US seen reimposing sanctions if bluster turns to annexation. Analysts say US giant’s deal for Hess is likely safe (RBN Energy)Mitchell Ferman, Bloomberg News

HOUSTON

EnergiesNet.com 12 08 2023

After playing the long game in Venezuela, home to the world’s largest oil reserves, Chevron Corp. is being tested again.

President Nicolás Maduro is threatening to annex the disputed oil-rich region of Essequibo, which neighboring Guyana claims as its own. If he follows through, analysts expect the US to reinstate sanctions and potentially revoke a special license that allowed the oil supermajor to resume operating in Venezuela.

It remains to be seen whether rising tensions turn into open conflict, but energy market observers are warning the impact on the California-based company could be significant.

Should Maduro’s threat be “more than saber rattling, the US administration would most likely limit Chevron’s ability to operate there,” according to Shreiner Parker, Latin America managing director at research firm Rystad Energy. “Chevron themselves may choose that they wouldn’t want to be operating in a country that has invaded a sovereign neighbor,” he said by phone.

Representatives for Chevron didn’t immediately reply to requests for comment.

Maduro says he will grant new oil exploration licenses in Essequibo and order companies already working in the area to leave. Guyana is intensifying security measures and Brazil’s military has increased its presence along the border. The US, meanwhile, has called on Venezuela to respect the territory as Guyana’s until the matter is settled in international court.

The feud comes as Maduro’s political opposition consolidates ahead of a presidential election next year. Polls show challenger María Corina Machado leading the incumbent, which is why many analysts see the Essequibo threat as political bluster meant to lift nationalist spirits and rally the socialist government’s core supporters.

Maduro claimed an overwhelming victory in a plebiscite Sunday that put five questions on whether the oil-rich piece of territory about the size of Florida should be governed by Venezuela. Some 95% of voters backed the government’s position, but turnout numbers — which critics say were inflated — fell well short of Maduro’s target.

“We believe the referendum served as a demonstration of support for Maduro’s policies and an attempt to build a unification sentiment among voters,” Luiz Hayum, a Latin America upstream analyst at Wood Mackenzie, said by email. “But we believe there’s a very low chance that it will escalate into a wide armed conflict.”

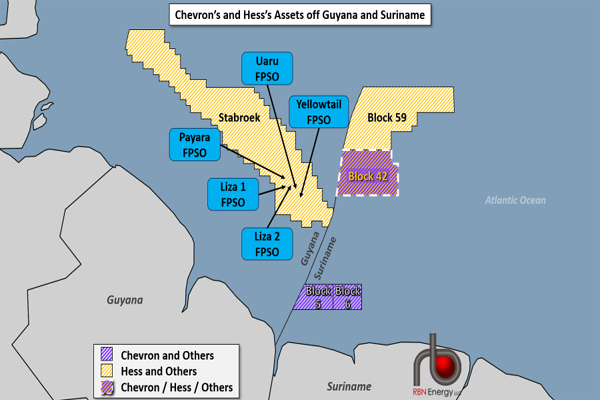

In theory, the oil fields off Guyana that Chevron is buying into with its $53 billion takeover of Hess Corp., which partners with Exxon Mobil Corp. in Guyana, could also be in jeopardy due to Maduro’s threat. But analysts see Venezuela taking over that offshore production as unlikely due in part to significant logistical challenges the South American nation is unequipped to handle. Chevron expects its Hess deal to close in the first half of 2024.

Analysts nonetheless caution that Maduro is an irrational actor surrounded by sycophants who don’t always provide the president with empirical facts. That could lead Maduro to make decisions that disrupt Venezuela’s efforts to boost oil output, and bring in much-needed revenue, now that the US has eased sanctions.

–With assistance from David Wethe and Fabiola Zerpa.

bloomberg.com 12 07 2023