- Winners of power auctions may sell new shares to fund growth

- Eletrobras, Equatorial and Taesa likely to participate: Itau

Vinicius Andrade and Cristiane Lucchesi, Bloomberg News

SAO PAULO

EnergiesNet.com 06 08 2023

Investment bankers are counting on massive auctions of energy transmission lines for a pickup in Brazil’s share sales.

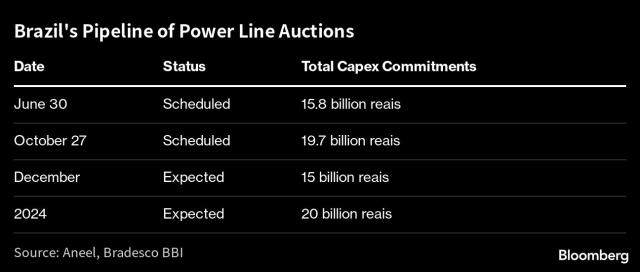

Projects demanding as much as 70 billion reais ($14 billion) in investments are expected to be auctioned through the end of 2024 and lure several publicly traded Brazilian firms. These companies, in turn, will likely need to fund their growth through local-debt issuances and share offerings, according to Felipe Thut, the head of Banco Bradesco SA’s investment-banking arm.

“The utilities sector is this year’s hottest,” Thut said in an interview. “Companies will have about five years after the auction to build the power transmission lines and over this time frame they will need money to fund those investments.”

The first auction — featuring nine projects across the Northeast and Southeast of the country — is scheduled for as soon as June 30. It’s likely to require total capital expenditures of about 16 billion reais, and companies including Centrais Eletricas Brasileiras SA (Eletrobras), Equatorial Energia SA and Transmissora Alianca de Energia Eletrica SA (Taesa) are likely to submit bids, say analysts at Banco Itau BBA SA.

The equity transactions would be a boon to dealmakers, who have grappled with tepid activity in recent months. The volume of domestic equity sales have plunged by half this year, according to data compiled by Bloomberg.

“What we may see by the end of the year in Brazil are share offerings, including initial ones, from more resilient industries, such as utilities, with predictability of cash flow and revenue,” said Alessandro Zema, head of investment banking at Morgan Stanley in Latin America and Brazil country chief. “The market is not there yet for tech companies.”

Cia Paranaense de Energia said last month it engaged banks for a potential share offering. The transaction would be similar to Eletrobras’s jumbo share sale last year and could end up privatizing the utility, which is currently owned by Parana state.

Taesa is readying a share offering of as much as 2 billion reais as it builds a war chest ahead of the auctions, website Brazil Journal reported in April.

The June auction is expected to be competitive even amid tougher macroeconomic conditions in Brazil, according to Citigroup Inc. Players like Eletrobras and Equatorial “all have plenty of access to capital markets,” analyst Antonio Junqueira wrote in a report earlier this week.

bloomberg.com 06 07 2023