Nicolle Yapur, Bloomberg News

CARACAS

EnergiesNet.com 02 20 2024

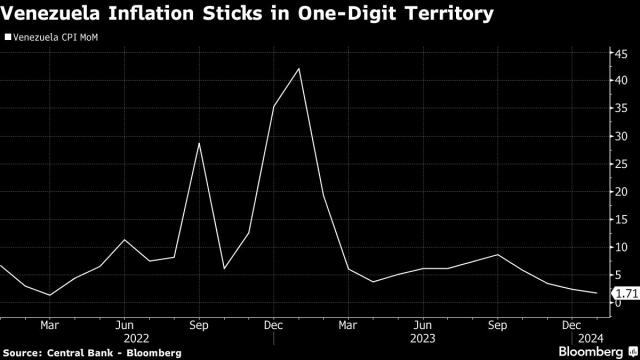

After a stretch of hyperinflation that neared an estimated 2 million percent a year, Venezuela posted the smallest consumer price increase for January in more than a decade.

The monthly inflation print stood at 1.7%, the lowest rise recorded for the start of the year since 2012, reined in by a drastic cut in government spending and Chevron Corp.’s additional dollar supply. The feat marks the eleventh-straight month of one-digit inflation and the smallest price jump since March 2022.

President Nicolás Maduro has struggled to contain prices since conquering hyperinflation in 2022, sticking with a strategy that combines tight monetary and fiscal restrictions while also allowing the free-flow of the US dollar, encouraging the supply of foreign currency. The strategy marked a sharp turnround of failed economic policies that led the country through a seven-year economic slump and one of the longest hyperinflation bouts in history.

“In 2024, Venezuela will have an annual inflation of two digits,” Maduro promised during his state of the union speech last month.

Dollar sales nearly doubled in December compared to a year prior, said Jesús Palacios, a senior economist at Caracas-based financial consultancy Ecoanalitica. At the same time, the government has been restricting expenses more than expected, he added.

The increase in dollar sales has been led by Chevron, now a top supplier in the local exchange market after a US license allowed it to scale up operations in Venezuela without breaching oil sanctions, Ruth de Krivoy and Tamara Herrera wrote in a Sintesis Financiera report. It led the bolivar to strengthen 2.4% in January as the government maintained a steady flow of about $600 million in dollar sales in the local market, the report said.

Press officials for Chevron did not immediately respond to a request for comment.

Presidential elections scheduled for this year will test the government’s will to maintain monetary and fiscal discipline, said Henkel García, director of Venezuelan consultancy firm Albus Data. Maduro’s administration has limited credit and kept the minimum wage painfully low to avoid printing money.

“Circumstances are also forcing their hand, and politics have always prevailed over economics,” García said.

–With assistance from Andreina Itriago Acosta and Fabiola Zerpa.

bloomberg.com 02 19 2024