EnergiesNet.com or Petroleumworld.

Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of environmental and humanitarian significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml.

EnergiesNet.com 12 27 2023