after policy makers delivered the biggest interest rate increase in two decades. (Bloomberg)

Matthew Malinowski, Bloomberg News

SANTIAGO

EnergiesNet.com 03 30 2022

Chile’s central bank is poised to deliver its biggest interest rate increase since 2001 as its new chief confronts fresh price pressures and spiraling inflation expectations.

Eight of 17 economists surveyed by Bloomberg expect the overnight rate to jump by 200 basis points to 7.5% on Tuesday, while six forecast a 150 basis-point increase and three see a hike of 175 basis points.

The decision will be the first under Rosanna Costa, who assumed the bank’s presidency just before Russia’s invasion of Ukraine sent global commodities skyrocketing. That further complicated Chile’s inflation outlook, which had already been pressured by last year’s record economic growth. Investors see prices rising above target both this year and next.

What Bloomberg Economics Says

“We expect Chile’s central bank to increase its benchmark rate by 150 basis points to 7% on Tuesday and keep the door open for additional tightening. Higher-than-expected February inflation and additional pressure from increasing food and energy prices in March support tighter monetary conditions. Inflation expectations are also rising.”

–Felipe Hernandez, Latin America economist

Tuesday’s decision will be published on the bank’s website at 6:00 p.m. in Santiago, together with a statement from its board. Here’s are the key points that investors will be looking for:

Commodity Prices

Financial markets will scour the bank’s post-decision statement for insight on how long soaring raw material prices will drive inflation. So far, Costa has remained relatively tight-lipped on the matter, telling journalists in late February that the bank was in the process of gauging the impact in the short and medium-term.

Chile imports nearly all of the oil that it consumes, meaning the economy has been stung by prices that were near $130 a barrel earlier this month, compared to levels near $90 at the time of the last rate decision in January. Higher wheat prices have pressured the cost of bread, a staple in the local diet.

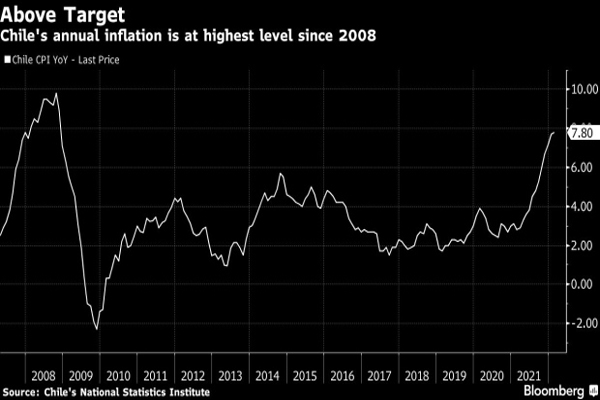

Analysts have taken notice, and their inflation outlook has worsened accordingly. Economists surveyed by the monetary authority raised their year-end consumer price estimates to 5.8% and 4% for 2022 and 2023, respectively.

By comparison, policy makers target annual inflation at 3%.

Rate Path

Within financial markets, there’s some divergence on the strategy that policy makers will implement on rates.

Interest rate futures show borrowing costs reaching 9% in three month’s time and then gradually falling from then on. Some economists warn that rates will have to remain elevated — though not as high as futures show — for a longer period in order to tame inflation.

Both the statement with the rate decision and the bank’s quarterly monetary policy report, to be published early Wednesday, should shed light on those issues.

“Our base scenario is that the central bank will raise rates by 175 basis points,” said Igal Magendzo, co-founder and chief economist of Pacifico Research in Santiago. Together with the monetary policy report, board members will lay out a view that “it’s possible to smoothly bring down both inflation and activity with borrowing costs that are maintained below levels implied by market rates, but for a longer period.”

Board Changes

Investors will also keep tabs on the bank’s newest board members. Luis Felipe Cespedes joined the bank’s board in February after the departure of Joaquin Vial. Meanwhile, earlier this month, the senate gave its backing to Stephany Griffith-Jones, though she won’t vote on Tuesday given that she will assume her role on May 1

bloomberg.com 03 29 2022