Colombia’s oil investments could plunge up to 30%, group says. Country’s oil output was already falling before anti-oil push

Peter Millard and Patricia Laya, Bloomberg News

RIO/CARACAS

EnergiesNet.com 10 26 2022

The UK scrapped a ban on shale gas production. Norway is hunting for oil deeper in the arctic. The US is pleading with drillers to pump more.

Many of the world’s biggest countries are walking back, or slow-walking, parts of their plans to shift away from fossil fuels.

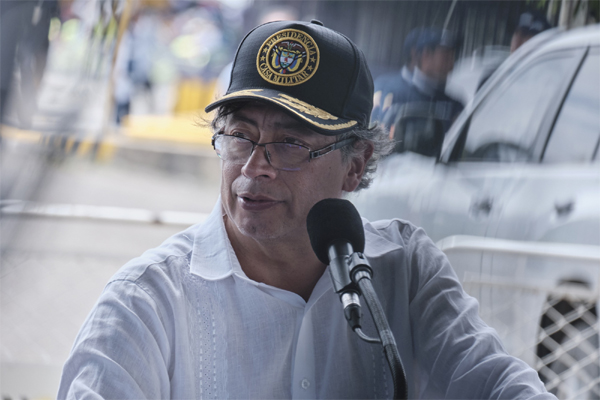

Not Colombia. Its first leftist president, Gustavo Petro, has stopped offering new licenses for oil exploration in Latin America’s third-biggest producer. He’s also pushing Congress, through legislation he shot over on his first day in office, to boost taxes on energy exports and is working on implementing a ban on fracking. No other other major oil country is constraining the industry this much.

Oil executives in Bogota are getting the message. Ecopetrol SA, the state-controlled producer, is dropping pilot projects for fracking, a controversial extraction technique it was relying on to revive output. And independent producers like Gran Tierra Energy are now looking elsewhere, including in neighboring Ecuador, as they make plans to boost output. The Colombian Petroleum Association estimates Petro’s plans will spark a 30% drop in investment in the industry.

“They’re scaring the bejesus out of the private sector,” said John Padilla, managing director at energy consultancy IPD Latin America who is based in Colombia.

All of this, of course, is great news for anyone concerned about global warming. The problem is that the oil crackdown is helping spark a meltdown in Colombian markets that, if left unchecked, will heap financial and political pressure on the new administration. The peso has plunged more than 20% against the dollar since Petro was elected in June, driving up the price of imports and adding to an inflation spiral that’s hammering everyday Colombians.

“The question,” Padilla said, “is how long can that rhetoric continue.”

Petro’s environmental activism stands out in a region where commodities have historically driven the economy. About fifty percent of Colombia’s export revenue comes from oil and mining. If Petro is successful, he will provide a road map to other emerging-market countries on how to get a head start on the energy transition.

Or it could turn into a cautionary tale of over-ambitious environmentalism. The anti-oil push is certain to accelerate Colombia’s decline in production and exports at a time when the country needs all the revenue it can get to fund its plans to boost social spending.

Backlash Risk

The risk of a public backlash against Petro is real, especially because he’s also unwinding expensive fuel subsidies. Ecuador’s president was nearly impeached this year over fuel prices. Brazil and Mexico have sacrificed tax revenue to subsidize gasoline and diesel. Many industry observers still expect Petro to backtrack under the weight of strained national budgets.

“Circumstances will dictate, and the rhetoric will have to align itself with reality sooner rather than later,” said Schreiner Parker, the head of Latin America for Rystad Energy, a consultancy.

Members of Petro’s economic team diverge on how fast the country should ditch oil and gas. Finance Minister Jose Antonio Ocampo has said there’s no final decision about the end of oil and gas exploration. Meanwhile, Energy and Mines Minister Irene Velez, an academic and environmental activist who has worked with Petro since he was mayor of Bogota, has said the ban on awarding new exploration areas is still in place.

The Energy Ministry, in a response to questions, said that Ecopetrol and other explorers already have enough licenses to increase Colombia’s proven oil reserves, and that the government will allow existing projects to go forward.

Even if Petro were to slow down or reverse his push, he’s already weakened Colombia’s ability to turn around an oil industry that’s been in decline for years. The country had always been a hard sell for international oil majors.

Colombia doesn’t offer the same type of multi-billion-barrel discoveries that have been made in Guyana and Brazil and needs to offer more incentives for companies to take on exploration risk. Chevron Corp. retreated from Colombia in 2019. Occidental Petroleum Corp. sold its Colombian onshore fields in 2020. Even Ecopetrol, a company whose leadership is handpicked by the government, has turned to US shale for expansion opportunities.

If Petro succeeds at shifting to renewable energy in a country with strong winds, raging rivers and plentiful sunshine, the rough start to his term will be forgotten. Colombia’s 13 gigawatts of planned renewable energy projects will help reduce dependency on hydrocarbons, and Ecopetrol has more concrete plans for renewable energy and green hydrogen than regional peers Petroleos Mexicanos or Petroleo Brasileiro SA, according to BloombergNEF.

Read more: Tumultuous Transition Ahead for Latin American Oil Majors

The Colombian Petroleum Association, though, sees a crisis building long before the country gets to that transition.

“All the alarms are going off,” Francisco Lloreda, the head of the group, said in an interview.

bloomberg.com 10 25 2022