By Lisam Denning

Today’s Take: Big Oil’s Smaller Horizons

Environmentalists’ elation at the sudden revival of the Democrats’ climate package has been tempered by a condition attached; namely, offering more leases for oil and gas exploration. Big Oil’s earnings suggest they shouldn’t panic.

Exxon Mobil Corp. and Chevron Corp. kicked off the weekend right with almost comically huge numbers. To choose one: combined free cash flow was almost $27 billion. To put that in perspective, the last time oil traded mostly in triple digits, in the third quarter of 2014, the two generated less than $5 billion.

Exxon Mobil Corp. and Chevron Corp. kicked off the weekend right with almost comically huge numbers. To choose one: combined free cash flow was almost $27 billion. To put that in perspective, the last time oil traded mostly in triple digits, in the third quarter of 2014, the two generated less than $5 billion.

Besides restrained spending, you can see this in the choice of projects. Shale, with its shorter and flexible development cycle, figures prominently for both. So, too, liquefied natural gas, where security and climate — the latter through displacing coal — coalesce to offer clearer long-term demand prospects.

Even in big oil projects, it pays to avoid building big, fixed infrastructure requiring decades of use to pay off. For example, Chevron’s deepwater Ballymore project in the Gulf of Mexico will tie back to an existing production hub. Exxon, meanwhile, uses self-contained floating production, storage and offloading vessels to exploit its spectacular discoveries in offshore Guyana.

Leaner oil majors can certainly apply efficiencies in considering new auctions. Their appetite for striking out into entirely new pastures is much tempered, however. That is, after all, what their owners want these days.

— Liam Denning, Bloomberg Opinion

Chart of the day

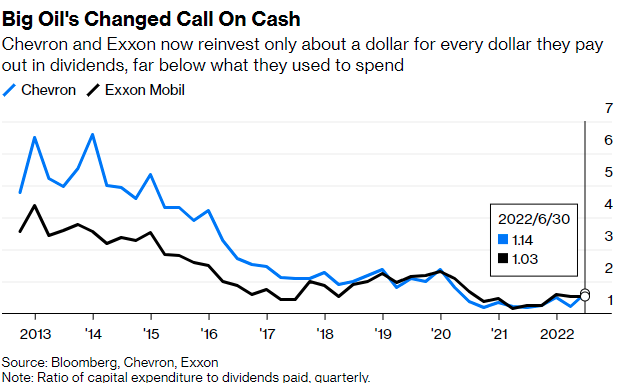

The last time oil traded at triple digits, Chevron and Exxon were reinvesting $4 or $5 for every dollar they paid in dividends. With shareholders having rebelled against blockbuster investment budgets yielding busted returns on capital, the direction of cash flows has shifted radically toward payouts and away from projects.

_____________________________________________________________________

Liam Denning is a Bloomberg Opinion columnist covering energy, mining and commodities. He previously was editor of the Wall Street Journal’s Heard on the Street column and wrote for the Financial Times’ Lex column. He was also an investment banker. Energiesnet.com does not necessarily share these views.

Editor’s Note: This article was originally published by Bloomberg on August 1 , 2022. EnergiesNet.com reproduces this article in the interest of our readers. All comments posted and published on EnergiesNet.com, do not reflect either for or against the opinion expressed in the comment as an endorsement of EnergiesNet.com or Petroleumworld.

Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of socially, environmental and humanitarian significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml.

EnergiesNet.com 08 03 2022