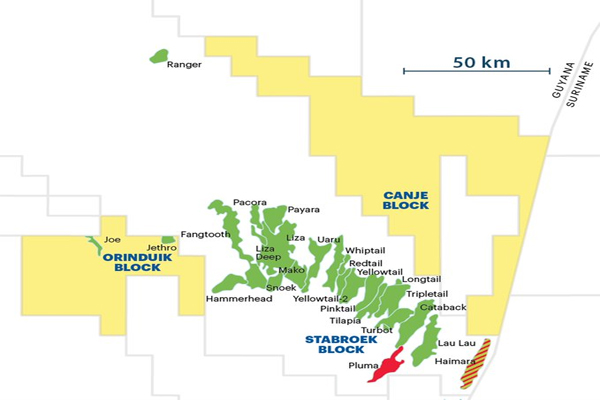

In partnership with Tullow Oil and Total EP Guyana BV, Eco holds a 15% working interest in the 1800 km2 Orinduik offshore block in

the shallow water of the prospective Guyana-Suriname basin.

Kaieteur News

GEORGETOWN

EnergiesNet.com 03 15 2022

Eco (Atlantic) Oil & Gas Ltd. has been a junior player in Guyana’s oil basin since 2016. Its main asset since its entry into the nation’s oil and gas industry has been the Orinduik Block. There, it works alongside Operator Tullow and holds a 15 percent working interest. In 2019, Eco and its partners struck heavy oil in two wells in the Orinduik Block.

As a result of this underwhelming result, its attention shifted to the highly prospective Canje Block that is operated by ExxonMobil’s subsidiary, Esso Exploration and Production Guyana Limited (EEPGL).

In 2021, Kaieteur News observed and reported that Eco initiated a series of small share purchases amounting to almost seven percent in JHI Associates Inc. which is one of the original licence holders for the Canje Block. In a most ambitious play to raise its stakes in the Guyana basin, on Monday, Eco disclosed to the market that it took a bold step with the acquisition of the remaining shares in JHI, thereby giving it full ownership of the company and its 17.5 percent working interest in the Canje Block. It is important to note that the move by Eco follows an application by EEPGL to the Environmental Protection Agency (EPA) to drill 12 wells in the block starting this year. That application is still under consideration.

On closing of the acquisition, JHI is to have a minimum cash balance of US$15 million, acquired as part of the transaction with Eco.

Pursuant to the Term Sheet and subject, inter alia, to the signing of a binding Arrangement Agreement and completion of the Acquisition, Kaieteur News understands that Eco Atlantic will issue to JHI’s shareholders, along with the holders of any JHI options and warrants, such number of new common shares in Eco that will provide JHI’s shareholders with 34.1 percent of Eco’s issued share capital, or approximately 127 million new common shares of Eco. This, therefore, provides for a cashless acquisition, with a value of approximately US$52 million.

Completion of the acquisition is subject, inter alia, to the signing of an Arrangement Agreement and satisfactory completion of due diligence by Eco and any requisite approvals from the Government of Guyana, the Canje Block partners, and the TSX Venture and AIM exchanges. In addition, certain shareholders of JHI will enter into lock-up agreements to restrict the sale of the consideration shares.

As of 31 December, 2021, JHI’s audited financial statements provides that it had total gross assets of approximately US$30.7 million, of which approximately US$19.7 million are cash and cash equivalents and US$3.5 million is the book value of its interest in the Canje Block. These financial statements also provide that JHI had total liabilities to third parties of approximately US$500,000.

On the heels of the disclosure, John Cullen, the Founder and CEO of JHI said the transaction provides JHI’s shareholders access to Eco’s exciting portfolio of exploration opportunities in the emerging oil basins of Namibia and South Africa, and in Guyana with their Orinduik Block, while maintaining their exposure to the Canje Block, where we have been working steadily with partners to identify the next prospect to drill. “It also represents the culmination of a tremendous amount of work from JHI’s technical team which, over the last six years, saw two supermajors join the Canje Block, and three wells drilled providing valuable information towards unlocking the potential of the deeper water portions of the Guyana-Suriname Basin,” the CEO said.

He added, “JHI’s team has come to work well with Eco’s team since they became shareholders last year, and we know that they will continue to be good stewards of the Canje Block as they add it into their impressive and expanding exploration portfolio.”

As for Gil Holzman, Co-Founder and CEO of Eco Atlantic, he commented that being a shareholder of JHI since last year has given his company a deep understanding of the Canje Block and its prospectivity.

Holzman said, “This transaction adds to Eco’s strategic acreage position in Guyana and ensures that there will be a number of drilling catalysts over the next couple of years on Eco’s eight offshore blocks. In addition, the enlarged Group will benefit from JHI’s current cash position, adding US$15million to Eco’s balance sheet, further strengthening the company’s liquidity position.”

Given Eco’s strategic investor base and proven access to the public capital markets, Holzman said the anticipated addition of JHI’s interest in the Canje Block and its working capital, will further augment the enlarged Group cash position for its share of all near term exploration programmes on its current blocks including: US$2B in South Africa where drilling preparations for a late third quarter spud are underway and work in the Eco Orinduik Block offshore Guyana to follow.

The Eco Chief concluded, “Ahead of our planned drilling campaign on Block 2B offshore South Africa, we are also looking to finalise drilling targets in the Orinduik Block, offshore Guyana. This demonstrates that the Eco team is head down and focused on delivering value for shareholders. We look forward to providing further corporate updates as appropriate”.

ABOUT JHI

It should be noted that JHI which has been overtaken by Eco, was a Guyana pure-play deepwater exploration company that was only founded in 2011. In 2014, JHI teamed up with Guyana-based Mid-Atlantic Oil and Gas Inc. (“MOGI”) which was awarded the Canje Block in 2015 by former President, Donald Ramotar, just a few months before General and Regional Elections were held. Both companies which are industry unknowns, had no wherewithal, and zero experience in deepwater drilling. In spite of no track record, JHI and its partner were awarded the block with no signing bonus to the country.

In 2016, JHI and Mid-Atlantic sold the major parts of their interest to ExxonMobil which allowed the American company to become the Operator. In 2018, Total Energies farmed into the Block. Five years of extensive technical and seismic data analysis led to the Canje partners identifying multiple drillable prospects and successfully applying for a multi-well drilling permit. These wells were drilled but oil was not found in commercial quantities.

The ownership structure of the block is as follows: Esso Exploration & Production Guyana Limited (35 percent), Total Energies E&P Guyana B.V. (35 percent), Eco Inc. (17.5 percent) and Mid-Atlantic Oil & Gas Inc. (12.5 percent).

MORE ABOUT CANJE

The Canje Block is approximately 4,800km2, located approximately 180 to 300 kilometres offshore Guyana in water depths ranging between 1,700 and 3,000 metres.

The Canje Block is a large and significant licence which captures the lower slope and base of slope play fairways, channels and fans outboard of multiple ExxonMobil discoveries in the adjacent Stabroek Block which is immediately up-dip of Canje. Canje is covered with 6,100km2 of 3D seismic and holds over three dozen prospects in four proven plays in the Lower Tertiary and Upper Cretaceous confined channels, Lower Cretaceous Carbonate structures and, with recent drilling of Sapote-1 well and Stabroek discoveries, now offers the opportunity of yet deeper horizons.

kaieteurnewsonline.com 03 15 2022