Kiana Wilburg, Kaieteur News

GEORGETOWN

EnergiesNet.com 08 12 2022

CGX Energy Inc. announced on Wednesday that for the first half of the year it has recorded almost US$7M in losses. Specifically, the company with Canadian heritage said it recorded a net and comprehensive loss of US$6.8M or US$0.02 per share for the six month period ended June 30, 2022, compared with a net loss of US$3.4M or US$0.01 per share for the same period in 2021.

In its latest financial statements CGX said net loss for the period is consistent with prior periods as expected, adding that the differences in the period include interest expense which increased by US$2,262,700 to US$2,638,308 in the six month period ended June 30, 2022 from US$375,608 for the same period in 2021. CGX said the increase in interest expense pertained to 2021 and 2022 convertible loans it has with joint venture partner, Frontera Energy Corporation.

It said too that general and administrative costs increased by US$325,712 to US$1,319,419 in the six month period ended June 30, 2022 from US$993,707 for the same period in 2021, due to increased business development costs related to pursuing strategic options.

Financial statements also note that the company has a history of operating losses and as at June 30, 2022 had a working capital deficiency of US$83,478,546 and an accumulated deficit of US$317,364,980.

In fact, CGX said the ability of the company to continue as a going concern is dependent on securing additional required financing through issuing additional equity or debt instruments, the sale of company assets, securing a joint farm-out for its Petroleum Production Licences (PPLs), or securing a partner for the deepwater port project.

It said as well that it does not have sufficient cash flow to meet its operating requirements for the 12 month period from the statement of financial position date.

CGX was keen to note however that it has been successful in raising financing in the past, where recently it was able to raise US$35 million through a convertible loan. It noted nonetheless that there exists material uncertainties that may cast significant doubt as to the company’s ability to continue as a going concern.

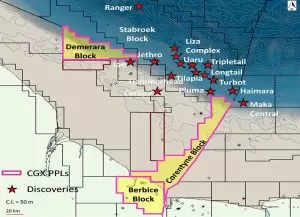

Kaieteur News previously reported that CGX initially held the PPLs for three licences. Due to its inability to honour its minimal work obligations, it was instructed to return to the State two of those blocks—the Demerara and Berbice. It continues to hold the Corentyne Block but has since relinquished the majority interest in the block to Frontera Energy Corporation due to its lack of funds to meet upcoming commitments.

CGX and Frontera are expected to drill their second well called Wei-1 in October.

kaieteurnewsonline 08 12 2022