By Liam Denning

Warren Buffett turned Occidental Petroleum Corp. into the sort of company he could love by helping it dig its own hole. You can read the history of that here. It turns out his ardor is even fiercer than it appeared. With Berkshire Hathaway Inc. owning more than a fifth of Oxy already, a filing published by the Federal Energy Regulatory Commission on Friday afternoon disclosed that Buffett’s company had applied for permission to buy up to half.

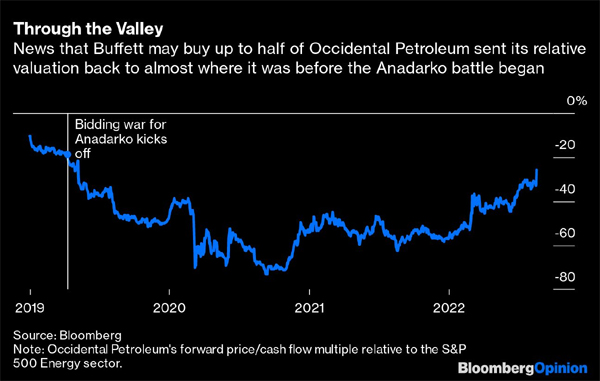

Given parallels to Berkshire’s piecemeal takeover of the Burlington Northern Santa Fe railroad in 2009-10, dreams that Oxy is about to become BOxy helped push the stock up 10% on Friday. At just over four times forecast cash flow, Oxy’s relative valuation is almost back to where it was before the ill-timed Anadarko Petroleum Corp. bidding war — in which Buffett played a vital part — kicked off.

One of the mysteries of Buffett’s buying spree in Oxy over 2022 is that it didn’t have the usual effect of luring everyone else into following him. Friday’s more traditional sequence of a Buffett filing followed by a stock pop restored some harmony to the universe on that front at least.

Still, Oxy’s spike contrasted with a generally down day for energy stocks, a reminder that this remains a unique situation. Buffett’s $10 billion in 8% preferred shares enabled the Anadarko deal but also damaged the reputation of Oxy’s management and now weighs on the balance sheet. High oil prices have enabled Oxy to pay down roughly half its net debt since the deal closed. Now that it has partly restored its dividend and started buying back stock, it is approaching a point at which it would trigger an early call on the preferreds (at a 10% premium). This happens once the 12-month trailing payout hits $4 a share.

Using consensus forecasts, by my math Oxy could buy back $1 billion of stock per quarter and hit that threshold in the first quarter of 2023. By then, net debt would have dropped to an implied $14 billion or so. However, it would then face the prospect of borrowing to pay the $11 billion owed to Buffett.

Buffett’s stake in Oxy enables him to benefit in multiple ways. The preferreds, along with other lingering leverage from the Anadarko deal, act as a brake on management’s ambition, which is the bare minimum for a decent equity story in oil these days. They also pay a healthy yield and, by incentivizing buybacks, provide a kicker to the common equity Buffett owns. As an aside, the rise in Oxy’s stock price has also put the warrants he got in 2019 in the money. Taking Friday’s news into consideration, if Buffett raises his stake to 50%, the implied backing from the Berkshire hoard means Oxy should also find it easier (and cheaper) to borrow when it triggers that call on the preferreds.

On the downside, if a recession takes oil prices south, and Oxy slows its payouts, Buffett would still get the yield on his preferreds. And knowing that any recession is unlikely to be as deep as the pandemic-related crash Oxy endured in 2020 — especially as the company has cut its debts already — Buffett should be more comfortable about waiting for the next recovery and eventual redemption. Buffett is clearly bullish on oil, but he’s been making his own luck with Oxy for a while now.

______________________________________________________________

Liam Denning is a Bloomberg Opinion columnist covering energy, mining and commodities. He previously was editor of the Wall Street Journal’s Heard on the Street column and wrote for the Financial Times’ Lex column. He was also an investment banker. Energiesnet.com does not necessarily share these views.

Editor’s Note: This article was originally published by Bloomberg on August 16 , 2022. EnergiesNet.com reproduces this article in the interest of our readers. All comments posted and published on EnergiesNet.com, do not reflect either for or against the opinion expressed in the comment as an endorsement of EnergiesNet.com or Petroleumworld.

Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of socially, environmental and humanitarian significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml.

EnergiesNet.com 08 19 2022