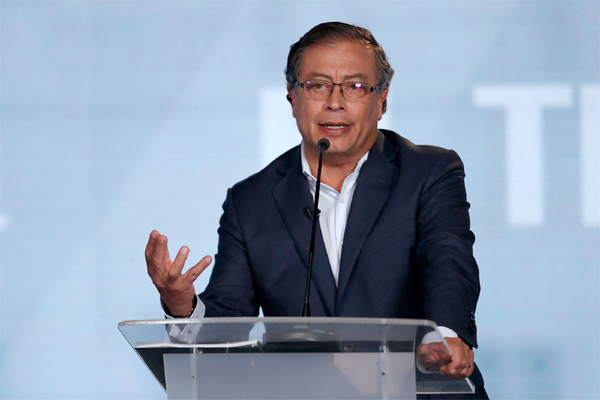

- Group rejects Petro’s statement that money in funds is public

- Primaries show Petro as frontrunner in presidential election

Andrea Jaramillo and Oscar Medina, Bloomberg News

BOGOTA

EnergiesNet.com 03 17 2022

The proposal by Colombian presidential candidate Gustavo Petro to transfer money from private pension accounts to the public system amounts to “expropriation”, according to the head of the nation’s pension fund association.

In a debate this week, Petro said that 18 trillion pesos ($4.7 billion) of pension fund assets could be shifted to the parallel public system Colpensiones, and accused private pension providers of charging excessive fees.

“The money from contributions is the property of workers,” Santiago Montenegro, the head of Colombia’s private pension fund association, Asofondos, said in an interview on Blu Radio after Petro referred to it as public money. “A government that intends to take that money would be expropriating.”

To provide pensions for millions of Colombians who don’t have one, and top-up handouts that are insufficient, Petro has said the government could “free up” money saved in private pension funds. He proposes a system in which everyone contributes to a public pay-as-you-go system, while workers who earn more than four times the minimum wage can make additional contributions to the private system.

Colombia’s private pension funds have assets under management of almost 350 trillion pesos. In a tweet, Petro said that transfers to the public system would be “free”, without elaborating. His press office didn’t immediately reply to a request for more details on his plans.

Petro’s remarks on pensions are the latest in a series of proposals that have investors on edge as they would mark a transformation of the nation’s economic model. He has also said he’ll halt oil exploration and has vowed to reform the central bank so that “productive organizations” gain a voice in setting monetary policy.

Primaries held on Sunday point to Petro as the strongest candidate to become Colombia’s next president, with a conservative former mayor of Medellin, Federico “Fico” Gutierrez, placing as his strongest contender. Presidential elections will be held May 29 with a possible runoff three weeks later. Colombia has never had a leftist government.

Fitch Ratings said in a report this week that Colombia’s newly elected congress, in which no bloc has an overall majority, will guarantee that the new government faces institutional checks and balances which are likely to prevent policy radicalization.

Asofondos published a statement March 15 disputing Petro’s assertion that Colombia’s private pension funds charge unreasonably high fees.

bloomberg.com 03 16 2022