Simon Casey, Bloomberg News

HOUSTON

EnergiesNet.com 03 19 2024 .

If you’re a mover and shaker in the energy world, there’s a high chance you’re either heading to — or are already in — the industry’s US capital.

It’s CERAWeek by S&P Global and Bloomberg News will be covering the event in depth. We’ll have a live blog of Monday’s proceedings and our team in Houston will take over Energy Daily for the next five days.

For the uninitiated, CERAWeek is arguably the most important event of its kind. Other happenings may draw more delegates, some exhibitions may fill more space, but CERAWeek reliably attracts the bosses of almost every large energy company.

On Monday morning alone, we’ll hear from the chief executive officers of Exxon Mobil Corp., Saudi Aramco, TotalEnergies SE, Shell Plc and Petroleo Brasileiro SA.

Having started more than four decades ago as a fossil-fuel-focused meeting, CERAWeek has evolved into a much broader forum that includes every conceivable kind of alternative energy.

Thematically speaking, this year’s gathering will discuss the “multidimensional energy transition.” The ringmaster is oil historian Dan Yergin, who made clear in an interview last week he’s focused on the green shift and its intersection with geopolitics.

But for all the talk of renewables, hydrogen and nuclear power, it’s the big beasts of the oil and gas world that are set to dominate the agenda.

Big Oil comes into the conference buoyed by several factors: a relatively strong and stable crude price supporting near-record earnings; easing pressure from ESG activism; and no immediate sign of peak oil demand, despite speculation during the pandemic that it may have been imminent.

Such bullishness has fueled a wave of M&A. In fact, one of the largest recent deals — Chevron Corp.’s $53 billion acquisition of Hess Corp. — took shape at CERAWeek last year when the heads of both companies rekindled the idea of a merger.

That’s evidence, if it were needed, that what happens behind the scenes in Houston this week matters just as much as what gets said on stage.

–Simon Casey, managing editor for energy and commodities in the Americas

Highlights from CERAWeek on Monday

- CEOs speaking during the morning: Exxon’s Darren Woods, Aramco’s Amin Nasser, TotalEnergies’ Patrick Pouyanne, Shell’s Wael Sawan, Petrobras’ Jean Paul Prates, Woodside Energy Group Ltd.’s Meg O’Neill

- Afternoon appearances: Gunvor Group Chairman Torbjörn Törnqvist, US Energy Secretary Jennifer Granholm, White House energy adviser Amos Hochstein and climate adviser John Podesta, Trafigura Group CEO Jeremy Weir, US Senator Joe Manchin

- TV interviews: ConocoPhillips CEO Ryan Lance

Chart of the day

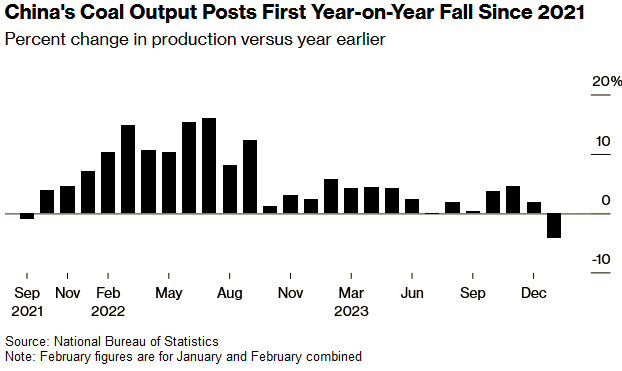

China’s thermal-coal output has fallen for the first time in years, adding to signs that Beijing’s long campaign to bolster energy security by digging up more of the fuel may have reached its apex. Coal production in January and February slid 4.2% from a year earlier to 705 million tons, National Bureau of Statistics data show.

bloomberg.com 03 18 2024