Both sides should stop misplaced finger-pointing and compromise to achieve some worthwhile energy goals.

(Nicholas Kamm/AFP)

By Liam Denning

I wasn’t expecting the U.S. to declare war at a conference in Houston, and I certainly wasn’t expecting it to be announced by the energy secretary. But we live in interesting times.

“We are on a war footing,” Energy Secretary Jennifer Granholm informed CERAWeek’s attendees on Wednesday. I suppose we are: How else to describe the financial barrage unleashed in response to Russia’s brutal attack on Ukraine? War usually involves mobilizing every available resource in a united effort. Which brings us to oil and Granholm’s speech.

Granholm was calling on U.S. exploration and production companies to do their part and raise output to help offset Russian barrels disrupted by new sanctions. The U.S. oil industry has of late been uncharacteristically diffident, saying it simply cannot do more in part because of a hostile Democratic administration. Somewhere in that gap between the energy secretary’s lectern and the assembled oil executives at the tables below lies the slim possibility of compromise.

Shocking as this may sound, the oil lobbyists’ line that U.S. output is being held back for want of White House support doesn’t quite comport with some underlying realities.

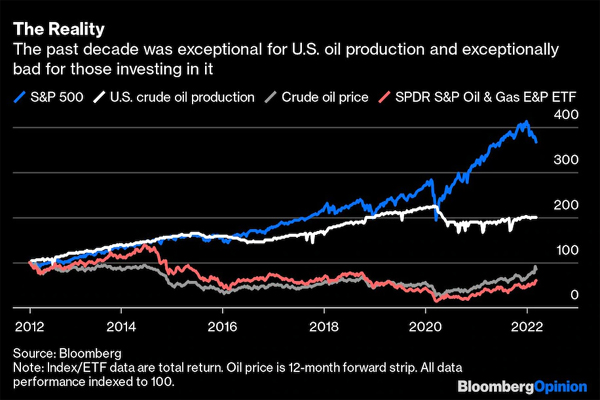

The shale boom rested on cheap capital untethered from profitability. Benefits accrued chiefly to the rest of the economy — the S&P 500 Index is a proxy — as cheap energy, similar to cut-price Uber rides back in the day. Meanwhile, investors in the oil and gas industry were left wondering how this renaissance left them sitting on big losses. Hence, they are not keen on more drilling today. At 5 times cash flow, the E&P sector is trading slightly below where it was a year ago even as crude oil has risen from $66 to $110 a barrel in that time. There’s no benefit of the doubt there.

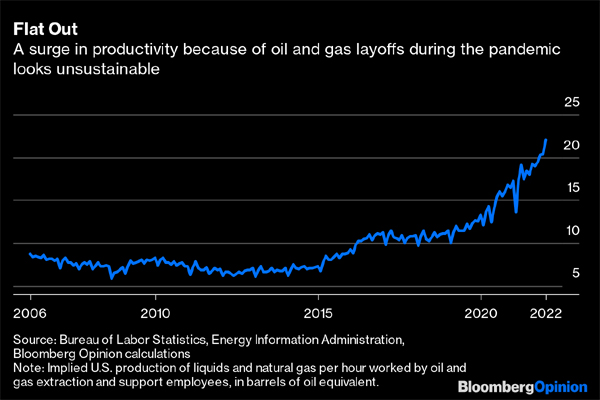

In any case, today’s oil price isn’t entirely relevant for a new well that might start producing six months from now and whose economics depend on cash flows spanning years. Oil spikes have a way of correcting themselves by destroying demand. Besides this, there are practical constraints, such as labor shortages. Ben Dell, chairman of Civitas Resources Inc., an E&P company based in Denver, says the firm has job openings for roughly an eighth of its workforce. Industry productivity has surged by two-thirds since the start of 2020, but that looks unsustainable. Wage inflation for oil and gas support employees hit almost 11% in December, the fastest pace in almost a decade.

These are all entirely valid reasons for an oil company to think twice. So why, instead, blame it on government restraints, especially when such claims are so easily debunked? For example, blaming slow permitting on federal land runs into the fact that (a) there are already more than 9,000 unused permits out there and (b) the vast majority of production comes from private land.

On the other hand, blaming the government has the undeniable benefits of being an established trope, avoiding the subject of past financial sins — and fending off criticism about the industry hurting Americans at the pump.

The same day Granholm called on oil producers to join the war effort, Senator Elizabeth Warren was declaring war on them, trumpeting plans for a windfall tax. On this, let’s just say the idea of taxing profits on an industry from which you want more output, but which lacks investor support to do so because it previously burned all the profits, has some logical kinks to be worked out. President Joe Biden is also guilty of trying to pin the blame for high gasoline prices on the industry which, apart from being incorrect, seems like a weird missed opportunity given Russia’s attack. Why blame nebulous corporations on your own side when the prime suspect is staring at you from across his inordinately long table?

It also rather undercuts the conciliatory aspect of Granholm’s speech. Her central argument is sound enough: essentially, that decarbonization requires an energy transition. but cars must be kept running in the meantime, especially in a crisis. As a slogan, though, drill-baby-but-then-not-drill lacks a certain viral quality, especially with investors and employees. Granholm’s comparison of this balancing act to walking and chewing gum rather understates things. Walking and chewing gum isn’t actually that hard; how else does so much of it end up on the sidewalk? Whereas rebuilding an airplane midflight — which is what the energy transition is more like — is fiendishly tricky.

Dell identifies one of the real constraints: the sheer volatility of oil prices. So ameliorating that risk offers some potential middle ground. Granholm’s rhetorical outreach, emphasizing a continued role for oil and gas, is one part of that. Even though the industry’s reluctance stems mainly from its relationship with Wall Street rather than Pennsylvania Avenue, Wall Street tends to listen when the administration says the industry has no future.

Going further, the administration could potentially offer more tangible inducements, such as a royalty holiday for wells on federal lands or, more broadly, tax credits for completing wells. On the latter, Kevin Book of ClearView Energy Partners points to precedent in the form of Section 29 nonconventional fuel credits, which were enacted under another administration battling global crises and hardly beloved of the oil industry, that of President Jimmy Carter. Anathema to many Democrats, such measures would have to be temporary and framed as relieving the oil burden on working Americans and vulnerable allies in Europe. They could also only apply at lower oil prices, aimed specifically at that volatility issue (every oil producer should be able to make money at more than $100 a barrel).

Above all, it would need a hefty quid pro quo. As much as we need oil and gas now, their use must fall or their emissions abated in a competitive way over time (Granholm was careful to give carbon capture a shout-out). As much as the industry speaks of being on board with this, its reluctance is palpable. So if it truly needs a helping hand, then how about, in return, it commits to full-throated support of Democrats’ proposed penalties on methane leaks? Even at the best of times, it’s hard to justify just letting gas escape. And these are not the best of times.

Pump prices with the numeral 4 in front of them are poison for presidents. Still, Biden might gain something from this approach. First, it would call the lobbyists’ bluff, putting the onus on producers to demonstrate they actually can deliver. Second, done right, it would offer a way of channeling internal divisions toward the actual common adversary sitting in the Kremlin.

Third, it might point the way to a more sensible, nuanced conversation about balancing today’s energy needs with future imperatives, reframing it as a matter of energy, environmental and economic security (see this recent post by Ben Cahill at the Center for Strategic & International Studies for a good discussion of this). If the Germans can square short-term expansion of coal use to face the current crisis with a radical overhaul of its energy system to alleviate the longer-term one, then the U.S. can also manage such tensions. There is a challenge but no contradiction in saying our way of life is built on fossil fuels but our future depends on decarbonizing our energy.

Lastly, this approach might actually achieve something useful now. Shale cannot deliver extra barrels in days or even weeks. But the promise of extra supply months out could at least dampen the hoarding instinct that fuels panic-driven price spikes like the one this week. Besides maximizing resources, war means keeping a lid on fear.

_________________________________________

Liam Denning is a Bloomberg Opinion columnist covering energy, mining and commodities. He previously was editor of the Wall Street Journal’s Heard on the Street column and wrote for the Financial Times’ Lex column. He was also an investment banker. Energiesnet.com does not necessarily share these views.

Editor’s Note: This article was originally published by Bloomberg on March 11, 2022. EnergiesNet.com reproduces this article in the interest of our readers. All comments posted and published on EnergiesNet.com, do not reflect either for or against the opinion expressed in the comment as an endorsement of EnergiesNet.com or Petroleumworld.

Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of socially, environmental and humanitarian significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml.

EnergiesNet.com 03 11 2022