Kaieteur News

GEORGETOWN

EnergiesNet.com 103 14 2022

Frontera Energy Corporation and CGX Energy Inc., the two Canadian joint venture partners with interests in three blocks in the Guyana basin announced that they have entered into a financing agreement for a US$35 million loan. This loan will enable CGX in particular to continue to finance part of its share of costs related to the Corentyne Block, the Berbice Deepwater Port, and other budgeted costs as agreed to with Frontera.

Kaieteur News understands that the loan to CGX will be available for drawdown in tranches on a non-revolving basis earlier than July 31, 2022 or the date on which CGX has drawn down the maximum amount of the Loan. The loan, together with all interest accrued, shall be due and payable July 31, 2022, or such later date as determined by Frontera, at its sole discretion.

Interest payable on the principal amount outstanding would accrue at a rate of 9.7% per annum payable monthly in cash, with interest on overdue interest. If the Loan is extended by Frontera past July 31, 2022, in its sole discretion, the new interest rate will be 15% per annum.

This newspaper understands that the loan will be secured by all of the assets of CGX. A standby fee of 2% per annum multiplied by the daily average amount of unused commitment under the loan in excess of US$19 million is payable quarterly in arrears by CGX, on the last business day of each fiscal quarter, during the drawdown period.

Subject to the approval of the TSX Venture Exchange, Frontera in its sole discretion, on or after July 31, 2022, may elect to convert all or a portion of the principal amount of the loan outstanding, including accrued interest that has not been repaid, into common shares of CGX at a conversion price equal to U.S. $2.42 per common share (being the U.S. dollar equivalent of Cdn. $ 3.10 per common share), provided Frontera provides CGX with 15 business days notice of such conversion.

CGX was keen to note that it has the right to prepay all or any portion of the Loan, including any unpaid interest, on 15 business days notice to Frontera before July 31, 2022. CGX is also required to repay all of the loan that is outstanding in the event that without the consent of Frontera, it issues any security that would dilute Frontera’s current ownership of CGX.

“We are pleased to complete this financing agreement in support of our joint venture as we build momentum towards spudding the Wei-1 exploration well in the second half of this year,” said Orlando Cabrales, Chief Executive Officer of Frontera. He added, “These are exciting times for our joint venture and we look forward to working with our partner, CGX, as we build on our recent exploration success at the Kawa-1 exploration well and generating value for our shareholders and the people of Guyana in one of the most exciting basins in the world.”

Also commenting on the loan was Professor Suresh Narine, Executive Co-Chairman of CGX. He said, “The Kawa-1 exploration well (which was disclosed on January 31, 2022 as a discovery) represents a transformative discovery for CGX, in partnership with Frontera. With positive results and data supporting the 200 feet of net pay indicated, we have de-risked our exploration programme and can continue to move forward with our overall plans, beginning with Wei-1 (the second well to be drilled in the Corentyne Block this year).”

He added, “We look forward to adding to our positive momentum and creating value and opportunity for our stakeholders.”

ABOUT THE PARTNERS

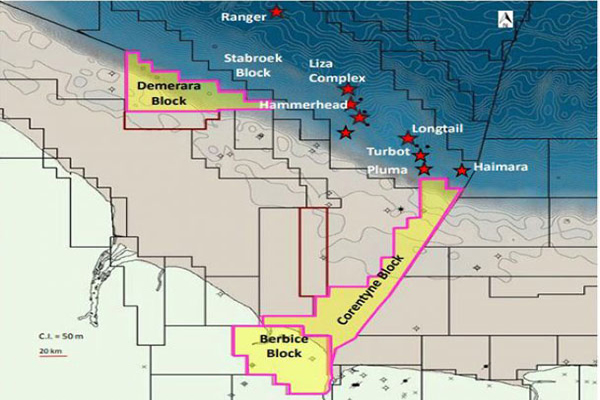

CGX is a Canadian-based oil and gas exploration company focused on the exploration of oil in the Guyana-Suriname Basin and the development of a deep-water port in Berbice, Guyana. It operates the Berbice, Corentyne and Demerara Blocks with its joint venture partner, Frontera.

Frontera is a Canadian public company involved in the exploration, development, production, transportation, storage and sale of oil and natural gas in South America, including related investments in both upstream and midstream facilities.

Frontera has a diversified portfolio of assets with interests in 34 exploration and production blocks in Colombia, Ecuador and Guyana, and pipeline and port facilities in Colombia.

kaieteurnewsonline.com 03 12 2022