Pemex has seen its crude output decline almost every year since 2004 as mismanagement, debt and failing projects drag down Mexico’s oil giant.

Amy Stillman and Peter Millard, Bloomberg News

MEXICO CITY/RIO

EnergiesNet.com 12 09 2022

The rebound in oil prices over the last two years brought in record profits for the world’s largest crude producers, shoring up local economies and boosting jobs. Despite the fanfare, Latin America, home to a fifth of the world’s oil reserves, missed the party.

At current production rates, Latin America is underperforming its potential by about 12 million barrels a day, one expert estimates. That’s the equivalent of roughly $864 million of lost oil revenue every day at current prices — a monumental loss for a region that’s saddled with some of the worst wealth inequality in the world, and at a time when a huge supply crisis in global energy markets means that output is more needed than ever.

Perhaps no other country better encapsulates the squandered opportunity than Mexico, where a potent combination of mismanagement, debt and failing projects have combined to drag down its storied state oil producer Petroleos Mexicanos, better known as Pemex.

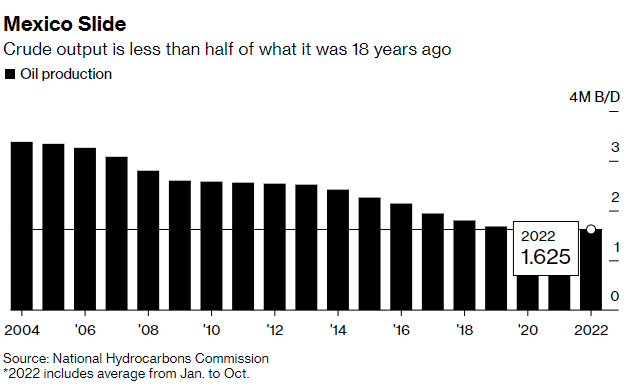

Pemex has seen its crude output decline almost every year since 2004; production is now less than half of what it was then. Meanwhile, its debt load has exploded to about $105 billion, making it the world’s most-indebted oil producer. The company has been kept on life support by Mexico’s current president, nationalist Andres Manuel Lopez Obrador, who sees energy independence as a lofty goal for the nation and has put more than $20 billion into capital injections and tax breaks for Pemex since 2019.

Despite AMLO’s ambitions and open wallet, the struggles at Pemex continue to get worse. With the looming global transition away from fossil fuels, Mexico may be about to miss out on what’s likely to be the last great oil boom.

“Absent any new discoveries from the medium to long-term, we see a general decline in production over the next 10 to 15 years,” said Omar Rios, a Latin America-focused research analyst for Welligence.

Pemex’s failure points to a broader trend for Mexico along with other countries in Latin America, where a once-burgeoning middle class is seeing its prospects eroded. Despite having some of the world’s biggest reserves of energy and metals supplies, along with being a stalwart in agricultural production, many nations in the region haven’t been able to take advantage of the recent run-up for commodity prices to bolster economic growth. Instead, persistent high inflation is widening the gap between rich and poor. One third of the entire region is poised to meet the criteria for poverty, defined as those living on $1.90 a day.

Oil output is a case in point. Venezuela, for example, could be producing some 6 million barrels a day. Instead, international sanctions coupled with limited finances and political missteps mean the country is pumping out only about 10% of that. In Argentina, a lack of investment in the rich Vaca Muerta shale patch has stifled output so badly that it’s “very significantly below” its potential, said Francisco Monaldi, a lecturer in energy economics at Rice University’s Baker Institute for Public Policy. And while nations such as Brazil and Guyana could see gains for output in the years ahead, there’s little hope of turnaround for laggards like Ecuador, Bolivia and Colombia.

“This is a long-term horizon business, and Latin American politics is factional and short-sighted,” Monaldi said.

Dwindling Reserves

Mexico’s proven oil reserves have shrunk to a quarter of what they were two decades ago, hitting 6.1 billion barrels at the end of 2020, according to BP’s Statistical Review. The country’s once flagship fields such as Cantarell and Ku Maloob Zaap, which made it a heavyweight producer in the late 20th Century, are now reaching retirement.

Under AMLO, Pemex’s output has stabilized with the incorporation of condensate, a very light oil that’s usually worth less than regular crude. Yet regular crude production continues to fall, decreasing by 2.6% in the first 10 months of 2022 compared with a year earlier, according to data from Mexico’s oil regulator. That’s even more disappointing when compared with the major gains seen on the Texas shale patch.

What’s worse, Pemex is hemorrhaging money at a time when global rivals are turning huge profits. In the third quarter, the Mexican giant posted a quarterly loss of 52 billion pesos ($2.62 billion) as the oil producer got bogged down with high costs from importing gasoline, diesel and other fuels to serve domestic customers. By contrast, Exxon Mobil Corp. and Chevron Corp. reported that they amassed more than $30 billion in combined net income last quarter as they took advantage of high prices for crude and natural gas.

Pemex and AMLO’s office both didn’t respond to requests for comment.

‘It Should Be Booming’

So what’s going wrong at Pemex? The somewhat simplified answer is that the state oil producer doesn’t actually pay much attention to extracting as much oil as possible.

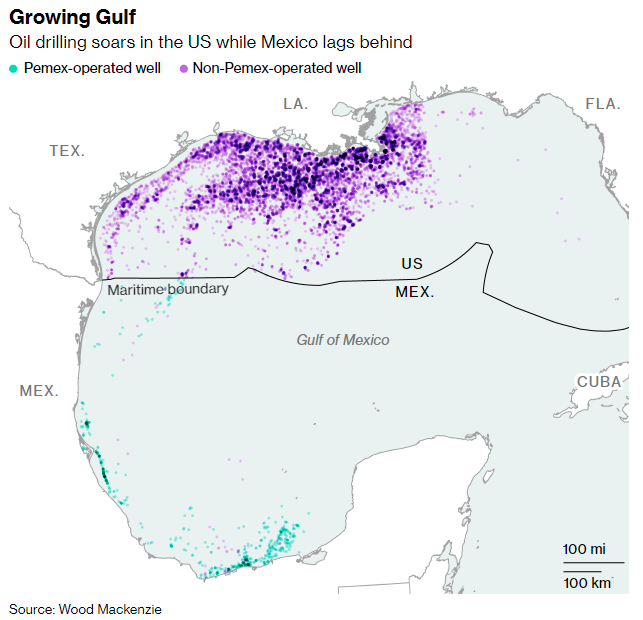

Pemex has focused on developing onshore and shallow-water prospects instead of riskier, and more promising, deep-water fields that could boost its reserves over the long term. The company doesn’t have the liquidity, the technology and the engineering know-how to take on those projects. An oil map of the Gulf of Mexico exposes the disparity: US waters are filled with platforms, drilling rigs and a massive pipeline network, while the Mexican side is a desert of activity.

The simple solution would be to bring in private partners or allow for joint ventures to make up for what Pemex lacks. But AMLO has instead said he’d rather focus on easy-to-reach reservoirs. Perhaps more importantly, his nationalist stance means that he’s snubbed private partnerships. He ended the competitive oil auctions that were part of landmark 2013 and 2014 energy reforms from the previous administration.

“Mexico has the resources — it should be booming right now,” said Luis Maizel, co-founder of San Diego-based LM Capital Management, which holds Pemex’s bonds.

The one small exception to AMLO’s anti-privates stance is that he’s allowed for some less lucrative service contracts. This year, Pemex signed a service contract with New Fortress Energy to develop its deep-water Lakach gas field, but Pemex will maintain ownership of the area.

Failed Field

The most notable example of Pemex’s hesitancy to take on big projects is the blockbuster offshore oil discovery known as Zama, which by now could have been ramping up to become the nation’s third-biggest field.

The 800-million-barrel Zama find was discovered in 2017 by U.S. driller Talos Energy after Mexico opened the industry to private investment for the first time in three-quarters of a century. Initial excitement quickly turned to shock and disappointment. A year after the discovery, Mexico determined that the reservoir bled into a neighboring area controlled by national oil company Pemex, and, instead of sharing the prize, Pemex fought to take over Zama with backing from the presidential palace. Talos and its partners Wintershall Dea and Harbour Energy have sunk at least $350 million in Zama whereas Pemex has yet to invest anything significant in the project.

Mexico will hold elections in July 2024, and, so far, there’s little opposition to AMLO’s ruling Morena party. Expectations of a Morena victory have added to investor caution, even as the president himself is limited to one term. Some international oil companies such as Shell Plc have begun to drill in deep-water and shallow-water prospects in Mexico, but many of them — including BP Plc and Equinor ASA — have returned blocks they won under the previous administration.

International oil companies “lost a lot of money” as Mexico opened up to foreign investment from 2014 to 2016, and then quickly pivoted away again under AMLO, said Nymia Almeida, senior vice president at Moody’s Corporate Finance Group in Mexico City.

“If the same party will stay for another six years, which is a high probability, they aren’t going to take any chances,” she said.

Focus on Refining

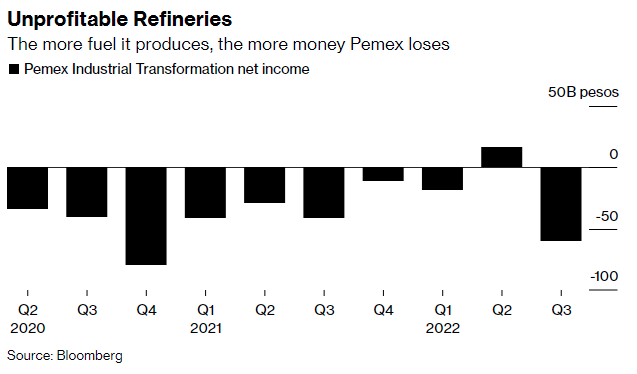

Instead of pouring money into producing crude oil, AMLO’s leadership has seen Pemex pivot more into refining to curb the nation’s dependency on gasoline and diesel imports. But so far, that goal remains a pipedream.

Take Dos Bocas, Mexico’s seventh refinery constructed in the president’s home state of Tabasco. Initially expected to cost $8 billion when it was proposed in 2019, the refinery’s budget for construction work through 2024 rose to more than $14 billion in May, with the final price tag likely totaling between $16 billion and $18 billion, people familiar with the matter have said. And while AMLO himself attended a grand opening ceremony back in July, the refinery, poised to become the nation’s largest, has yet to process any significant amounts of crude into gasoline and diesel. It’s now set to come online next year, months later than planned.

Meanwhile, Pemex’s Deer Park refinery in Texas, which the company has pledged would contribute to the national refining system, isn’t sending any fuel to Mexico. Instead, it’s mostly selling to US clients, Reinaldo Wences, deputy director of evaluation and regulatory compliance at Pemex Industrial Transformation, said on a recent call with investors.

In addition to the cost of new projects, Pemex’s six existing refineries are unprofitable due to a lack of maintenance and failure to invest in new technology, resulting in further financial strain. In the first nine months of the year, Pemex’s refining arm reported 61.7 billion pesos in net losses.

Source: Bloomberg

Brain Drain

AMLO has also come under sharp criticism for staffing the state behemoth with party loyalists with no experience of running an oil company. He has also slashed executives’ salaries, setting into motion a cycle that meant the industry’s best and brightest were no longer incentivized to stay at Pemex.

The brain drain that followed should come as little surprise. It started in 2018, when AMLO first came to power, but has continued at a worrying pace, with some employees quitting while others were ousted. The number of directors leaving the firm in the past two years is now in the double digits.

Among the most notable changes was Pemex’s former Chief Financial Officer Antonio Lopez Velarde, who after nine months in the job returned to his former role on the risk-management team in September. His predecessor, Alberto Velazquez, was also demoted in December last year. A former director of crude oil trading, Armando Mejia Sanchez, retired in August, and Pemex treasurer Emmanuel Quevedo left in January.

History of Nationalism

Mexico was one of the first countries in Latin America to nationalize its oil sector back in the 1930s, and the industry remained fully under state control well into the 1990s. The nation was able to bolster its output largely due to productive shallow-water fields through the 1970s, before seeing a period of stagnation through the 1980s and early 1990s.

The troubles started at the gargantuan Cantarell field that helped Mexico to once hold reign as the world’s third-largest oil producer, pumping more than 2 million barrels a day from the reserve at its peak.

That productivity “allowed the Mexican government to overtax Pemex, lose money in refining, and invest relatively little in exploration and production, without, for many years, facing a production fall,” consultancy Rystad Energy said in a report. “But it all came to an end when Cantarell initiated its rapid decline.”

That trend of overtaxing and underinvesting isn’t unique to Mexico. In fact, Latin America’s oil wealth greatly diverges based on how closely the state has control over the energy sector.

Venezuela, Argentina, Ecuador and Bolivia also stand out as having failed to develop the full potential of world class hydrocarbon deposits. Mexico and Argentina import more crude and natural gas than they export, a reversal from the last oil boom a decade ago. Monaldi of Rice University estimates that Latin America could be producing 20 million barrels a day, more than double its current level, if it followed the business-friendly model of oil hubs like Texas.

But Brazil, Guyana and Suriname stand out in contrast. The countries have welcomed private international oil majors. Growth in oil for Brazil and Guyana could potentially offset stagnation and declines in the rest of the region, according to an analysis from BloombergNEF, which projects that gains in the countries could add almost 3 million barrels per day to Latin America’s oil production by 2030.

Many of Pemex’s critics would like to see the company go the way of Brazil’s Petrobras, a state-controlled company that’s also publicly traded and which regularly partners with others in the private sector. But any change like that would need to happen fast because of the looming energy transition that’s discouraging investments for fossil fuels, said Cleveland Jones, a consultant and researcher at the National Institute of Oil and Gas in Rio de Janeiro.

“You can’t invest just because the oil price of today is at $100 a barrel, you have to make a forecast for the next 15, 20, 25 years that the project is running,” Jones said. “That’s a difficult sell. I don’t think we can make up for lost time anymore.”

bloomberg.com 12 08 2022