Jeff Mower, Platts S&P Global

HOUSTON

EnergiesNet.com 03 20 2024

Mexico could revise its energy policies to encourage an increase in oil and gas production following the June 2 presidential election, Harbour Energy executive vice president Gustavo Baquero said March 19.

“Every country has a different risk, and that picture is moving,” Baquero said at the CERAWeek by S&P Global conference. “In the case of Mexico, I’m still optimistic.”

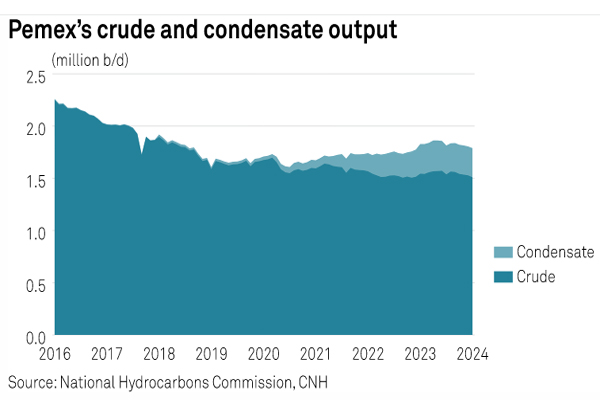

Under the administration of Andrés Manuel López Obrador, Mexico’s oil production has fallen, as López Obrador halted upstream auctions put in place by the prior administration, essentially stalling Mexico’s energy liberalization.

State-owned Pemex saw its crude production average 1.5 million b/d in January 2024, down from 1.54 million b/d in in January 2023, data from the National Hydrocarbons Commission showed Feb. 23, and its output is reliant on seven main fields, some of which are already declining. At 92,374 b/d, production from private operators was the lowest since February 2022.

For the rest of the decade, the prospects for the Mexican upstream sector are not very promising unless there is a change in policy in the first years of the next administration, according to S&P Global Commodity Insights.

Claudia Sheinbaum, representing López Obrador’s MORENA party, is currently expected to win the June 2 election, according to polls cited in news reports. It remains to be seen if Sheinbaum, if elected, will continue with López Obrador’s energy policies.

Baquero said on the sidelines of the conference that Sheinbaum could be more pragmatic in order to exploit Mexico’s resources — such as the Zama oil field — and turn around the heavily-indebted state oil company.

“I think pragmatism will prevail in Mexico,” Baquero said.

Harbour increased its stake in the Zama oil field from 12.4% to little over 30% following its acquisition of Wintershall DEA’s upstream assets in December 2023. That deal is expected to close in the fourth quarter of this 2024.

Zama is estimated to hold almost 700 million barrels of light crude and over 260 Bcf of gas, according to Talos Energy, which in May 2023 completed the sale of a 49.9% interest in its Mexico subsidiary to Mexican conglomerate Grupo Carso, which held 17.4% in Zama. The main stakeholder in the field is Pemex, the operating partner, with 51%. Pemex said in February it will delay investments until late 2024 at Zama as it will take time to rethink the project’s engineering.

Pemex is in a similar financial situation that Brazil’s Petrobras was in 10 years ago, Baquero said. Brazil subsequently opened its oil and gas industry to foreign investment, including the sale of some of Petrobras’ refineries.

“Measures were taken and Petrobras is doing really well,” Baquero said.

Brazil pumped 4.487 million b/d of oil equivalent in January, up from 4.173 million boe/d in January 2023.

spglobal.com 03 19 2024