Daniel Cancel, Bloomberg News

SAO PAULO

EnergiesNet.com 12 31 2024

Carlos Slim, Latin America’s richest man, plowed $1 billion this year into growing his crude-oil producing and refining portfolio in a bet that demand for fossil fuels isn’t going away anytime soon.

Slim, 84, made his fortune largely by building the telecom behemoth America Movil SAB, but has diversified in recent years into other assets including the oil investments, real estate in Spain and a new stake in the UK’s BT Group Plc.

Through his family investment office Control Empresarial de Capitales, Slim invested $602 million in US refiner PBF Energy Inc., according to regulatory filings, boosting his stake to 25%. He also bought $326 million worth of shares in Houston-based oil producer Talos Energy Inc.

Slim now owns 24.2% of Talos, prompting the board in October to introduce a poison pill to prevent him from acquiring more than a quarter of the stock. He also recently boosted his stake in a Mexico joint venture with Talos to 80% from 49.9% for an aggregate purchase price of $82.7 million.

After his net worth rose above $100 billion for the first time, Slim’s fortune has taken a hit this year, falling 22% to $81.8 billion, according to the Bloomberg Billionaires Index. While part of the move can be chalked up to the drop in the Mexican peso after years of relative strength, his biggest assets are also down for the year, led by a 40% decline in holding company Grupo Carso SAB.

Slim spokesman and son-in-law Arturo Elias Ayub didn’t reply to a request for comment on the oil investments. Slim said in February he was making a bigger push into oil with plans to learn more about refining and petrochemicals. He also said he was looking to partner with firms with experience in and around the Gulf of Mexico.

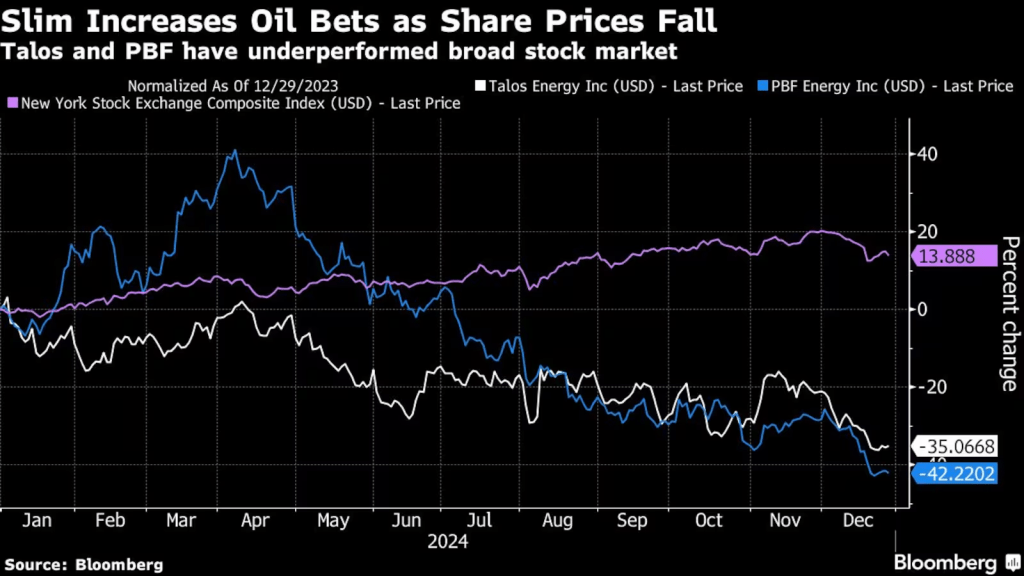

Slim’s purchases of PBF and Talos shares have often come when the stock price was falling. Talos is down 35% in 2024 while PBF has dropped 42%.

Slim’s move this month to boost his stake in the Mexico joint venture with Talos gives his family greater control over the expected windfall from the Zama oil field, one of Mexico’s most promising new discoveries in decades.

In July, he vowed to invest $1.2 billion to develop the Lakach offshore gas field through Grupo Carso, in conjunction with state oil firm Petroleos Mexicanos. Carso will work with Talos and a local unit of Spain’s Fomento de Construcciones y Contratas SA for the project.

Slim owns more than 80% of FCC, as the Spanish firm is known.

bloomberg.com 12 30 2024