Laura Hurst, Bloomberg News

LONDON

EnergiesNet.com 05 04 2022

BP Plc boosted its share buybacks by $2.5 billion as cash flow surged, offsetting some of the discomfort caused by a $25.5 billion charge linked to its planned exit from Russia.

The London-based major followed its peers Exxon Mobil Corp., Chevron Corp. and TotalEnergies SE, all of which saw their first-quarter net income — excluding Russia-related writedowns — soar in tandem with oil and gas prices after the invasion of Ukraine.

“In a quarter dominated by the tragic events in Ukraine and volatility in energy markets, BP’s focus has been on supplying the reliable energy our customers need,” Chief Executive Officer Bernard Looney said in a statement. “Our decision in February to exit our shareholding in Rosneft resulted in the material non-cash charges.”

BP will expand its share buyback by $2.5 billion, following through on a pledge to return a portion of surplus cash flow to investors. The company repurchased $1.6 billion in the first quarter. That figure could grow further this year as oil and gas prices are forecast to remain above $100.

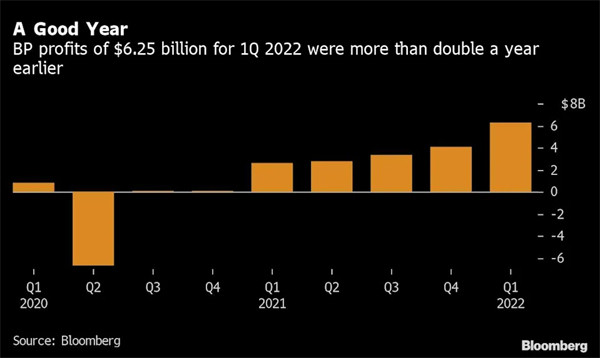

BP’s first-quarter adjusted net income was $6.25 billion, more than double the amount from a year earlier and surpassing analyst expectations of $4.43 billion. The figure doesn’t include an accounting loss of $29.29 billion, which is largely due to BP’s decision to dump its stake of about 20% in Kremlin-controlled oil giant Rosneft PJSC.

BP has approached state-owned companies including China National Petroleum Corp. and Indian Oil Corp. in an effort to offload its Russian assets. Officials at China’s Cnooc said last week that it believed any deal in Russia with European oil majors would likely require government approval. Cnooc itself is said to be in joint discussions with Shell Plc for a potential acquisition of its stake in Russia’s Sakhalin-2 liquefied natural gas project.

bloomberg.com 05 03 2022