Alberto Araujo, Argus Media

QUITO

EnergiesNet.com 09 14 2022

the stakeholders of which are CNPC subsidiary PetroOriental with 36.26pc; Argentinian Pampa Energia, 30.06pc; Repsol, 29.66pc and Perenco, 4.02pc — has a 20-year contract with the Ecuadorian government that ends on 12 January 2024. After that date, the company would transfer the operations to the ministry of energy without compensation.

While the consortium has already told the ministry it would like to remain in Ecuador, no schedule for discussions has yet been set, Vugdelija said.

OCP started the process required if it must revert the operation of the pipeline to the Ecuadorian state more than a year ago. This includes environmental audits and asset inventories supervised by the energy ministry in a two-party commission with OCP.

“We have expressed our will to keep contributing to the country’s development,” Vugdelija said. “But we respect the government’s will. If its choice is that we won’t continue, we guarantee the pipeline will be handed over to the country.”

In return for the extension of the contract, OCP aims to make capacity available to the government that would be needed if Ecuador duplicates its crude output as it aims to do by 2026-2028. In addition, OCP could extend the pipeline to more distant blocks such as 43-ITT, close to the border with Peru.

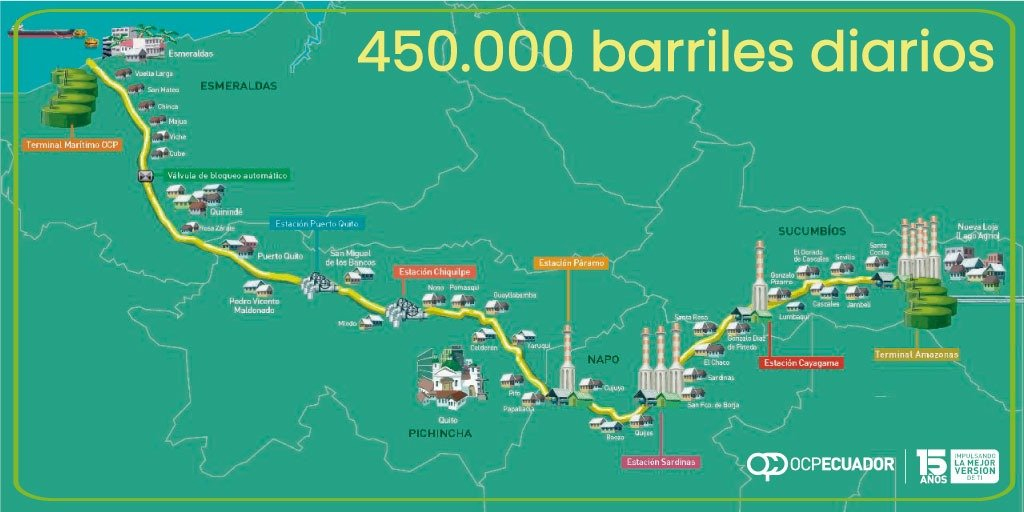

OCP is the largest of two crude pipelines in the South American country but has only transported an average of 151,690 b/d in 2021, or 34pc of its total capacity, according to company reports. The 360,000 b/d SOTE pipeline is state run.

OCP transported an average of 152,016 b/d from January-July, 7.3pc less than what was transported in the same period in 2021, according to state-owned PetroEcuador data.

OCP charges $2.15/bl to move crude 485km (301.3 miles) from the Amazonian region in the east to the OCP terminal in Esmeraldas on the Pacific coast. The fee is equal to 0.4¢/bl/km, one of the lowest fees on the continent, said Vugdelija.

OCP reported a loss of $34.27mn in 2021 and assets of $20.75mn, according to the superintendency of companies.

By Alberto Araujo

argusmedia.com 09 13 2022