By Julian Lee | Bloomberg Today at 3:43 a.m. EST

We may be about to see a surge in oil from Iran. That’s the hope, at least, surrounding talks in Vienna aiming to revive the 2015 nuclear deal, also known as the Joint Comprehensive Plan of Action.

Sanctions on Iran were first removed in 2016, after a deal was struck to limit the Persian Gulf nation’s nuclear program, only to be reinstated when former President Donald Trump later tore up the agreement. If sanctions are lifted once more, the country will be able to boost its oil production and unlock a wave of barrels stored in onshore tanks and on ships anchored around the world.

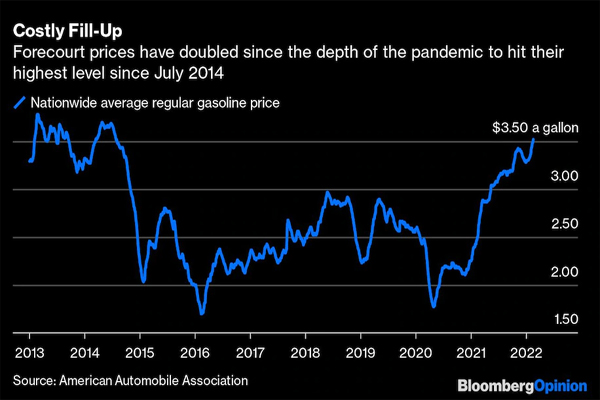

That could help reverse some of the recent rise in crude prices and take pressure off motorists faced with the highest fuel prices they have seen in more than seven years.

The talks between Iran and a group of six nations — the U.S., China, Russia, the U.K., France and Germany — have been going on for months and are heading for the finish line, according to a senior European Union diplomat. But what lies beyond the tape remains unclear, and there are still some political obstacles to overcome.

Chief among these for Iran is a guarantee that future U.S. administrations won’t simply revoke the deal again. That’s something President Joe Biden, or any other U.S. leader, can’t promise, particularly when doing a deal with Iran remains unpopular for many members on both sides of Congress. If it wants an agreement, Iran is going to have to be realistic. It may yet decide that accepting a deal that could last as little as three years simply isn’t worth it.

On the other side of the table, major differences remain on what’s required to roll back Iran’s nuclear advances — which have allowed it to enrich uranium closer to weapons-grade levels and near the threshold of becoming a nuclear state. There seems to be a general acceptance that time is running out to do a deal before Iran’s capabilities have developed so far as to make the 2015 agreement meaningless.

But if a deal is done it could have big implications for oil markets and a knock-on effect on fuel prices.

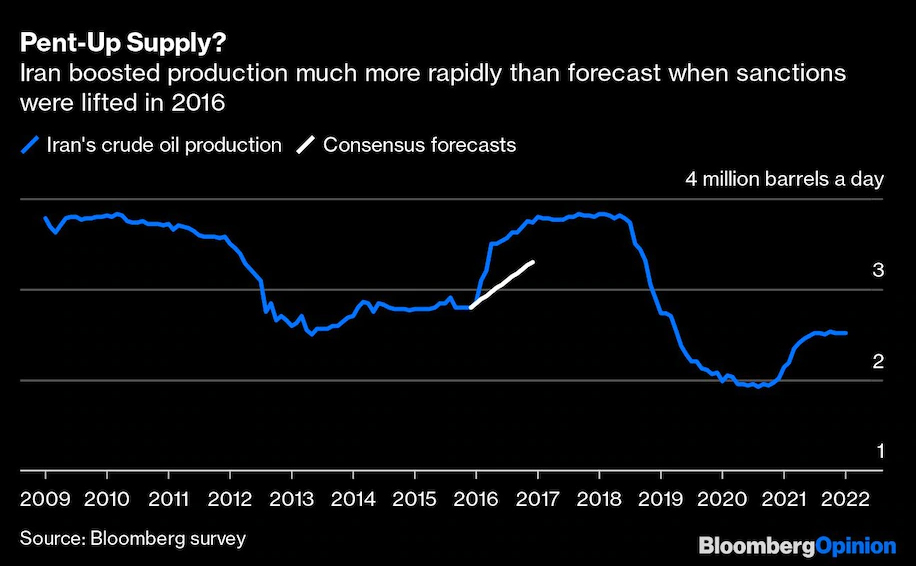

When sanctions were eased in 2016, after the nuclear deal first came into effect, Iran boosted its oil production much more quickly than consensus forecasts. Most analysts saw the country’s crude production rising by 500,000 barrels a day over the first 12 months without sanctions. In fact, Iran achieved that in less than four months and went on to add almost the same amount again before the year was out.There are reasons to think it might be able to do the same again.

Iran was using about 1.8 million barrels of oil a day before the pandemic, according to figures from the Organization of Petroleum Exporting Countries. That domestic consumption provides a solid base for the country’s oil industry, even without exporting to external markets — and those external markets never dried up completely, despite the sanctions.

Iran has continued to ship crude and refined products to China and Syria, as well as condensate, a light form of crude extracted from gas fields, to Venezuela. Most of that trade has been conducted on ships running without sending position signals, making them much more difficult to track and masking the true volume of the trade.

Analysts appear to have taken that earlier recovery into account. Citigroup Inc. says that should sanctions end, Iran could boost output by 500,000 barrels a day as soon as April or May and by 1.3 million barrels a day by the end of the year. That’s a view that would have seemed outlandish in 2015, but it’s much less so now.

And then there’s the oil Iran has already pumped out of the ground and put into storage tanks and onto ships. Estimates of that quantity vary widely, from about 85 million barrels split between tanks and tankers, to as much as 85 million barrels just in storage at sea.

In 2016, buyers in India and Europe were quick to boost purchases of Iranian crude. With oil in short supply and prices above $90 a barrel, they will be just as keen to do so again, given the opportunity.

Last time around, Iran’s Asian customers enjoyed sanctions waivers that permitted them to keep importing its crude in decreasing quantities. Those markets were never fully lost. This time it’s different. Most of Iran’s former customers haven’t processed its crude for more than three years, establishing or deepening relationships with other suppliers in the meantime. That’s perhaps why Iranian officials have already met former customers in South Korea — an important market alongside the United Arab Emirates for Iran’s condensate exports.

If an Iranian nuclear deal can be revived, the extra barrels it will release onto the global market will come at just the right time and will move quickly. The OPEC+ group of oil producers is struggling to boost production as much as it’s promised, and the Texas shale patch shows no sign of riding to the rescue. It might be down to longtime foe Iran to come to U.S. motorists’ aid.

________________________________________________

Julian Lee is an oil strategist for Bloomberg. Previously he worked as a senior analyst at the Centre for Global Energy Studies. Energiesnet.com does not necessarily share these views.

Editor’s Note: This article was originally published by Bloomberg Opinion, on February 17, 2022. All comments posted and published on EnergiesNet.com, do not reflect either for or against the opinion expressed in the comment as an endorsement of EnergiesNet.com or Petroleumworld.

Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of environmental and humanitarian significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml.

EnergiesNet.com 02 21 2022