Brian Swint, Barron’s

RIGHTON, England

EnergiesNet.com 01 09 2023

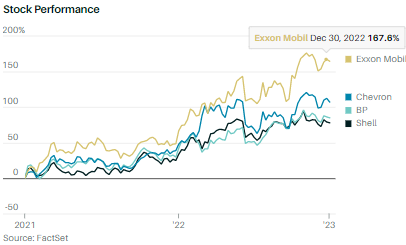

Last year, global oil companies boomed. BP BP +1.65% and Shell SHEL +1.67% , both based in London, saw share prices rise some 40% in 2022 and trade at five times forward earnings. U.S.-based Exxon Mobil XOM +1.21% soared nearly 80% and trades at almost 10 times earnings, while Chevron CVX +0.75% rose 50% and trades at 11 times.

Why that gap? Many blame windfall-profit taxes. All of the oil giants feasted on rising oil prices after Russia invaded Ukraine. While prices have fallen, they’re still at levels that produce sizable profits. However, European governments are clawing back some of those gains by taxing oil producers to subsidize high energy costs for consumers.

Still, taxes don’t fully explain the gap. All global producers are taxed in Europe. Exxon recently sued the European Union over the plan. And analysts discount the impact of the tax, which kicks in at high revenue levels.Powered by OilMost stocks fell in 2022, but not Big Oil.

Deutsche Bank analyst James Hubbard estimates that sector earnings will be cut by “low-single digits.”

Adds Morningstar strategist Allen Good: “2023 earnings won’t match 2022, but they’re still great. Shareholders are going to see a lot of cash flow coming back between [share] repurchases and dividends.”

A bigger factor is sustainable-energy investments. All four have targeted 2050 for reaching carbon net zero. But BP and Shell are investing about $1 billion a year each in low-carbon energy, and say their oil-and-gas production has peaked. Exxon and Chevron spend less as a percentage on green projects, and expect fossil-fuel output to rise. Meanwhile, environmental, social, and governance investors avoid BP and Shell because they remain big fossil-fuel producers.

In time, that may change. For now, BP and Shell look like bargains.

barrons.com 01 06 2023