Natural-gas futures log weekly rise of nearly 13%

By Myra Saefong and Williams Watts/MarketWatch

SAN FRANCISCO/NEW YORK

EnergiesNety.com 02 14 2022

Global benchmark crude prices posted their first weekly gain in a month Friday, finding support as the U.S. looked to reduce Iranian crude exports and after President Donald Trump did not immediately impose reciprocal tariffs on U.S. trading partners.

Prices for both global and benchmark crude, however, ended the trading session lower as traders continued to fret over uncertainty surrounding tariffs and their impact on oil demand.

Price moves

- April Brent crude BRN00-0.13% BRNJ25-0.13%, the global benchmark, fell by 28 cents, or 0.4%, at $74.74 a barrel on ICE Futures Europe, settling 0.1% higher for the week, according to Dow Jones Market Data.

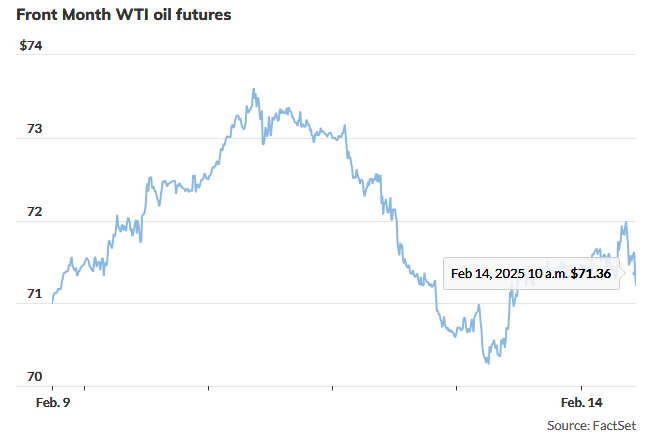

- West Texas Intermediate crude CL00-1.01% for March delivery CL.1-1.01% CLH25-1.01% fell 55 cents, or 0.8%, to settle at $70.74 a barrel on the New York Mercantile Exchange, ending down 0.4% for the week. That was its fourth weekly fall in a row.

- March gasoline RBH25-1.32% shed 1% to $2.09 a gallon, down 0.7% for the week.

- March heating oil HOH25-0.20% added 0.5% to $2.46 a gallon, contributing to a weekly rise of 1.3%.

- Natural gas for March delivery NGH25+2.70% settled at $3.73 per million British thermal units, up 2.7% Friday, for a 12.6% rise on the week.

Market drivers

Global benchmark crude prices ended slightly higher for the week while U.S. oil prices posted a weekly loss — but both have fallen in the month so far as traders weigh Trump’s day-to-day comments and policy changes, and how they could impact the supply of, and demand for, oil.

Trump’s tariff threats “continue to pose a notable risk to global oil demand,” Han Tan, chief market analyst at Exinity, told MarketWatch. “Crude’s downtrend since mid-January may also extend on further progress in talks to end the Russia-Ukraine war, along with the potential ramp-up in U.S. and OPEC+ output.”

Treasury Secretary Scott Bessent said the U.S. wants to reduce Iran’s oil exports by more than 90%, according to Bloomberg, which cited a Friday interview with Fox News. That would further Trump’s expressed desire for “maximum economic pressure” on Tehran.

Read: Trump is putting ‘maximum economic pressure’ on Iran. What’s next for oil?

Meanwhile, Trump on Thursday ordered his administration to study ways to impose tariffs that would match levies on U.S. products imposed by other countries — a process that Howard Lutnick, Trump’s nominee for commerce secretary, is charged with completing by April 1. That proved a relief to investors, who had feared the immediate imposition of tariffs.

Oil had seen pressure previously on fears that tariffs would dampen economic growth and crude demand.

“Tariffs, at least for the short term, are on the backburner,” with levies on Canada to be decided at the end of the month and other tariffs still to be determined, noted Tariq Zahir, managing member at Tyche Capital Advisors. Risks for oil prices are to the “downside from here,” he told MarketWatch.

Crude had also seen pressure after Trump earlier this week said he and President Vladimir Putin of Russia had agreed to begin talks on ending the Russia-Ukraine war.

Read: Stock-market rally says Trump tariffs more ‘bark than bite.’ Investors beware.

The news of progress toward negotiations to end the war in Ukraine shaved off part of the “fear bid” in prices over oil supplies from Russia.

But prices haven’t completely tanked yet, said Stephen Innes, managing partner at SPI Asset Management. “As always, it boils down to the basics: supply and demand,” he said. “Nothing has fundamentally shifted on that front yet.”

Prices likely have more room to run lower, Innes told MarketWatch. But while they may trend lower, “expecting an immediate freefall would be a mistake,” because “getting a deal inked is far from a slam dunk.”

A resolution to end the Russia-Ukraine war may lead the U.S. to lift sanctions on Russia, leading to more supply on the global market, analysts have said. But even if greater supply is on the horizon, global demand, along with OPEC+ policies and broader macroeconomic forces, will remain the key drivers of oil prices, Innes said.

Natural-gas prices, meanwhile, climbed nearly 13% for the week to mark their highest settlement in three weeks.

“More winter weather reports are shaking up the market — in fact, we might not see spring until March or even April, which is causing a dramatic shift in the natural-gas world and an end to the supply glut,” said Phil Flynn, senior market analyst at the Price Futures Group, in a daily note.

marketwatch.com 02 14 2025