Vinícius Andrade and Martha Beck, Bloomberg News

SAO PAULO/BRASILIA

EnergiesNet.com 06 13 2022

Brazil is set to give up its controlling stake in Latin America’s biggest power utility Eletrobras through a share sale that could raise $7 billion, the country’s largest privatization in over two decades.

Centrais Eletricas Brasileiras SA, as the Rio de Janeiro-based company is formally known, is issuing new shares while national development bank BNDES is selling part of its holdings in the utility in a deal expected to price after markets close on Thursday. In a rare victory for President Jair Bolsonaro’s lagging privatization push, the proceeds will likely be used to finance subsidies and other relief measures ahead of October’s elections.

The government stake will be diluted to less than 50% of voting shares after the sale. At an estimated 34 billion reais based on the stock’s June 8 closing price, it could be the second-largest equity deal globally this year.

After years of talking about privatizing Eletrobras, the deal bolsters Economy Minister Paulo Guedes’s credentials in his push to shrink the size of the state. It also comes at a moment when Bolsonaro, trailing leftist Luiz Inacio Lula da Silva in the presidential race, needs to reassure investors who are questioning his commitment to a liberal agenda and, at the same time, boost his popularity with Brazilians who blame him for the country’s soaring inflation. The deal may help him in both fronts.

“It’s a welcome surprise,” said Sylvio Castro, founding partner and chief investment officer at Grimper Capital in Sao Paulo, pointing out that the window for the sale was quickly closing as the country nears the election. “It might make room for the privatization debate to gain traction.”

Cash from the sale will finance a reduction in electricity bills, and possibly a series of measures being proposed by Bolsonaro to lower fuel prices and rein in inflation. Consumer prices which have surged by nearly 12% a year have become a make-or-break issue for Bolsonaro’s re-election campaign.

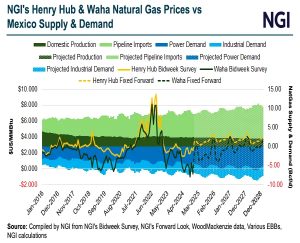

Brazil unveiled plans to privatize Eletrobras in 2017, under President Michel Temer. The process only gained traction in the past few months, however, after the government gave in to several demands from lawmakers, such as agreeing to the construction of several thermoelectric power plants running on natural gas, which will require pipelines and transmission lines.

“The sale has ironically picked up steam at a moment of frustration with the liberal agenda,” said Elena Landau, an economist who contributed to a privatization push in the 1990s while working at the BNDES. “It looks like an exception — as if it were a response to investors.”

Diverging Policies

The sale of Eletrobras also underscores a major ideological disagreement between Brazil’s presidential front-runners. While Bolsonaro has pledged to move forward with the privatization program if re-elected, putting oil producer Petroleo Brasileiro SA on the chopping block, Lula has harshly criticized the process and promised to reverse it if he wins the election.

Additional privatizations would stop under Lula, but his threat to cancel the sale of Eletrobras is largely rhetorical, as it would require the government to obtain congressional authorization to spend a large sum of money to buy back the shares. It would also raise questions about the new government’s willingness to respect contracts, possibly scaring off investors.

The Eletrobras deal, which received the approval of Brazil’s audit court and congress, will likely become the country’s second-largest equity offering on record after the $70 billion sale of Petrobras’s stock in 2010, according to Bloomberg data. It will likely be the biggest Brazilian privatization since the sale of Telecomunicacoes Brasileiras SA in 1998.

Despite last-minute legal attempts to derail the operation, there is enough investor appetite for the deal to succeed, according to two people with knowledge of the matter. The pricing of the shares is coming above the minimum value established by the country’s audit court, the people added, asking not to be named discussing non-public information.

Banks running the deal are Banco BTG Pactual SA, Bank of America Corp., Goldman Sachs Group Inc., Banco Itau BBA SA, XP Investimentos SA, Banco Bradesco BBI SA, Caixa Economica Federal, Citigroup Inc., Credit Suisse Group AG, JPMorgan Chase & Co., Morgan Stanley and Banco Safra SA.

bloomberg.com 06 10 2022