Chen Aizhu, Reuters

SINGAPORE

EnergiesNet.com 05 22 2024

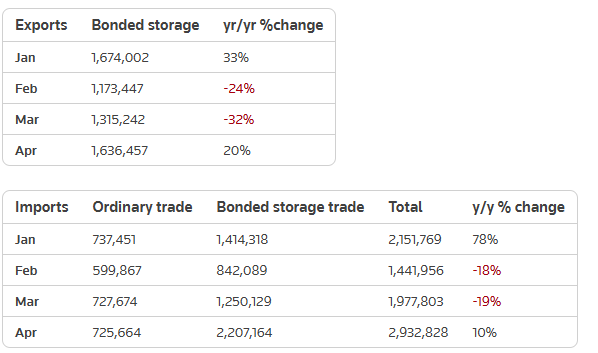

China’s imports of fuel oil rose 10% in April from a year earlier to 2.93 million metric tons, data from the General Administration of Customs showed on Monday, the highest level since at least 2020 according to Reuters’ records.

The April imports, which equate to about 620,180 barrels per day, were 48% higher than in March, as traders brought in more shipments from Venezuela and Iran, according to trading sources familiar with the transactions.

The import volumes included purchases under ordinary trade, which are subject to import duty and consumption tax, as well as imports into bonded storage.

Imports into the bonded tanks reached 2.21 million tons, or roughly 467,800 bpd, also the highest since at least 2020.

“Higher supplies from Venezuela due to the relaxation of sanctions contributed to the higher volumes. Refiners’ margins processing the heavier materials were also supportive,” said one Chinese trading executive.

Imports trended higher as some refiners ramped up purchases before prices strengthened further, amid a global rally in the high sulphur fuel oil market in the second quarter this year.

Meanwhile, fuel oil export volumes, mostly of low-sulphur fuel oil, in April were at 1.64 million tons, or about 347,130 bpd, up 10% from the corresponding month last year.

Exports rose from the same month last year as global bunker demand firmed amid geopolitical shipping disruptions this year.

The exports are measured mostly by sales from bonded storage for vessels plying international routes.

The tables below show China’s fuel oil exports and imports in metric tons. The exports section largely captures China’s low sulphur oil bunkering sales along its coast.

(metric ton = 6.35 barrels for fuel oil conversion)

Reporting by Chen Aizhu; Writing by Emily Chow and Jeslyn Lerh; Editing by Sonali Paul

reuters.com 05 21 2024