Andrea Jaramillo and Ruth Liao, Bloomberg News

BOGOTA/WASHINGTON

EnergiesNet.com 08 29 2023

Colombia has significantly ramped up imports of liquefied natural gas to conserve its hydroelectric operations as El Niño threatens to bring dryness to the South American nation, according to the power generators’ association.

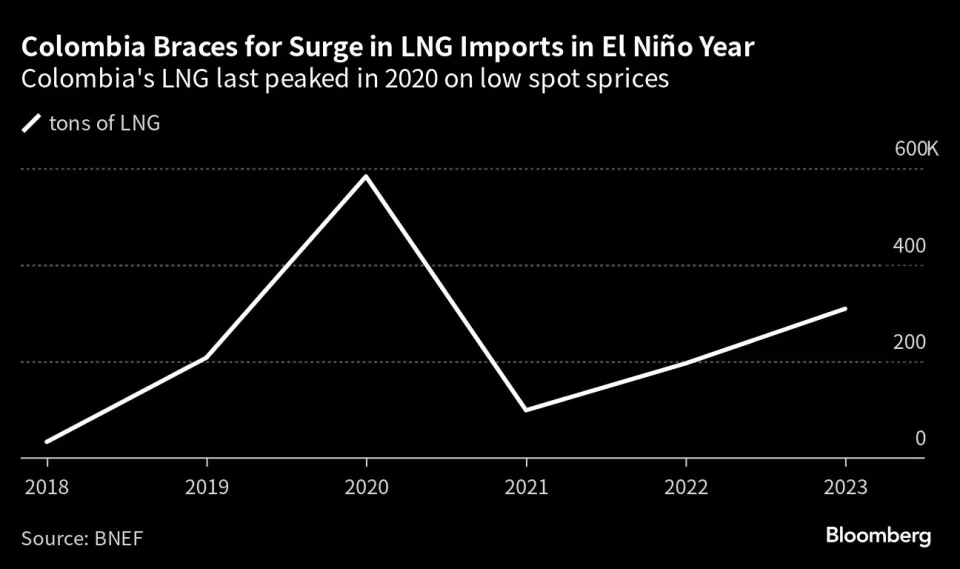

The country has already imported 309,000 metric tons of LNG as of Monday amid emerging prospects of an El Niño, according to data compiled by Bloomberg. That is almost 60% more than all of last year and more than triple 2021’s annual total, the data show.

Colombia’s appetite for LNG will raise greenhouse gas emissions in a nation with one of world’s cleanest electricity grids and tighten global supplies for the fuel when Europe and Asia stock up for winter. While Latin America receives fewer LNG imports than in Europe or Asia, Brazil also faces similar El Niño-driven demand through early next year.

Colombia’s electrical system is vulnerable to droughts, with about two-thirds of its installed capacity coming from hydropower. An El Niño weather phenomenon could amplify chances of dryness in the country, threatening reservoir levels and power output from hydroelectric dams.

Colombia has been buying spot LNG cargoes this year to feed natural gas-fired plants that are filling 25% to 30% of the nation’s power demands so reservoir levels can be maintained, according to Alejandro Castañeda, director of the association known as Andeg. That compares with about 15% of demand in a wet year, he said.

“The concern with El Niño is that rains between September and November disappear and you can’t recover dam levels,” Castañeda said in a phone interview.

Continued Imports

Castañeda expects Colombia to continue importing LNG through next March, with an amount that depends on El Niño’s intensity. Water reservoirs need to be preserved until November, before the country faces the prospects of four months of drier weather, he said.

Castañeda said gas-fired plants have begun to produce more power to allow for hydroelectric plants to store water during El Niño, which is allowing reservoirs to stay at around 82% capacity.

Colombia only sporadically imports LNG through the six-year-old SPEC LNG port in Cartagena, given its reliance on hydroelectricity. The country’s LNG imports peaked in 2020, when both rainfall levels and global spot prices were low — which Castañeda said made importing LNG cheaper than tapping its domestic natural gas supplies.

bloomberg.com 08 28 2023