By Javier Blas

If the oil market was a religion, its central article of faith would be the maximum production capacity of Saudi Aramco, a tenet based on confidence in what we hope to be true and belief in properties we have not yet witnessed. The market is about to have its epiphany.

Aramco, the state-owned Saudi Arabian oil giant, claims it can sustainably pump 12 million barrels a day, well above the kingdom’s OPEC+ August target of 11 million barrels. For the global economy, Saudi spare capacity is the last line of defense against more energy inflation. But apart from a few top company executives and a handful of Saudi royals, no one knows for sure whether Aramco can deliver. The rest either have blind faith in Aramco — or simply don’t believe.

On Tuesday, French President Emmanuel Macron was caught at the Group of Seven summit relaying second-hand information to US President Joseph Biden that suggests the Saudis don’t have as much oil production capacity as they claim. Call it French secularism.

The truth will emerge in the next few weeks. On Thursday, OPEC+ will greenlight the final of its series of monthly output increases, giving Riyadh a target of almost 11 million barrels a day for August. Aramco has only pumped at that level for a grand total of eight weeks in its entire history, in late 2018 and early 2020. Now, it faces the prospect of sustaining that level or higher, for several months, perhaps even longer, for the rest of 2022 and through 2023.

Over the last eight weeks or so, there has been frenetic activity inside Aramco to prepare for an output surge. “MSC,” as maximum sustainable capacity is known at the company’s headquarters in Dhahran, has been the key topic of discussion. Company insiders, speaking in private, say it can reach 12 million barrels a day within 30 days and sustain that level for at least 90 days. What about longer? Aramco is simply confident it will prove skeptics like Macron wrong. Have faith, is the message.

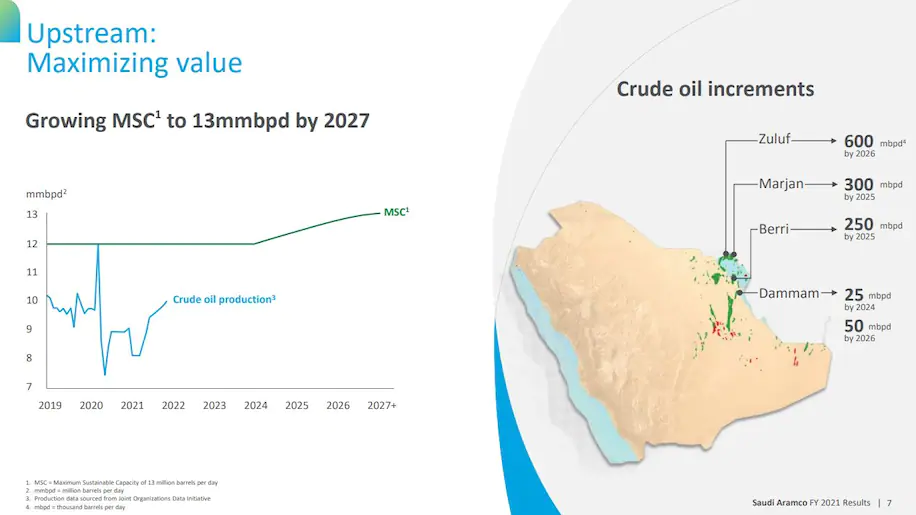

The company is taking steps to boost its MSC to 13 million barrels from 12 million. But the first increase, a tiny extra 25,000 barrels a day, won’t arrive until 2024. The bulk of the expansion, including boosting production at three key oilfields known as Zuluf, Marjan and Berri, is slated for 2025 and 2026.

Aramco’s maximum capacity is a mystery because it hasn’t ever been tested for an extended period. In April 2020, Riyadh reported its highest ever monthly average, at 11.55 million barrels a day. Back then, Aramco briefly — for a few days, I hear — pumped 12 million barrels a day. Aramco executives, including Chief Executive Officer Amin Nasser, took selfies in front of a giant screen wall showing production hitting the record level. At one point, it surged to 12.3 million barrels. Smiles all round.

Behind closed doors, however, things were more complicated. In private, Saudi oil industry executives describe that effort as a real challenge and express concern about having to sustain that output. It’s one thing to briefly hit the target, quite another to keep pumping and pumping at that level for a year, the internal thinking goes.

Oil executives and energy officials who’ve spoken to the Saudis in recent months have received conflicting signals about Aramco’s capabilities. Many have been told, in no uncertain terms, that the company will do as promised: the 12-million level is guaranteed. But I’ve heard a different version from a few others who have intimate connections with the kingdom and say anything above 11.2 to 11.3 million barrels for more than a few months would prove difficult.

That more skeptical version echoes what Macron was overheard telling Biden at the G7. According to Macron, Sheikh Mohammed bin Zayed, ruler of the United Arab Emirates, told him the Saudis couldn’t currently boost production by much, perhaps another 150,000 barrels per day and, if more was needed, Riyadh would need another six months. “They don’t have huge capacities,” the French leader was caught saying.

Both the optimistic and pessimistic scenarios can be simultaneously true. Pumping 12 million barrels a day can be possible and also very challenging; difficult needn’t equal impossible. Experience says that Riyadh will do whatever it takes to maintain its reputation as the world’s most reliable oil supplier. Money won’t be an issue; extra drilling would be approved, maintenance delayed, and oil reservoirs will be run hard if needed.

Aramco can pull a few extra levers to deliver, rather than produce, extra crude, maintaining the illusion of higher capacity. The company maintains vast crude storage in Egypt, the Netherlands and Japan, from where it can ship more barrels. In addition, it keeps a strategic reserve of refined products in underground caverns at five locations in the kingdom. It can tap that little-known reserve, which took two decades to build, to supply its domestic market with gasoline, diesel and jet fuel for a while, reducing crude intake at its local refiners and thus freeing more for export. Secretly, that’s precisely what Riyadh did after the attack in 2019 on its large Abqaiq oil-processing center.

Experience also says that every time the market has doubted the Saudi ability to boost production, the kingdom has proven the naysayers wrong. Perhaps the most notable example is how the late Matt Simmons, author of the much-discussed book “Twilight in the Desert: The Coming Saudi Oil Shock and the World Economy,” lost a bet based on his view that Saudi oil output had peaked.

And yet, there are reasons to worry.

Aramco doesn’t just use its spare capacity to meet surges in global oil demand but also, according to the IPO prospectus, to “maintain its production levels during routine field maintenance.” As Riyadh ramps up to maximum sustainable production, Aramco would be forced to run its oil fields at full throttle with little maintenance possible — a recipe for trouble. Any unplanned outages, which in normal times Saudi Arabia can conceal thanks to its spare capacity, would be catastrophic. There would be no cushion.

Regardless of the true potential production number, one thing is clear: the days when Aramco could easily pump more and more barrels are over. From now on, each incremental barrel is a struggle. Whether or not you have faith in in the Saudis, the world faces a reckoning.

________________________________________________________________

Javier Blas is a Bloomberg Opinion columnist covering energy and commodities. He previously was commodities editor at the Financial Times and is the coauthor of “The World for Sale: Money, Power, and the Traders Who Barter the Earth’s Resources.” @JavierBlas. Energiesnet.com does not necessarily share these views.

Editor’s Note: This article was originally published by Bloomberg Opinion, on June 29, 2022. All comments posted and published on EnergiesNet.com, do not reflect either for or against the opinion expressed in the comment as an endorsement of EnergiesNet.com or Petroleumworld.

Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of environmental and humanitarian significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml.

energiesnet.com 06 29 2022