By Juan Pablo Spinetto

In Latin America, it’s not every day you see a city getting so much government income that spending it becomes a headache. Welcome to Maricá, a municipality of almost 200,000 people 60 kilometers (37 miles) up the coast from Rio de Janeiro.

Thanks to its proximity to the deepwater oil developments that have made Brazil into a major crude producer, Maricá is the country’s largest recipient of royalties from hydrocarbon production, effectively getting billions of reais from the different legal arrangements that distribute the nation’s commodity wealth.

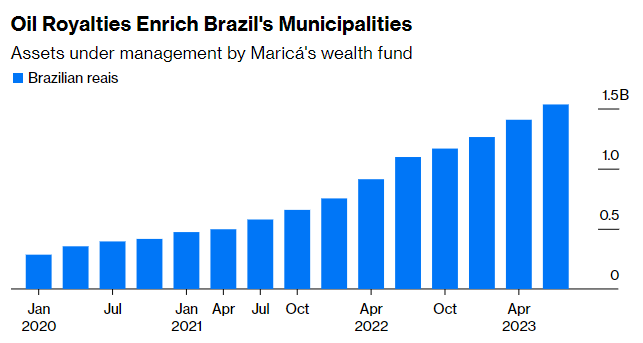

The money funds an innovative basic income program that provides unconditional transfers to about a quarter of Maricá’s population1. But what’s left over is so significant that in 2017 the city smartly decided to set up a vehicle to save part of the newfound riches: Currently, its wealth fund has 1.53 billion reais (or about $320 million) under administration, from just 285 million reais at the start of 2020. It’s set to keep growing because it’s receiving between 5% and 15% of the regular royalty transfers that the local government gets, on top of generating its own returns.

Marcus Moura, an official overseeing the fund, notes that it’s currently returning 13% per year, close to the benchmark interest rate. “The purpose is to have the fund not only as an intergenerational savings tool, but also to be a catalyzer of regional development,” he says.

Maricá’s recent social indicators reflect the impact of the oil wealth: GDP per capita has more than quintupled between 2016 and 2020, reaching almost 217,000 reais, according to Brazil’s statistics institute. That’s more than four times the average income of residents in Rio de Janeiro, the state capital, putting Maricá in the top 25 richest of Brazil’s more than 5,500 municipalities. Population has grown 55% since 2010, driven by new jobs and opportunities.

Maricá’s strategy for saving commodity profits for the future is hardly unique. With Brazil producing more than 4 million barrels of oil and natural gas equivalent per day this year, local wealth funds are mushrooming: Neighboring Niteroi, Ilhabela — in Sao Paulo state — and the Espírito Santo state all have similar vehicles managing more than 4 billion reais overall. The Rio state and its municipality of Saquarema, on the east of Maricá, also passed legislation last year to set up similar vehicles. Others are following, even using mining royalties as a source to generate long-term savings.

“Oil’s riches are limited. Our generation must make an ethical compromise with future generations to save these resources,” says Ricardo Ferraço, vice governor of Espírito Santo and its fund’s president.

The state, which has received almost 3.9 billion reais in oil royalties since 2018 and expects more to come as state-owned producer Petrobras boosts output, is already trying to diversify the fund’s investments into more sophisticated options. It recently hired a private asset manager to oversee the deployment of 250 million reais to finance “disruptive” start-ups that would create jobs and high-technology projects. It’s also launching a separate 250 million reais investment to support ESG projects.

As these funds are backed by local laws and have their own corporate governance rules, they have a good chance of generating the popular support they need to endure. Given Brazil’s volatile local politics and its economic ups and downs, when the temptation to deplete the savings will be higher, that’s critical to their survival.

“The consolidation of these funds depends on society to adopt them as key to the future because it’s the society that sets the agenda for politicians,” Ferraço says.

Of course, these figures are still small beer compared with the trillions of dollars under management by their role models, the sovereign wealth funds of Norway, Singapore or Saudi Arabia. But for a country — and a region — accustomed to spending what it doesn’t have, the idea of saving part of the wealth and investing it for higher future returns once the energy transition arrives is revolutionary.

In fact, with consistent policies and compliance, a professional investment approach and the expected further increase in hydrocarbon production, they have the potential to swell in the next decade, promoting local businesses and deepening the country’s capital markets.

Brazil, which is also revamping its fiscal and tax rules at the federal level to make them more reasonable, should reconsider the merits of reestablishing a sovereign wealth fund to manage its commodities wealth (and environmental footprint) over time, after a previous attempt ended in catastrophic failure in 2019. A successful national initiative would also provide guidelines to the subnational funds.

The country discovered some of the world’s largest oil deposits this century deep in the Atlantic Ocean. After much effort, investment and corruption (remember the Carwash scandal?), these fields are finally generating big bucks for Brazil — just the time to save some of this wealth for a future when oil may no longer be needed.

- The program also included the launch of a community development bank and a local digital currency, the mumbuca, to incentivize the spending of the extra funds within the city. You can read more about this topic in this research by the Jain Family Institute, which is supporting the initiative.

_________________________________________________________

Juan Pablo Spinetto is a Bloomberg News managing editor for economics and government in Latin America. Energiesnet.com does not necessarily share these views.

Editor’s Note: This article was originally published by Bloomberg Opinion, on July 24, 2023. All comments posted and published on EnergiesNet.com, do not reflect either for or against the opinion expressed in the comment as an endorsement of EnergiesNet.com or Petroleumworld.

Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of environmental and humanitarian significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml.

EnergiesNet.com 07 24 2023